The Bank of Japan showed economic optimism on Friday

2024-09-20

Summary:

Summary:

The yen rose as the BOJ showed optimism on growth and signaled cautious tightening, while the dollar fell on expectations of more US rate cuts.

EBC Forex Snapshot , 20 Sep 2024

The yen pared its losses on Friday as the BOJ sounded optimistic about growth

and signalled it will be judicious about further policy tightening, while the

dollar sagged as markets priced in more US rate cuts.

The central bank maintained its view the economy remained on track for a

moderate recovery, but said inflation was moderating and on target, leaving

traders reluctant to increase bearish bets.

Markets imply a 40% chance the Fed will cut by another 50 bps in November.

Rates are seen at 2.85% by the end of 2025, which is now thought to be the Fed's

estimate of neutral.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 16 Sep) |

HSBC (as of 20 Sep) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0857 |

1.1202 |

1.1045 |

1.1233 |

| GBP/USD |

1.2812 |

1.3266 |

1.3084 |

1.3399 |

| USD/CHF |

0.8375 |

0.8763 |

0.8384 |

0.8559 |

| AUD/USD |

0.6618 |

0.6871 |

0.6676 |

0.6895 |

| USD/CAD |

1.3441 |

1.3792 |

1.3466 |

1.3649 |

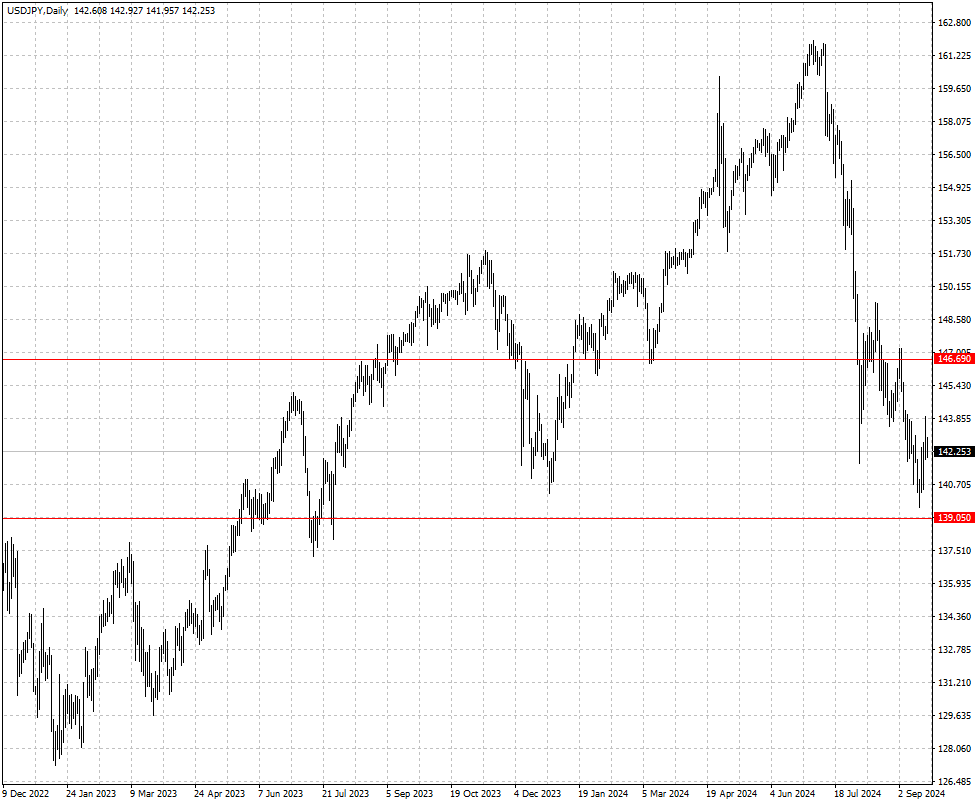

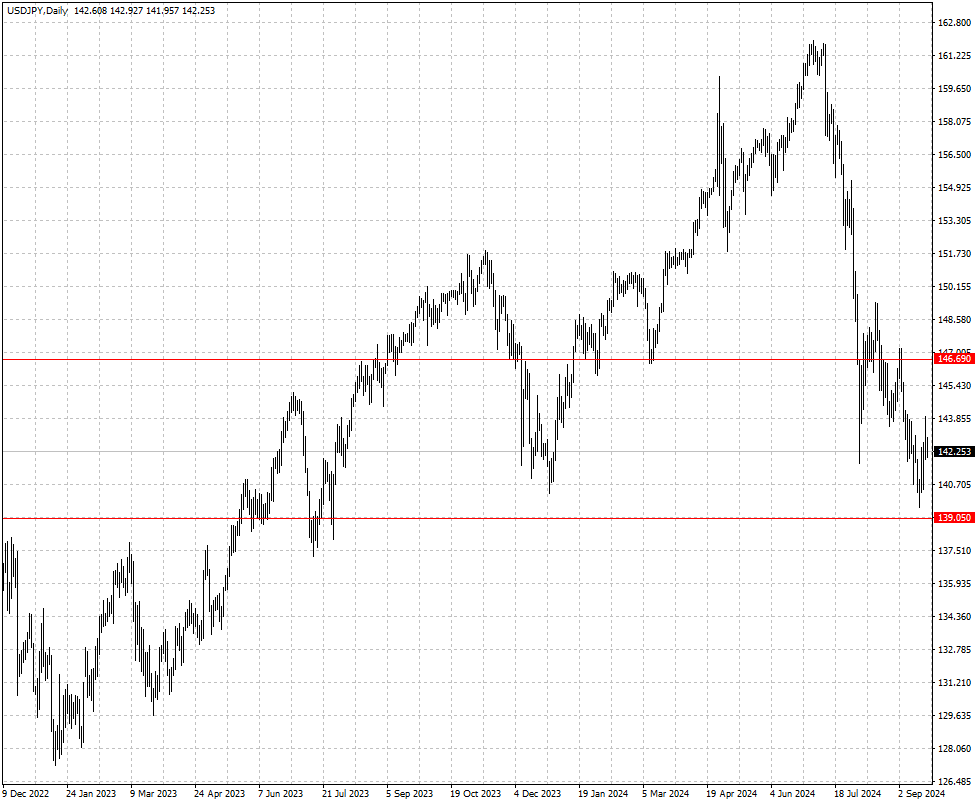

| USD/JPY |

140.25 |

147.13 |

139.05 |

146.69 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.