The Turtle Trading Act is a famous public trading system founded in 1983 by

the renowned commodity speculator Richard Dennis, who is renowned for his

promotion in a trader training class that covers various aspects of the trading

system. Its rules cover all aspects of trading and do not leave any room for

traders to make subjective or imaginative decisions. It has all the components

of a complete trading system.

The core idea of this trading method is to follow the Market trend and make

use of long-term trends to trade in order to obtain higher returns.

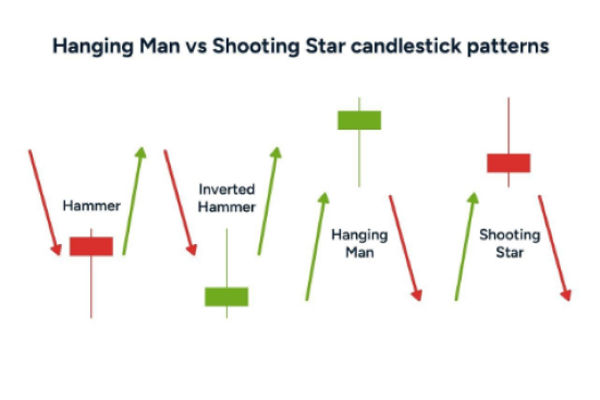

The basic principle of the Turtle Trading Law is to determine the entry and

exit points of transactions through technical analysis and risk management.

Traders need to follow a series of strict rules, including stop loss, position

size, entry, and exit points, to ensure risk control and maximum returns in

trading.

The success of the Turtle Trading Law lies in its strict risk management and

discipline, as well as its keen insight into Market trends. This trading method

has become one of the classic trading strategies of many traders and investors

and is widely used in markets such as stocks, futures, and foreign exchange.

Although the Turtle Trading Act has performed well in the past few decades,

it still has some flaws and limitations. For example:

1. Overadapting to specific market conditions

The Turtle Trading Law performs well under certain market conditions but may

not be applicable to other markets. This strategy relies on the continuity of

the trend, and if there is a sideways or volatile market situation, it may lead

to frequent trading signals and cause losses.

2. Lack of flexibility

The rules of the Turtle Trading Law are very strict and lack flexibility.

When there are special circumstances or temporary changes in the market, it may

not be possible to adapt. This may lead to traders being unable to adapt to

market changes in a timely manner, resulting in missed opportunities or

losses.

3. Requires significant funding and leverage

The Turtle Trading Law relies on establishing gradually increasing positions,

which means a large amount of funds is needed to support it. In addition, this

strategy typically uses higher leverage in order to achieve higher returns. If

traders do not have sufficient funds or manage leverage correctly, they may face

significant risks.

4. Unable to cope with rapid market changes

The market situation may undergo sudden changes, especially in markets with

high volatility. The exit rules of the Turtle Trading Rule may not be able to

capture these changes in a timely manner, leading traders to miss out on

opportunities to exit in a timely manner and suffer greater losses.

5. High disciplinary requirements for traders

The Turtle Trading Rules require traders to have a high degree of discipline

and patience, always following strict trading rules. However, this may be

difficult for some traders as they may be influenced by emotions, greed, or

fear, leading to violations of trading rules.

In summary, although the turtle trading rule has been widely used in the

past, there are still some shortcomings and limitations. Traders need to

recognize these deficiencies when using this strategy and make appropriate

adjustments and judgments based on their own situation and market

conditions.