Stocks are essentially a manifestation of human emotions. Behind every minute fluctuation in Stock Prices lies a dynamic shift in human emotions, a result of collective sentiment analysis. To grasp the patterns of emotional fluctuations, it is crucial to understand the underlying factors. This is where market sentiment indicators come into play. There are various types of such indicators used in the investment world, and we will explore them one by one.

Market sentiment indicators are tools designed to gauge and represent the emotions and expectations of market participants, including investors, traders, and other market players, regarding the market's direction and prospects. These indicators help analyze the market's varying sentiments, such as pessimism, optimism, fear, and greed, providing insights into short-term and medium-term market trends. They are primarily used to measure market participants' emotions and expectations, aiding in the analysis of market trends and potential turning points.

Market sentiment indicators are tools designed to gauge and represent the emotions and expectations of market participants, including investors, traders, and other market players, regarding the market's direction and prospects. These indicators help analyze the market's varying sentiments, such as pessimism, optimism, fear, and greed, providing insights into short-term and medium-term market trends. They are primarily used to measure market participants' emotions and expectations, aiding in the analysis of market trends and potential turning points.

These indicators can take various forms, including numerical indices, survey data, text sentiment analysis, market liquidity data, and more. They are typically based on market participants' behaviors, attention, and emotions, as well as relevant economic and financial events. These indicators serve as essential tools for investment decision-making and risk management since market sentiment significantly influences market price fluctuations and trends. For example, highly pessimistic sentiment can lead to market crashes, while extreme optimism can trigger market bubbles.

What are the market sentiment indicators?

CSI 300 Volatility Index: Also known as the VIX, this measures volatility and sentiment in the Chinese stock market. It is also considered a "panic index" because it rises during market turmoil, reflecting investor uncertainty and concern.

AAII Investor Sentiment Survey: The AAII (American Association of Individual Investors) publishes a weekly survey of investor sentiment, including investor perceptions of market direction (optimistic, pessimistic, or neutral). The results of this survey are used as an indicator of investor sentiment.

CBOE Put/Call Ratio: CBOE is the Chicago Board Options Exchange. It publishes the Put/Call Ratio, which measures the ratio of puts to calls in the stock options market. Higher values indicate that investors are worried about the market.

CNN Panic and Greed Index: An indicator based on market volatility and investor behavior that measures investor panic or greed

Financial News Sentiment Index: A number of organizations and data providers offer indices based on sentiment analysis of financial news texts to measure sentiment in news stories, such as positive, negative, or neutral sentiment.

Market Liquidity Indicators: These include trading volume, turnover spreads, market depth, etc., and are used to measure the level of liquidity in the market. Low liquidity may lead to mood swings.

Social Media Sentiment Analysis: analyzes posts and comments on social media platforms to assess investor and trader sentiment and perceptions.

Where can I see the sentiment indicators

| Market indicator sentiment |

Common source |

| VIX (Fear Index) |

Bloomberg, Reuters, CBOE, financial charting tools |

| AAII Investor Sentiment Survey |

AAII official website, financial news websites (e.g. CNBC) |

| CBOE Put/Call ratio |

Courtesy of the Chicago Board Options Exchange |

| The CNN Fear & Greed Index |

CNN official website, financial news website |

| News emotion analysis |

Financial news website |

| Consumer confidence index |

National Bureau of Economic Analysis, financial news website |

Formulas for Market Sentiment Indicators

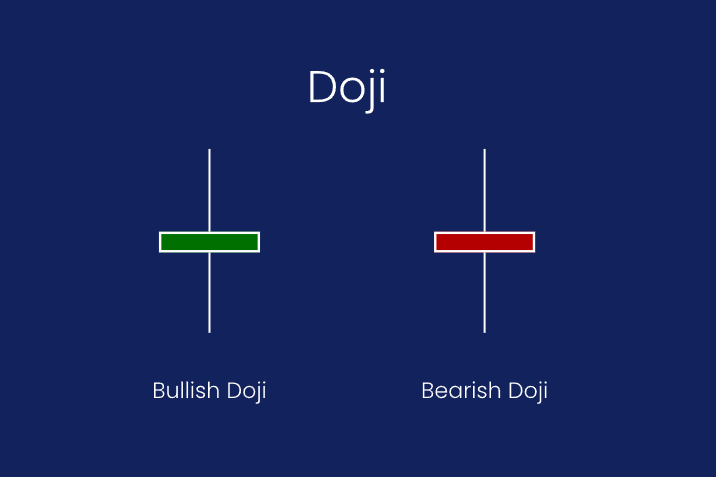

First, there is the volatility indicator. Market volatility can be an important sentiment indicator, usually measured in terms of standard deviation or volatility. Common volatility indicators include daily or annualized stock price volatility.

Annualized volatility = standard deviation (daily return) x √252 (assuming there are 252 trading days in a year)

There's also the Sentiment Index, which is based on sentiment analysis of market news, social media comments, or other text data. Sentiment analysis evaluates market sentiment based on positive, negative, or neutral sentiment in the text.

Sentiment index = (number of positive sentiment words minus number of negative sentiment words)/total number of sentiment words

Finally, there is the Investor Sentiment Index, which is calculated based on investor behavior, such as trading behavior, speculative positions, or hedge fund positions.

