When people think of New Zealand, they often picture sheep grazing in lush green fields and the stunning landscapes featured in movies like The Lord of the Rings. Despite being a small country, New Zealand boasts a robust economy with significant economic value. In the foreign exchange market, its currency pairs are highly favored by many investors. In this article, we will provide a detailed explanation of the New Zealand dollar (NZD) and the factors that influence its exchange rate. Our goal is to offer valuable insights to aid your understanding.

New Zealand dollar

Yes, the New Zealand dollar is also called the New Zealand dollar. It is the official currency of New Zealand, with the international currency code NZD. It is not as prominent in the international monetary system as the US dollar or the euro, but it is an active currency in the foreign exchange market, especially in the Asia-Pacific region. It is often traded with other major currencies, such as the U.S. dollar, the euro, the Japanese yen and is especially frequently traded in cross-currency pairs with the Australian dollar.

New Zealand is located in the southwestern part of the Pacific Ocean, with Wellington as its capital, and became a British colony on February 6. 1840. after the signing of the Treaty of Waitangi between the natives of New Zealand and the United Kingdom. 1947 saw the independence of New Zealand from the United Kingdom, and New Zealand is now a member of the Association of the United Kingdom.

New Zealand is a developed country with a GDP per capita comparable to Japan and the United Kingdom. In 2017. it was ranked by the World Bank as the number one best country for doing business, surpassing most developed countries. The Leggadon Institute, a British think tank, released the Global Prosperity Index survey report in 2018. and New Zealand, which ranked second in the prosperity indicators, including the quality of the economy, was awarded the world's first throne.

Openness and transparency in investment attraction have kept New Zealand's economy at the forefront year-round, attracting investors from all over the world to buy New Zealand dollars. For this reason, the New Zealand dollar is also known as the premium currency. Unlike other countries, New Zealand's industrial and technological sectors are not well developed,while the livestock industry accounts for the largest proportion of exports. Among them, sheep meat, dairy products, and wool exports ranked first in the world. Agricultural and livestock exports contribute to New Zealand's annual 16 billion U.S. dollars, accounting for about 65% of the total value of exports.

It is not only exports that drive economic growth; tourism is also extremely important, bringing more than $10 billion in business opportunities to New Zealand every year. As a country of natural beauty, New Zealand attracts a large number of international tourists. Therefore, its official currency plays an important role in the tourism industry and for international tourists, exchanging New Zealand dollars is an essential operation when they travel in New Zealand.

The New Zealand dollar is divided into bills and coins. New Zealand's bills are divided into five denominations, namely $5. $10. $20. $50. and $100 bills. These bills are printed with New Zealand's famous people, culture, and natural landscapes. Among them, the $5 front side features Sir Edmund Hillary,the first person to summit Mount Everest and Mount Cook, as well as agricultural machinery. On the back are Huangyan Qineng and Campbell Island Shihara.

The $10 features feminist activist Catherine Shepherd and camellias on the front and a view of New Zealand's South Island and rivers on the back. The $20 features Queen Elizabeth II and an iconic Auckland landmark, the Ippui Building, on the front. On the back is the New Zealand falcon, a distinctive raptor.

The $50 coin features the Lawyer and Statesman's Settlement Tower and City Hall on the obverse,while the reverse usually features a small bird called the "droopy-eared" bird,also known as the long-eared bird. 100 features physicist Ernest Rutherford and the Nobel Prize Medal on the obverse,while the reverse features New Zealand's Yellow-Headed Eagle and the Ohio River Forest.

New Zealand coins include 1. 2. 5. 10. 20. and 50 cent pieces,as well as $1 and $2 coins. These coins usually feature New Zealand flora and fauna, national symbols, and cultural symbols.

The obverse of these coins all features a portrait of Elizabeth II and the year of issue,while the reverse has a more varied design. The reverse of the 10 cents features a carved Maori head; the reverse of the 20 cents features a Maori carving of a Maori man; and the reverse of the 50 cents features the triple-tailed sailing ship Nuri and Taranaki. The reverse of the 1 dollar features a taro and silver horns,and the reverse of the 2 dollar features a white egret.

Overall,the New Zealand dollar is an important currency that is widely used and traded both inside and outside of New Zealand,and its value is affected by a variety of factors,including economic conditions,central bank policies,and global market factors.

