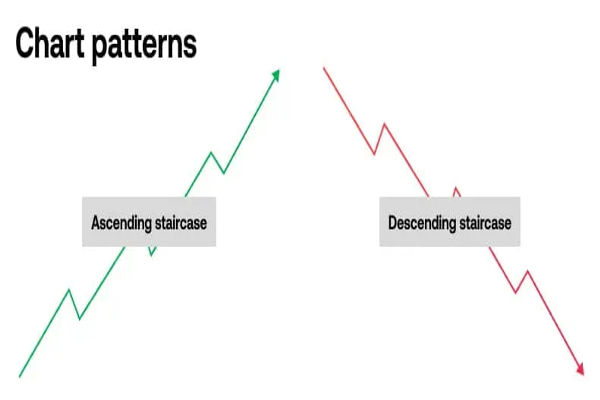

The trend of forex will show different changes, which will vary

over time. Investors should pay more attention to these issues when conducting

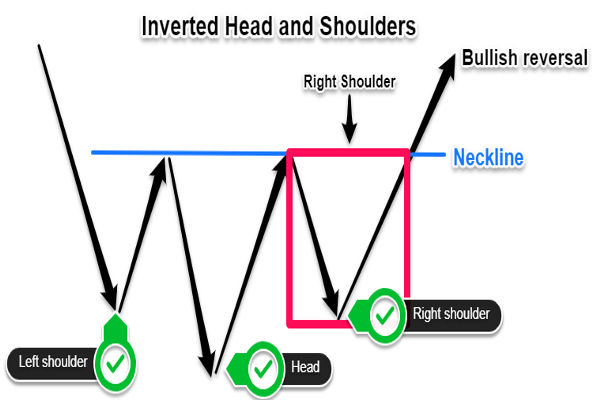

analysis. Forex margin trading prices sometimes form a left- or

right-shoulder shape. Let's take a look at the operating methods under these two

forms.

The left shoulder typically emerges towards the conclusion of a prolonged and significant upward (or downward) market trend, often accompanied by notable trading volume. Subsequently, the market begins to decline following its peak. In forex margin trading, investors must remain vigilant, understanding that markets are dynamic and ever-changing, devoid of any perpetual state.

When the price drops to a certain level, the trading volume begins to shrink

and borrow, leading to a slowdown in the market's decline. Subsequently, there

was a buying trend, and an upward trend began to emerge.

When the head appears during a rebound, the price continues to climb, even

crossing the high point on the left shoulder. When the head appears during a

rebound, the stock price continues to climb, even crossing the high point on the

left shoulder. This situation indicates that in the foreign exchange margin

trading market, households are not as willing to buy high as the left

shoulder.

Trends need to be analyzed rationally in forex trading, and when

analyzing a trend, attention should be paid to maintaining rationality. It is

better to make reasonable judgments on both the left and right shoulders before

deciding how to proceed with the next step of trading. Do not blindly engage in

forex margin trading, and do not only follow your subjective

feelings.