AAII Investor Sentiment Index = (Number of buying investors - Number of selling investors)/Total number of investors

Freezing point boiling point

The terms "freezing point" and "boiling point" are metaphors used to describe the state of market sentiment, which is meant to convey the extremes of market sentiment.

In finance, "freezing point" usually refers to the lowest point of market sentiment, where investor sentiment deteriorates to the point of extreme deterioration, usually accompanied by a sharp drop in market sentiment and panic. It is the lowest point in market sentiment and can occur during a market crash or major crisis. Investors may feel extremely worried and unable to react calmly to market volatility.

The "boiling point" is when market sentiment reaches its highest point and investors are in a state of extreme excitement and optimism. The market may be in a frenzy, with investors chasing stocks or other assets and prices rising rapidly, often accompanied by overvaluation and bubbles." At the "boiling point", the market may be at risk of correction or collapse.

Performance characteristics of market sentiment

| Performance characteristics |

Description. |

| Extreme optimism and pessimism |

May cause overconfidence or panic. |

| Panic mood |

Markets fall sharply, sell assets |

| greed |

Markets go wild, throw in the towel and chase assets |

| Emotionally driven trading |

Replaces rational analysis |

| Highly variable |

Active market sentiment |

| Indicators of surface emotion |

VIX, investor sentiment surveys show market sentiment |

| Reverse behavior |

Markets inspire counter-trend operations. |

| Emotional communication |

Spread through media, social media, investor communication |

| Market bubble |

Extreme emotion drives assets away from intrinsic value |

| Affective neutrality |

Neutral and smooth period. |

How to judge market sentiment indicators

First, it is important to understand the types of mood indicators. Different types of sentiment indicators may focus on different aspects of market sentiment, such as consumer confidence, investor sentiment, manufacturing sentiment, etc. Different mood indicators have specific uses and ways of interpreting them.

Looking at trends in emotional indicators is a common way to judge. If the sentiment indicator is on an upward trend, it may indicate a positive development in market sentiment. On the contrary, if the indicator value falls, it may indicate that market sentiment is moving. You can also compare the current values of sentiment indicators with historical data to see if there are any significant changes.

Observe how changes in sentiment indicators correlate with market performance. For example, if a consumer confidence index is up but the stock market is down, this may indicate that the market is more sensitive to other factors or that the market has already reflected the confidence index.

Link sentiment indicators to other economic indicators, financial news, and events. Certain events or news may have a direct or indirect impact on market sentiment, so consider these factors. Understand the timing of the release of sentiment indicators and related events to help explain possible market reactions. For example, elections, economic policy changes, geopolitical events, etc. can have a significant impact on sentiment markets.

Be careful not to treat sentiment indicators as a single market forecasting tool. It is a market reference, but market sentiment itself is complex and volatile, affected by a variety of factors. Therefore, additional information and analysis are needed to make detailed decisions.

How to set market sentiment indicators

First, identify the market and asset class. Then choose the appropriate sentiment indicators, such as the volatility index, investor sentiment survey, news sentiment analysis, etc.

Get data about the selected sentiment indicator. Timely access to data from market data, news feeds, social media data, etc. is necessary to ensure the quality of the data.

Use appropriate tools and software for data analysis and calculations, including the use of statistical analysis software or professional sentiment analysis tools. Some sentiment indicators may require sentiment analysis algorithms to process text data.

According to the results of the analysis of sentiment indicators, develop corresponding trading strategies. Different emotional indicators may require different strategies. Consider how sentiment indicators can be used in conjunction with other market analysis tools.

Use charts and visualization tools to visualize mood indicator data to better understand and interpret mood trends. Visualization helps to quickly identify mood changes and potential opportunities.

Market sentiment is dynamic, so it is important to monitor and update sentiment indicators regularly. Adjust and improve your sentiment indicator settings and strategy conditions to adapt to the changing market.

Consider the possible existence and limitations of emotional indicators, and do not rely too heavily on emotional indicators to make unwise decisions. Set stop-loss and risk management strategies to reduce potential risks.

5 Investor Sentiment Indicators

| Investor sentiment indicator |

Description |

| AAII Investor Sentiment Survey |

Weekly release of consumer views on the market |

| VIX index |

The Fear Index measures the market's expectations of volatility. |

| CBOE bearish/bullish |

Expresses investor concern about the market. |

| CNN Fear&Greed Index |

Low value market panic, high value greed. |

| News emotion analysis |

Assess the sentiments and opinions of market participants. |

Disclaimer:This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security, transaction, or investment strategy is suitable for any specific person.

Market sentiment indicators are tools designed to gauge and represent the emotions and expectations of market participants, including investors, traders, and other market players, regarding the market's direction and prospects. These indicators help analyze the market's varying sentiments, such as pessimism, optimism, fear, and greed, providing insights into short-term and medium-term market trends. They are primarily used to measure market participants' emotions and expectations, aiding in the analysis of market trends and potential turning points.

Market sentiment indicators are tools designed to gauge and represent the emotions and expectations of market participants, including investors, traders, and other market players, regarding the market's direction and prospects. These indicators help analyze the market's varying sentiments, such as pessimism, optimism, fear, and greed, providing insights into short-term and medium-term market trends. They are primarily used to measure market participants' emotions and expectations, aiding in the analysis of market trends and potential turning points.