New Zealand Dollar Exchange Rates

New Zealand Dollar Exchange Rates

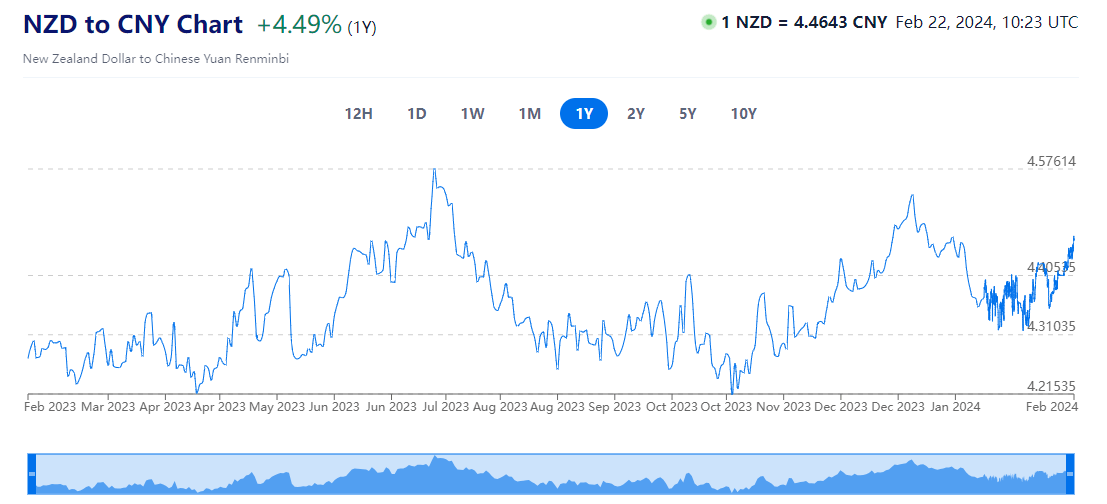

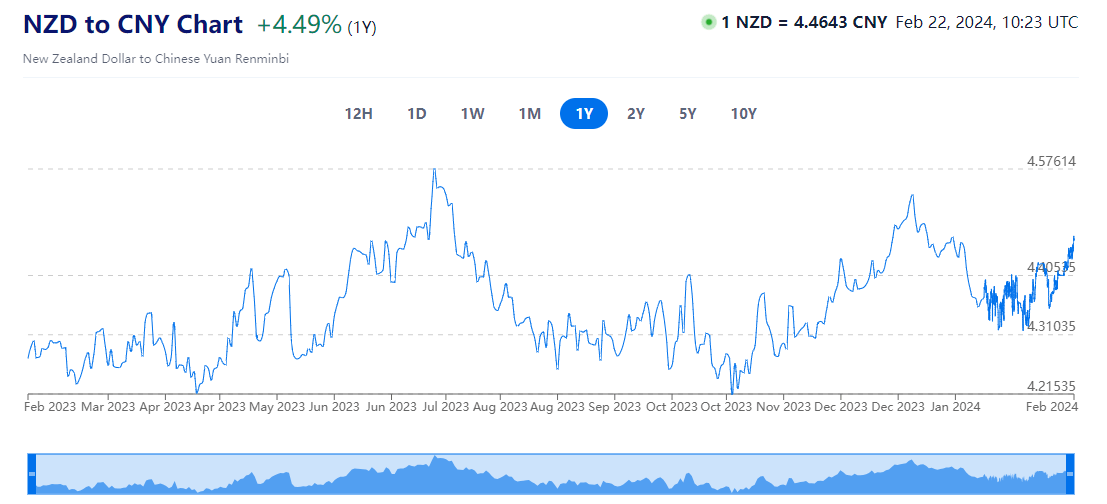

The New Zealand dollar is a free-floating currency,so its exchange rate is subject to fluctuations due to many factors. For example,in terms of its currency attributes,it is the national legal tender of New Zealand. So some political and economic factors in New Zealand will have an impact on the New Zealand dollar.

Secondly,as a commodity currency,it will also be affected by the sentiment in the foreign exchange market,which in turn will affect the exchange rate movement. Then, as a non-US currency,the movement of the US dollar will also affect it. Therefore,if you want to invest in the New Zealand dollar,you need to pay attention to the exchange rate changes with the US dollar.

In detail,as New Zealand's national currency,its own economy and interest rates will have a great impact on it and can almost be said to control its exchange rate trend. Among these,economic fundamentals,or its economic data,have a significant impact on its exchange rate.

These include Gross Domestic Product (GDP), employment data,inflation,trade data,unemployment,inflation,employment,price index,consumer confidence,purchasing managers index,and retail sales data. Better economic data usually leads to an appreciation of the New Zealand dollar and vice versa.

