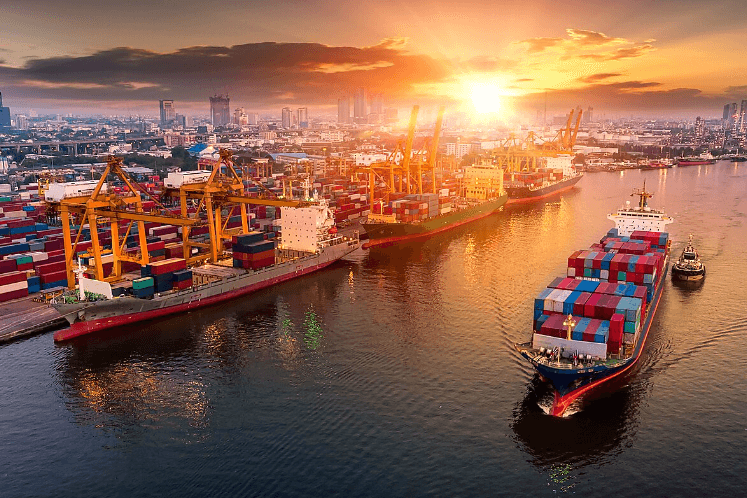

In today's economic globalization, the international division of labor cooperation interoperability is particularly important. Once there is international trade, there will inevitably be a trade balance.

Trade Balance is usually abbreviated as "TB", which is the abbreviation of Trade Balance. It is the difference between a country or region's exports and imports in international trade. Specifically, it is the total value of goods and services exported by a country or region minus the total value of goods and services imported by that country or region, usually expressed in a monetary unit (e.g., the U.S. dollar).

It can be categorized into trade surpluses and deficits.

The so-called trade surplus refers to the country's total export trade being greater than the total import trade in a certain period of time, also known as outflow. The opposite is a trade deficit, also known as an incoming tide or trade deficit.

Trade surpluses and deficits can affect changes in the exchange rate of a country's currency. In the case of China, for example, a large trade surplus means an increase in merchandise exports and pressure on the RMB to appreciate. Conversely, when there is a large trade deficit, the yuan will tend to depreciate.

When a country has a trade surplus, it means that the country is making a net profit from foreign trade. For the national economy, it has a class role in promoting industrial development, increasing employment, boosting GDP growth, and increasing foreign exchange reserves.

However, too large a trade surplus means a strong dependence on the international market. Once the international market doesn't buy anymore, the economy will be affected. Also, in order to cope with the pressure of the appreciation of the national currency, the country usually increases the amount of money issued, causing inflation. In addition to this, an excessive trade surplus over a long period of time can easily lead to friction with trading partner countries. After all, who wants to do business with someone who is always making money for themselves?

And when a country runs a trade deficit, it indicates that the country is at a disadvantage in foreign trade. In order to pay for the debt incurred at the end, national income flows out and economic performance turns weak. However, trade deficits are not all bad; an appropriate spread is conducive to reducing domestic inflationary pressure. It has a positive effect on easing short-term trade disputes and promoting long-term, stable growth in trade.

Overall, there is no advantage or disadvantage to having a trade surplus or deficit, and balance is the best state for a country.

Trade balance includes

| Component |

Definition |

| balance |

The export-import balance is the net value of a country or region in international trade. |

| exit |

The total value of goods and services sold by a country or region to other countries. |

| entrance |

The total value of goods and services purchased from other countries or regions. |

How to calculate

TB, as an important economic indicator in international trade, applies loosely to the difference between exports and imports of a country or region over a certain period of time. Its calculation is very simple and usually follows the following formula:

Trade Balance = Exports minus Imports

Exports are the total value of goods and services sold by a country or region to other countries, and imports are the total value of goods and services purchased by a country or region from other countries.

The steps for the calculation are as follows:

Finally, reduce the total amount of exports by the total amount of imports to get the balance. If the result is positive, it indicates a trade surplus, i.e., more exports than imports. These data should include detailed descriptions, quantities, and values of goods and services.

The values of all exported goods and services are then added together to obtain the total value of exports.

The value of all imported goods and services is then added to get the total imports.

Finally, reduce the total amount of exports by the total amount of imports to get the balance. If the result is positive, it means a trade surplus, that is, exports more than imports; if the result is negative, it indicates a trade deficit, i.e., more imports than exports.

