The opening price refers to the price of the first transaction at the

beginning of a certain trading day in financial markets such as stocks, futures,

and foreign exchange. It is the first transaction price after the market opens

and also the starting point for trading that day. The opening price is usually

determined by the buyers and sellers in the market based on their respective

trading intentions and the market supply and demand relationship at the

opening.

The opening price is an important price indicator in the financial market. It

is usually regarded as the starting point of trading activities and represents

the first transaction price of assets within a specific time period. The

significance of the opening price lies in its ability to provide useful

information and insights about the market.

Firstly, the opening price can reflect the buying and selling power and

expectations of the market at the opening. If the opening price is high, it

means that the buyer has strong strength, and investors are optimistic about the

asset and more willing to buy at a high price. On the contrary, if the opening

price is low, it means that the seller has strong power, and investors may be

cautious about assets and more inclined to sell at a low price. By observing the

opening price, investors can have a preliminary understanding of the market's

supply and demand relationship and possible price trends.

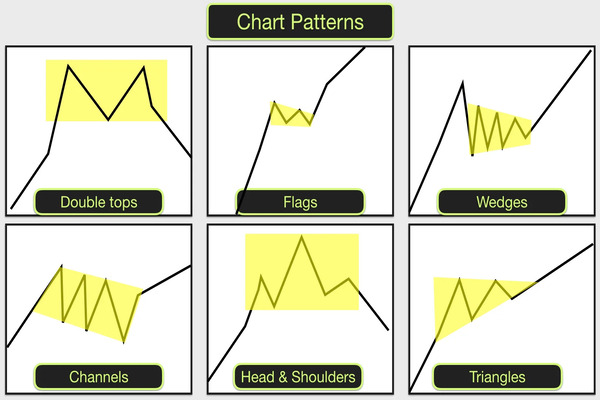

Secondly, the opening price is also related to other price indicators, such

as the highest, lowest, and closing prices. These price indicators together form

the foundation of price charts and technical analysis tools. By comparing

opening prices with other price indicators, investors can gain more

comprehensive market insights and make more accurate judgments and decisions.

For example, if the opening price is much higher than the lowest price and close

to the highest price, it may indicate market strength and buyer control. On the

contrary, if the opening price is far below the highest price and close to the

lowest price, it may indicate market weakness and seller pressure.

Finally, changes in opening prices are of great significance to investors and

traders. They can develop trading strategies based on changes in opening prices,

such as observing the fluctuations in opening prices to determine market

activity and investment risks or making buying and selling decisions by

utilizing the relationship between opening prices and other price indicators.

The opening price can also serve as a reference point for setting stop-loss and

profit targets.

In summary, the opening price is of great significance in the financial

market as it provides information about market expectations, supply and demand

relationships, price trends, and investment opportunities. By accurately

observing and understanding the opening price, investors can better grasp market

dynamics and make wiser investment decisions.