Furthermore,New Zealand is an export-oriented economy, and its foreign trade activities have a significant impact on the exchange rate. An increase in exports usually pushes the New Zealand dollar to appreciate,and a decrease in exports may cause it to depreciate. Among them,the price of raw materials is critical. Because it is the largest exporter of dairy products and sheep meat,the world's largest importer of raw materials is currently China. China's economic downturn will also affect the performance of raw material exporters.

Meanwhile,the Reserve Bank of New Zealand's interest rate policy has a significant impact on the exchange rate. Raising interest rates may attract more capital inflows into New Zealand,supporting the New Zealand dollar; lower interest rates may lead to a depreciation of the New Zealand dollar. The change in interest rate depends on the inflation target and the employment rate.

When inflation reaches the central bank's target and is under full employment,the central bank may raise the benchmark interest rate,maintaining a tight monetary policy. On the contrary,when inflation stEPS into the target range of the central bank, unemployment continues to climb. The central bank will adjust the benchmark interest rate and implement monetary easing. Interest rates are the most important policy pushers for central banks.

For example,in May 2019. the Central Bank of New Zealand announced an interest rate cut,opening the first round of interest rate cuts in advanced countries. In August,it even cut interest rates in one big breath,reducing the benchmark interest rate level to 1%. Like Australia,the New Zealand government has changed its monetary policy instruments in the past and vigorously implemented loose monetary policy.

The reason for this is that the US-China trade war has disrupted the global supply chain,and the currencies of commodity-exporting countries have all depreciated. In the face of sluggish inflation and falling raw material prices,boosting inflation has become the primary goal of central banks.

The political stability of New Zealand is also an important factor for investors to consider. Political turmoil may lead to a decline in investor confidence in New Zealand,leading to a depreciation of the New Zealand dollar. And international capital flows also have an impact on the New Zealand dollar exchange rate. The inflow or outflow of funds from foreign investors can affect New Zealand's capital account,which in turn affects the supply and demand for New Zealand dollars and the level of the exchange rate.

New Zealand is a highly open economy, and the risk appetite in global markets has a significant impact on its exchange rate. If global investors are optimistic about risky assets,it will usually support the New Zealand dollar; on the contrary,increased panic in the global market may lead to a depreciation of the New Zealand dollar.

As you can see from the above,the global economic situation,geopolitical tensions,natural disasters, and other external events,as well as investor sentiment and expectations,all have an impact on the New Zealand dollar's exchange rate.

