Many investors know that there are many professional terms in the financial market, each representing a different meaning, and many people often hear bear and bull markets the most. So what do bear and bull markets mean?

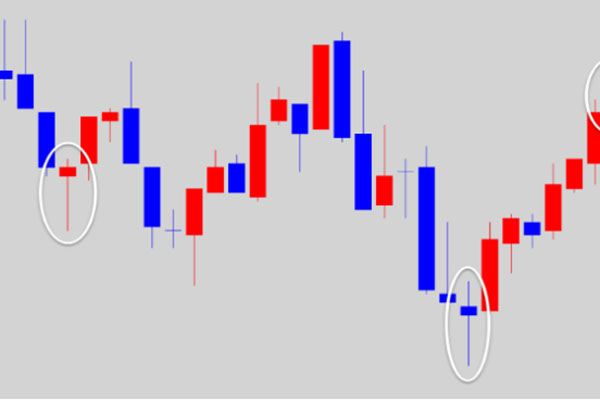

Bull market and bear market are terms used to describe two different trends in financial markets.

A bull market refers to a situation where market prices rise and remain strong. In a bull market, investors generally show optimism and expect prices to continue to rise. This usually leads to more buying pressure, causing the market to rise further. Bull markets are usually accompanied by high buying volume and active trading activity and persist for a long period of time. In this case, investors can obtain significant returns from investments in stocks, commodities, real estate, and other related industries.

On the contrary, a bear market refers to a situation where market prices fall and remain low. In a bear market, investors generally show pessimistic sentiment and expect prices to continue to decline. This may trigger more selling pressure, leading to a further market decline. A bear market is usually accompanied by high selling volume and low trading activity and may last for a long time. In this situation, investors often face losses, and the investment value in the market will also decrease.

The emergence of bull and bear markets is caused by a combination of market supply and demand, economic fundamentals, investor sentiment, and a variety of other factors. The alternation between bull and bear markets is a part of the normal operation of the market, and investors should understand and adapt to these different market environments. In a bull market, investors can adopt appropriate risk management strategies to achieve maximum returns. In a bear market, investors should strengthen risk control, protect their investments, and look for possible investment opportunities.

The characteristics of bull and bear markets can be summarized as follows:

Bull market characteristics:

1. Price increase: In a bull market, market prices generally rise, and investors experience positive returns over a long period of time.

2. Optimism: Investors generally show optimism, expecting prices to continue to rise, which may drive more buying pressure.

3. High buying volume and active trading activity: In a bull market, market activity is high, trading volume increases, and investors actively participate in trading.

4. Confidence enhancement: In a bull market, investors are optimistic about the market outlook, have increased confidence, and are more willing to take risks and invest.

Bear market characteristics:

1. Price decline: In a bear market, market prices generally decline, and investors may face long-term losses and asset depreciation.

2. Pessimistic sentiment: Investors generally show pessimistic sentiment, expecting prices to continue to decline, which may trigger more selling pressure.

3. High selling volume and low trading activity: In a bear market, market activity decreases, trading volume decreases, and investors gradually withdraw or conservatively participate in trading.

4. Uncertainty and panic: In a bear market, investors feel uncertain about the market outlook, worry about losses, and may be in a state of panic, seeking protective investment strategies.

The characteristics of a bull market and a bear market can be judged

according to the overall trend of the market and investor sentiment. Although it

is impossible to accurately predict the trend of the market, understanding and

identifying the characteristics of bull markets and bear markets can help

investors better develop investment strategies and reasonably assess and manage

risks.