With the booming development of the forex market, many traders

prefer intelligent quantitative trading, and the Martin strategy in quantitative

trading is more popular. It has to be said that, in reality, many investors rely

on Martin's strategy to make big money. Martin seems to have dominated the

forex market. So, what exactly does Martin's strategy mean? Is it

really reliable?

The Martin strategy was initially a form of betting that involved winning

back the principal by placing double bets. In the 18th century, it was proposed

by French mathematicians. Today's Martin strategy is a way of managing funds.

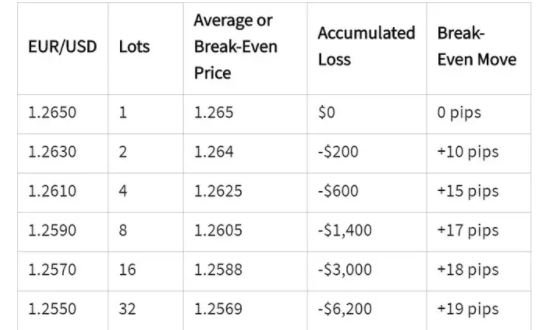

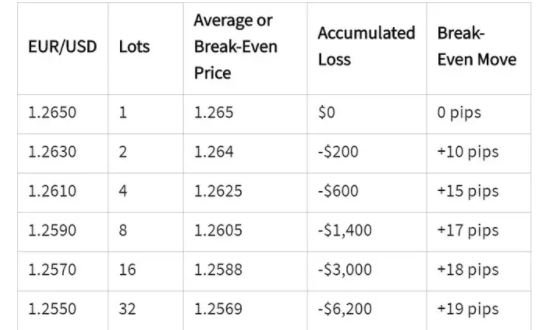

The basic principle of Martin's strategy is to bet on one side in the Two-sided

market, where you can buy up or down. If you make a mistake, continue to

increase prices in the opposite direction and dilute capital. As long as the

market withdraws, the trapped funds can be released, and all previous losses can

be covered up.

In theory, you won't lose money using this strategy. As long as you have

enough funds, theoretically, you will win every battle. Combining

forex-programmed EA24 operations will win the entire world. But there are also

significant potential risks. By placing double bets on loss positions, the

trading account may further fall into the shadow of loss, ultimately leading to

account exposure.

One of the reasons why Martin is so popular in forex

trading is that the forex market is different from the stock market,

and the exchange rate will not fall to zero. Although companies are prone to

bankruptcy, the state will not. Sometimes, even if a currency depreciates very

quickly, it will not fall to zero.

For traders with strong funds, Martin's strategy has a unique advantage in

the forex market and is very attractive. Traders can earn interest to

offset some losses. Traders can sell currency at low interest rates and buy

currency at high interest rates. If you hold a very large position, you will

receive a large amount of interest, which can also lower the average breakeven

price.

Although Martin's strategy sounds good, it should be emphasized that those

attempting this trading strategy in the forex market should be

vigilant against trading risks. Martin's Strategic risk is extremely

high. Usually, all the money in the account is lost before the price rebounds.

Therefore, all investors must be clear about whether it is worth taking such

risks to try the Martin trading strategy in forex trading.

Of course, there are few pure Martin strategies for EA on the market now, and

they are generally integrated with other strategies. In any case, we must attach

great importance to Martin's Systematic risk in strategy design, effectively

control the retreat range, design multiple indicators, and combine them with

Martin's strategy so as to develop a series of Martin derivatives. Using

multiple indicators to mix and match with Martin's strategy from multiple

dimensions, rather than just adding positions at equal intervals, requires

strategy designers to establish a complex Martin model and solve some inherent

problems of Martin's strategy and the risk of significant pullbacks and bursts

through quantitative hedging!