New Zealand Dollar to US Dollar Exchange Rate

New Zealand Dollar to US Dollar Exchange Rate

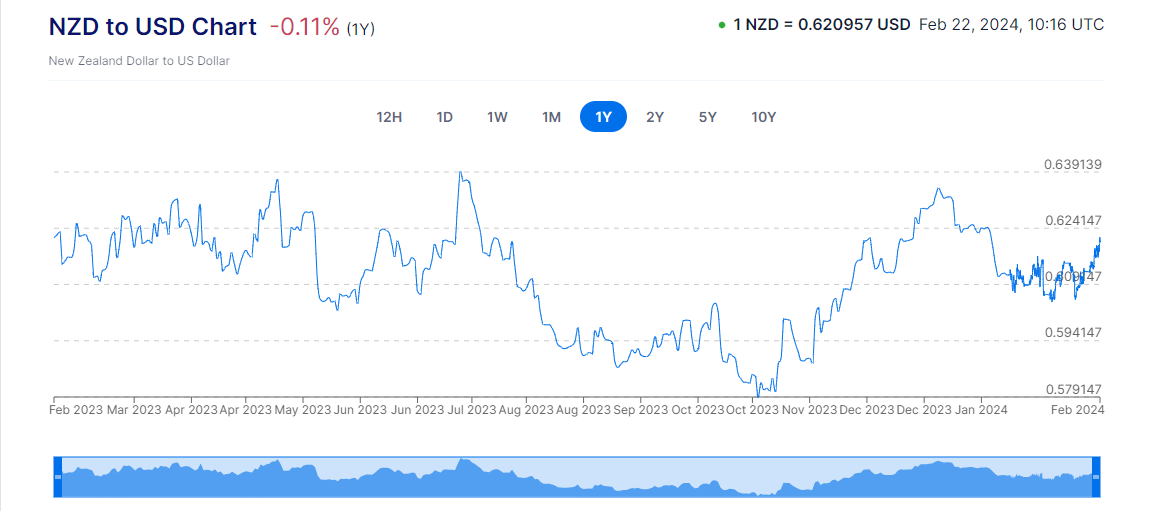

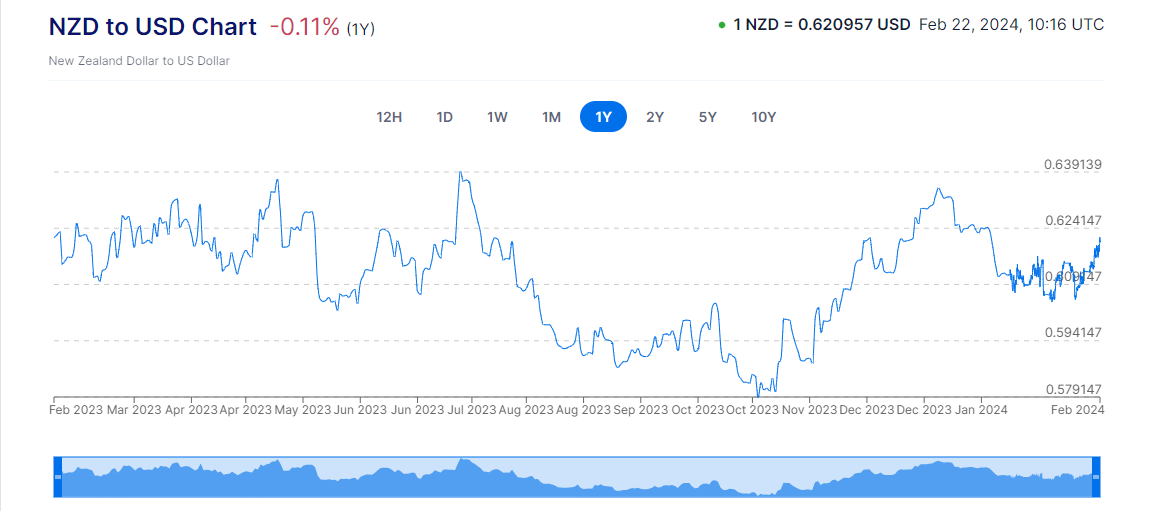

Like New Zealand itself,the New Zealand dollar to US dollar exchange rate is affected by economic data and interest rates. And it is the economic data (e.g., GDP growth rate,Inflation rate,employment data, etc.) and monetary policies (e.g., interest rate decisions,quantitative easing, etc.) of both New Zealand and the United States of America that will have an impact on their exchange rates. In general,strong economic data and hawkish monetary policy may support the NZDUSD exchange rate,while the opposite can negatively impact it.

Also, the difference in interest rates between New Zealand and the US can have a significant impact on the exchange rate. If New Zealand's interest rates are higher than those in the US, investors may be more willing to hold the New Zealand dollar for higher interest income, driving its appreciation. Whereas if US interest rates are higher than New Zealand's, the result is the opposite: an appreciation of the US dollar.

Changes in trade activity and economic relations between two countries can also affect the exchange rate. For example, if New Zealand exports to the United States increase,then increased demand may push the New Zealand dollar to appreciate, and vice versa. At the same time, changes in the New Zealand dollar's exchange rate against the U.S. dollar will affect New Zealand's exports.

It is important to realize that New Zealand is an export-oriented country with considerable exports to the United States. Therefore,changes in the New Zealand dollar-US dollar exchange rate will directly affect New Zealand exporters and importers. If the New Zealand dollar strengthens against the US dollar,the price of New Zealand's exports to the US will increase,potentially reducing US demand for New Zealand products,and vice versa.

Geopolitical tensions or uncertainty typically lead to increased investor demand for safe assets,which may include the U.S. dollar. Therefore,uncertainty associated with geopolitical events may lead to volatility in the NZD/USD exchange rate. At the same time, investors market sentiment and risk appetite can also affect the exchange rate. For example,if investors are optimistic about the global economic outlook,they may be more inclined to hold higher-yielding currencies,which could have a positive impact on the NZDUSD exchange rate.

And at the same time,changes in the NZDUSD exchange rate can have an impact on all aspects of the New Zealand economy,including exports, imports, tourism, investment and inflation and deflation. As a result, government and the central bank usually pay close attention to changes in the exchange rate and adopt appropriate policies in response.

Future New Zealand Dollar Forecast

|

Timeframe

|

Exchange rate forecast

|

|

The next few days or weeks

|

0.6179 |

|

Medium-term outlook (3-6 months)

|

0.6178 |

|

Long-term outlook (6 months to 2 years)

|

0.6156 (after one year), 0.6128 (after two years) |

Disclaimer:This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security, transaction, or investment strategy is suitable for any specific person.

New Zealand Dollar Exchange Rates

New Zealand Dollar Exchange Rates New Zealand Dollar to US Dollar Exchange Rate

New Zealand Dollar to US Dollar Exchange Rate