The dollar rose to a 4-week high against the euro

2024-09-12

Summary:

Summary:

On Thursday, the dollar hit a four-week high against the euro as persistent inflation suggested the Fed might avoid a large rate cut next week.

EBC Forex Snapshot, 12 Sep 2024

The dollar traded near a four-week high versus the euro on Thursday after

signs of some stickiness in inflation reinforced expectations that the Fed would

avoid a super-sized interest rate cut next week.

The US core CPI climbed 0.3% last month, accelerating from the previous

month's 0.2% increase. Meanwhile, consumer spending has held up even better than expected, according

to the most recent reading.

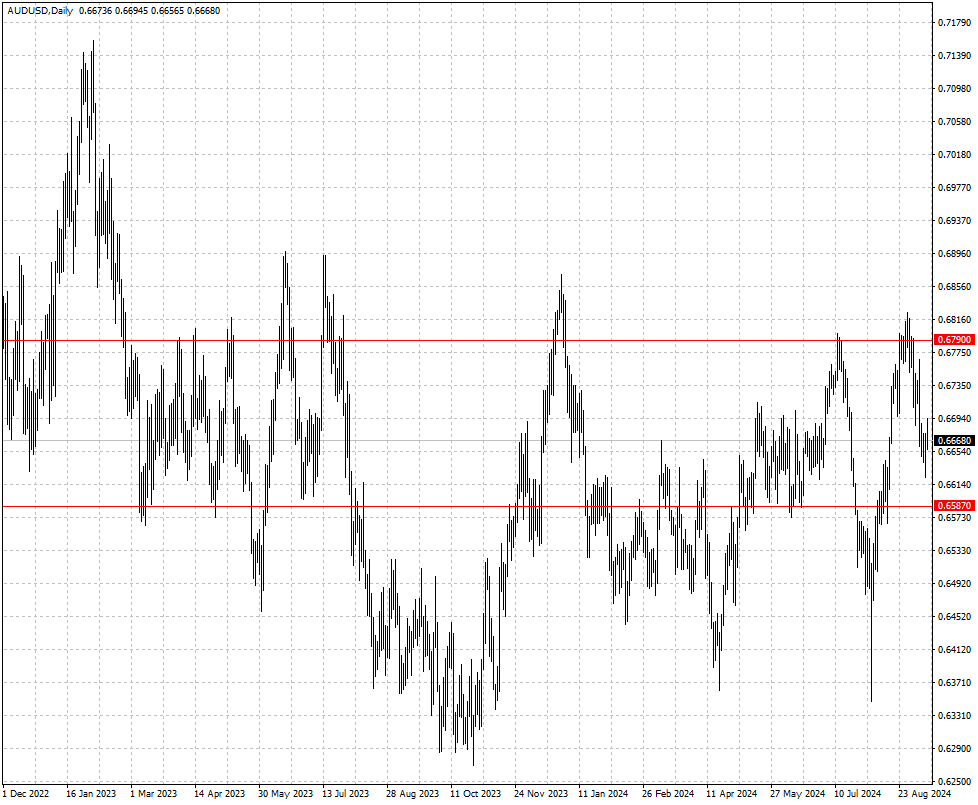

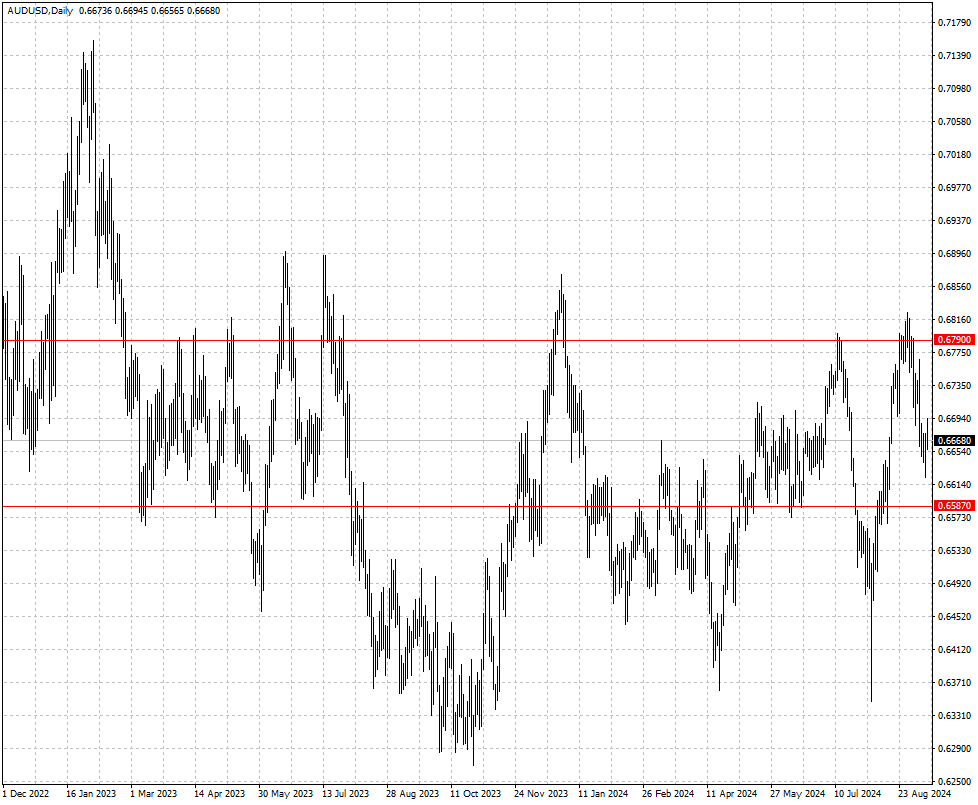

The risk-sensitive Australian dollar firmed as Asian stocks gained. China's

iron ore imports in August fell 4.73% from a year earlier, customs data showed,

as a gloomy demand outlook dampened buyers' appetite.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 9 Sep) |

HSBC (as of 12 Sep) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0857 |

1.1202 |

1.0941 |

1.1141 |

| GBP/USD |

1.2860 |

1.3266 |

1.2939 |

1.3206 |

| USD/CHF |

0.8375 |

0.8763 |

0.8416 |

0.8583 |

| AUD/USD |

0.6618 |

0.6871 |

0.6587 |

0.6790 |

| USD/CAD |

1.3441 |

1.3792 |

1.3465 |

1.3649 |

| USD/JPY |

141.70 |

149.39 |

139.63 |

146.13 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.