Its calculation is usually expressed in terms of currency values (e.g., dollars, euros, renminbi, etc.) to reflect the total volume of goods and services. This indicator is very important for international economic research, policymaking, and economic policy decisions, as it can show the trade surplus or deficit of a country or region and the impact on economic activity and international trade.

Trade balance function

| Functional formula |

TB = X -M |

| TB |

Trade balance |

| exit |

X |

| entrance |

M |

| TB greater than zero |

There is a trade surplus, that is, more exports than imports. |

| TB less than zero |

There is a trade deficit, that is, more imports than exports. |

| TB equals zero |

Exports equal imports, trade balance. |

Is it the same as Net Exports?

They are two concepts, but there is a close relationship between them. Both concepts are related to international trade, but they focus on different aspects. According to the formula, both are the value of exports minus the value of imports, but their focus is different. TB focuses on the financial aspects of international trade, i.e., the difference in the value of goods and services between exports and imports. Net exports, on the other hand, focus on a country's overall impact on the international economic system, which has an effect on domestic production.

TB is usually a component of a country or region's trade data, whereas net exports are a more macroeconomic indicator that can be used to analyze a country's overall poor economic performance.

Trade Discrepancy

They are two related but different concepts that have different meanings in the vein of international trade:

Trade balance is mainly used for the current trade surplus or deficit between a country or region and other countries.

Trade balance is usually used to describe the trend of TB or any gap or shortfall in international trade. It can refer to an increase or decrease in TB or a gap between various trade figures, such as the gap between trade in goods and trade in services. It can also be used to discuss trends in international trade, e.g., a "widening trade balance" means that the trade balance is increasing, while a "narrowing trade balance" means that the trade surplus is decreasing.

The TB is a specific economic indicator that shows the difference between a country or region's exports and imports over a certain period of time. The trade balance is a more general term used to describe the difference in international trade, trends, or discrepancies between various trade data.

Relationship with Capital Outflows

There is a close relationship between the two, which is usually explained through the balance of payments. The balance of payments consists of two main components: the trade account and the capital account.

The trade account involves international trade in goods and services, including exports and imports. If a country's exports exceed its imports, it creates a trade surplus, indicating that it receives more money than it spends in international trade. Conversely, a trade deficit indicates that imports exceed exports.

The capital account includes capital flows, i.e., international investment and financial transactions. Capital flows are categorized into direct investment and portfolio investment. Trade surpluses usually lead to capital jumps because the country has foreign exchange reserves that can be used for direct investment, purchasing foreign assets, or providing loans. Conversely, a trade deficit usually triggers an inflow of capital to make up for the deficit, which can be in the form of foreign direct investment, foreign foreign exchange, or domestic purchases of assets by foreign investors.

The relationship between trade balance and capital outflow

| Trade balance |

Capital outflow |

Relation description |

| Trade surplus |

Capital outflow |

Outflows balance the balance of payments. |

| Trade surplus |

Capital inflow |

Attracting foreign investors, leading to capital inflows |

| Trade deficit |

Capital inflow |

Stimulate capital inflows to compensate. |

| Trade deficit |

Capital outflow |

Continued expansion leads to the return of funds. |

| Balanced trade |

Capital balance flow |

The balance of payments remained stable.

|

Why does a Trade Balance Deficit Appreciate Currency?

The relationship between trade deficits and Currency Appreciation can be explained by the supply and demand mechanisms of the foreign exchange market. Typically, when a country runs a deficit trade balance (i.e., imports exceed exports), there may be pressure for that country's currency to appreciate.

A change in the trade deficit indicates that the country needs large amounts of foreign currency to pay for imported goods and services, and the demand for foreign exchange (usually in the form of foreign currency) increases. This can cause supply and demand to occur in the foreign exchange market as the forces of supply and demand begin to push the currency to appreciate for more foreign currency.

Trade deficits may cause international investors to take an interest in investing in their country because they perceive higher returns from an appreciation of their currency. This investment demand can also drive currency appreciation.

Some national central banks may take measures to support the appreciation of their currencies in order to reduce the impact of trade deficits. Such interventions may include purchases of the national currency or sales of foreign currency.

If a country's currency appreciates, then foreign investors may be attracted because they can obtain higher interest rates on the local currency. This attraction to foreign investment may lead to an appreciation of the national currency.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.