Most global stocks dipped and Treasury yields climbed on Tuesday, as

investors weighed declining factory activity in the euro zone and China with

stabilizing U.S. manufacturing and job openings that signalled a still-tight

labour market.

U.S. Treasury yields rose with 30-year paper touching a new year-high as

investors expected an increase in government debt issuance and anticipated more

signs of economic resilience, despite data showing a slowdown in activity.

Gold prices fell around 1%, weighed down by a stronger dollar and an uptick

in bond yields. Oil prices edged lower on a stronger dollar and signs of

profit-taking, after a rally in July when investors bet on tighter global

supplies and demand growth in the second half of 2023.

Commodities

U.S. Crude Oil stocks fell by about 15.4 million barrels in the week ended

July 28, according to market sources citing API figure. Analysts had expected a

drop of 1.37 million barrels.

Gasoline inventories fell by about 1.7 million barrels, compared with

estimates for a 1.3 million-barrel drop. Distillate inventories fell by about

510,000 barrels, compared with analysts estimates for a build of 112,000

barrels.

To revive China's private sector amid a flagging economic recovery following

a protracted period of COVID restrictions, Chinese ministries, regulators and

the central bank on Tuesday pledged more financing support to small

businesses.

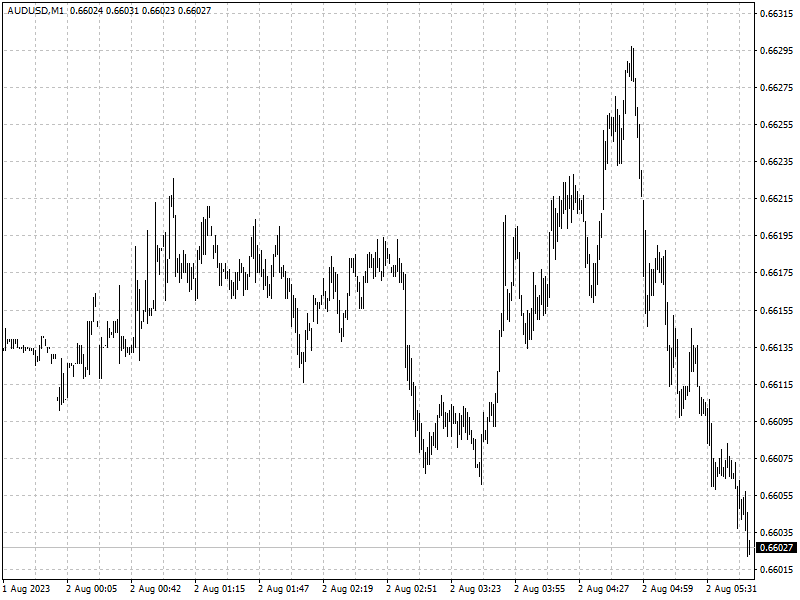

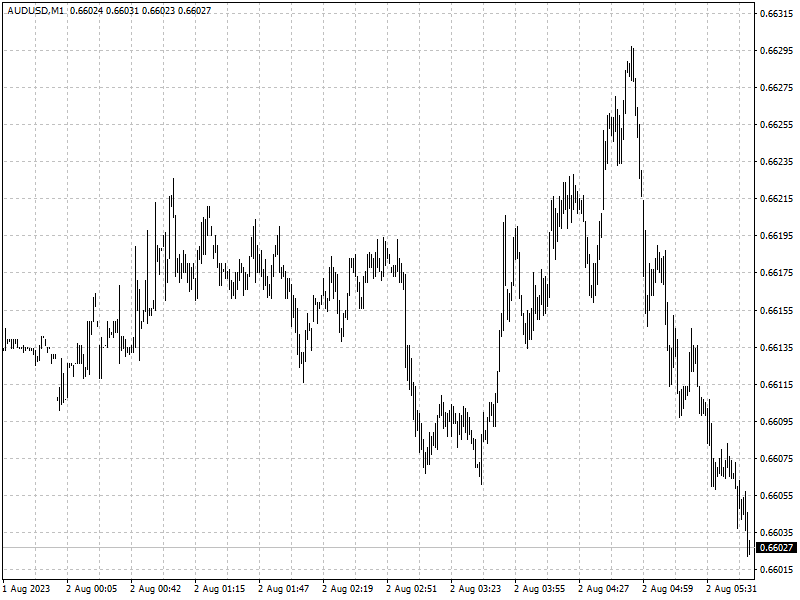

Forex

The ISM said that its manufacturing PMI edged up to 46.4 last month from 46.0

in June, which was the lowest reading since May 2020. It was the ninth straight

month that the PMI stayed below the 50 threshold.

Meanwhile, U.S. construction spending increased solidly last month and May's

data was revised higher. U.S. job openings fell to the lowest level in more than

two years in June but saw a third straight monthly decline in layoffs.

The Australian dollar posted its biggest daily decline since March after the

RBA held rates at 4.1% for a second month, saying past hikes were cooling demand

but more tightening might be needed to curb inflation.

Disclaimer: Investment involves risk. The content of this article is not an

investment advice and does not constitute any offer or solicitation to offer or

recommendation of any investment product.