The dollar wavered on Wednesday

2024-09-18

Summary:

Summary:

The dollar wavered 18 Sep 2024 after US retail sales unexpectedly rose in August, and the Atlanta Fed raised its GDPNow estimate to 3% from 2.5%.

EBC Forex Snapshot, 18 Sep 2024

The dollar wavered on Wednesday after data showing US retail sales

unexpectedly rose in August and the Atlanta Fed's GDPNow estimate was raised to

3% from 2.5%.

The Fed is expected to make its first interest rate cut in more than four

years this week, with markets pricing a 2/3 probability of a 50 bps. Its tone

will drive the reaction in the forex market.

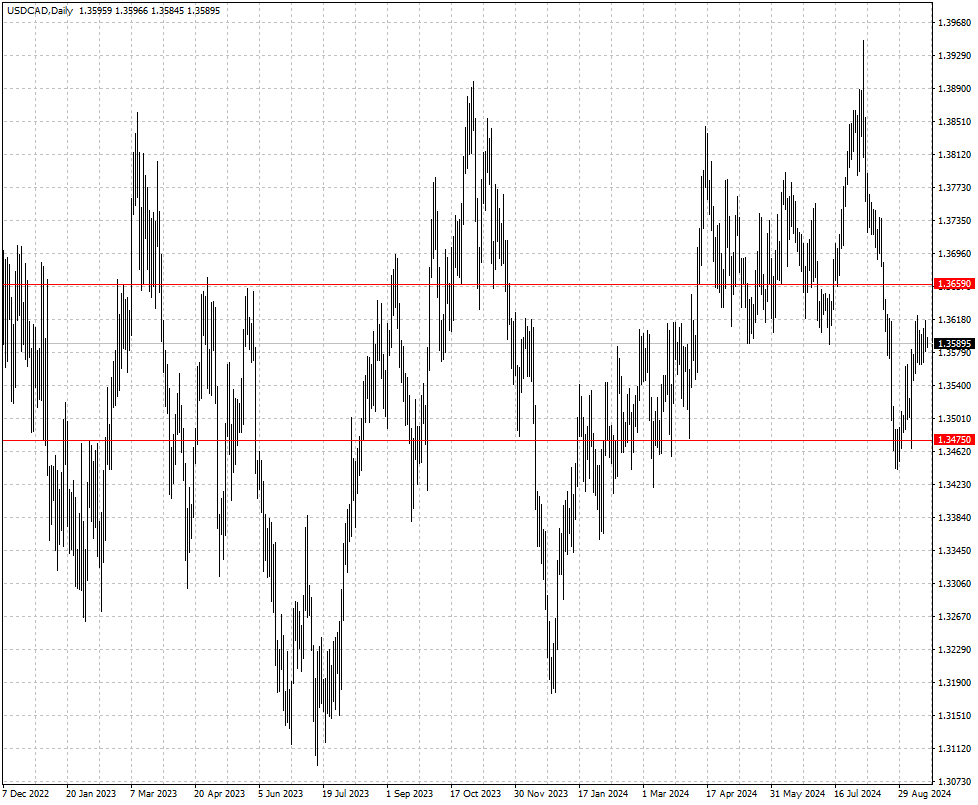

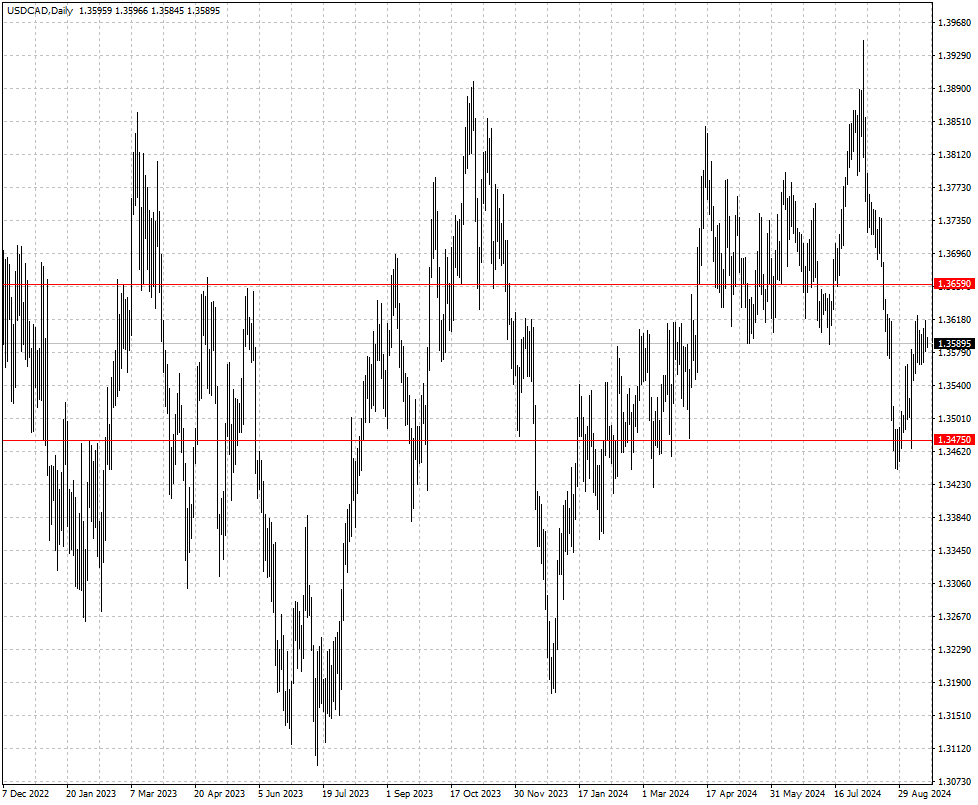

Loonie dipped as inflation fuels sizable BOC rate cuts. Consumer prices

posted its smallest rate of increase since February 2021 and reached the 2%

target in August.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 9 Sep) |

HSBC (as of 17 Sep) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0857 |

1.1202 |

1.1027 |

1.1211 |

| GBP/USD |

1.2860 |

1.3266 |

1.3056 |

1.3319 |

| USD/CHF |

0.8375 |

0.8763 |

0.8364 |

0.8539 |

| AUD/USD |

0.6618 |

0.6871 |

0.6640 |

0.6843 |

| USD/CAD |

1.3441 |

1.3792 |

1.3475 |

1.3659 |

| USD/JPY |

141.70 |

149.39 |

137.71 |

145.35 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.