AUD rebounds on jobs report

2024-09-19

Summary:

Summary:

The US dollar fell on Thursday after the Fed's larger-than-expected rate cut, which Powell said was to maintain low unemployment.

EBC Forex Snapshot, 19 Sep 2024

The US dollar edged lower on Thursday after a larger than usual interest rate

hike from the Fed that had been priced in by markets. Powell said that was meant

to sustain a low unemployment rate.

Policymakers projected the benchmark interest rate would fall by another 50

bps by the end of this year. Some analysts expect the greenback will fall next

year as the Fed keeps cutting rates.

The Aussie dollar rose. Australian employment blew past forecasts for a third

straight month in August while the jobless rate held steady, reinforcing the

view that the labour market remains tight.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 9 Sep) |

HSBC (as of 17 Sep) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0857 |

1.1202 |

1.1027 |

1.1211 |

| GBP/USD |

1.2860 |

1.3266 |

1.3056 |

1.3319 |

| USD/CHF |

0.8375 |

0.8763 |

0.8364 |

0.8539 |

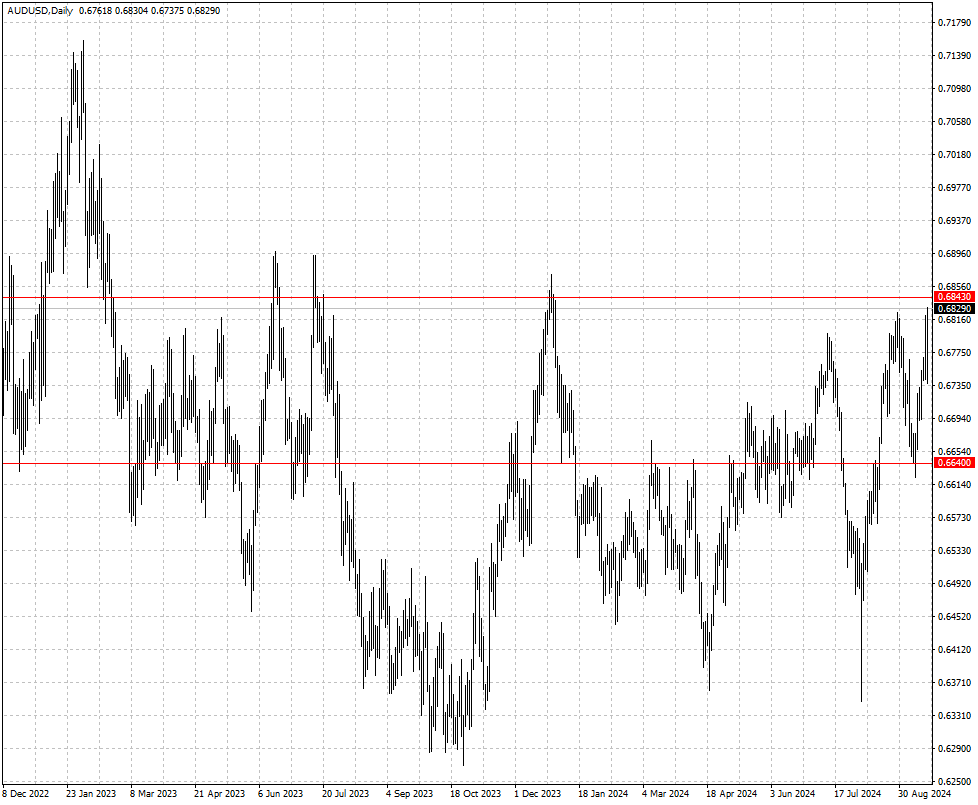

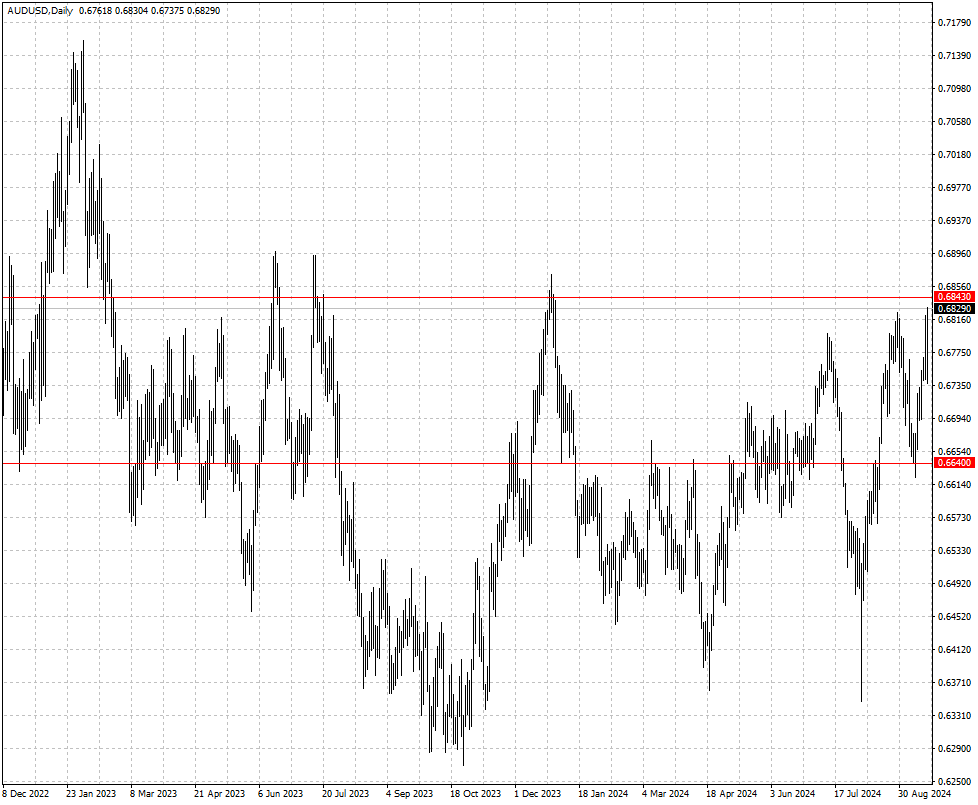

| AUD/USD |

0.6618 |

0.6871 |

0.6640 |

0.6843 |

| USD/CAD |

1.3441 |

1.3792 |

1.3475 |

1.3659 |

| USD/JPY |

141.70 |

149.39 |

137.71 |

145.35 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.