The dollar was set to end 2023 lower

2023-12-29

Summary:

Summary:

The dollar is poised to finish 2023 lower, halting two years of gains. The market anticipates the Fed rate easing by March, causing the decline.

EBC Forex Snapshot

29 Dec 2023

The dollar was set to end 2023 lower, reversing two straight years of gains,

dragged by market expectations that the Fed could begin easing rates as early as

next March.

The yen also underperformed, extending into a third straight year of losses

as the BOJ maintained its ultra-loose monetary policy in a year of aggressive

interest rate hikes by other central banks.

BOJ Governor Kazuo Ueda said he was in no rush to unwind negative interest

rates as the risk of inflation running well above 2% and accelerating was small,

NHK reported on Wednesday.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 14 Dec) |

HSBC (as of 28 Dec) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0724 |

1.1017 |

1.0843 |

1.1243 |

| GBP/USD |

1.2326 |

1.2848 |

1.2590 |

1.2905 |

| USD/CHF |

0.8667 |

0.8957 |

0.8283 |

0.8697 |

| AUD/USD |

0.6445 |

0.6526 |

0.6632 |

0.6959 |

| USD/CAD |

1.3381 |

1.3695 |

1.3048 |

1.3492 |

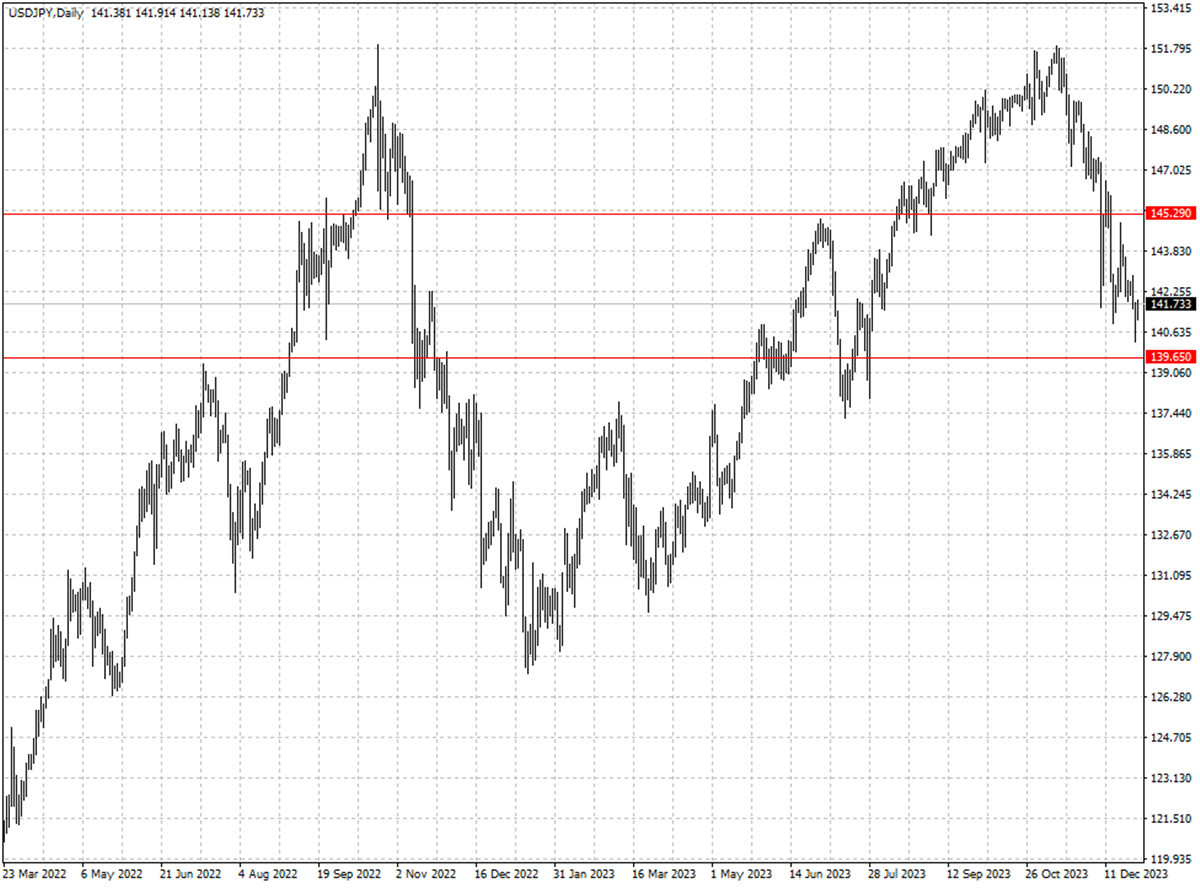

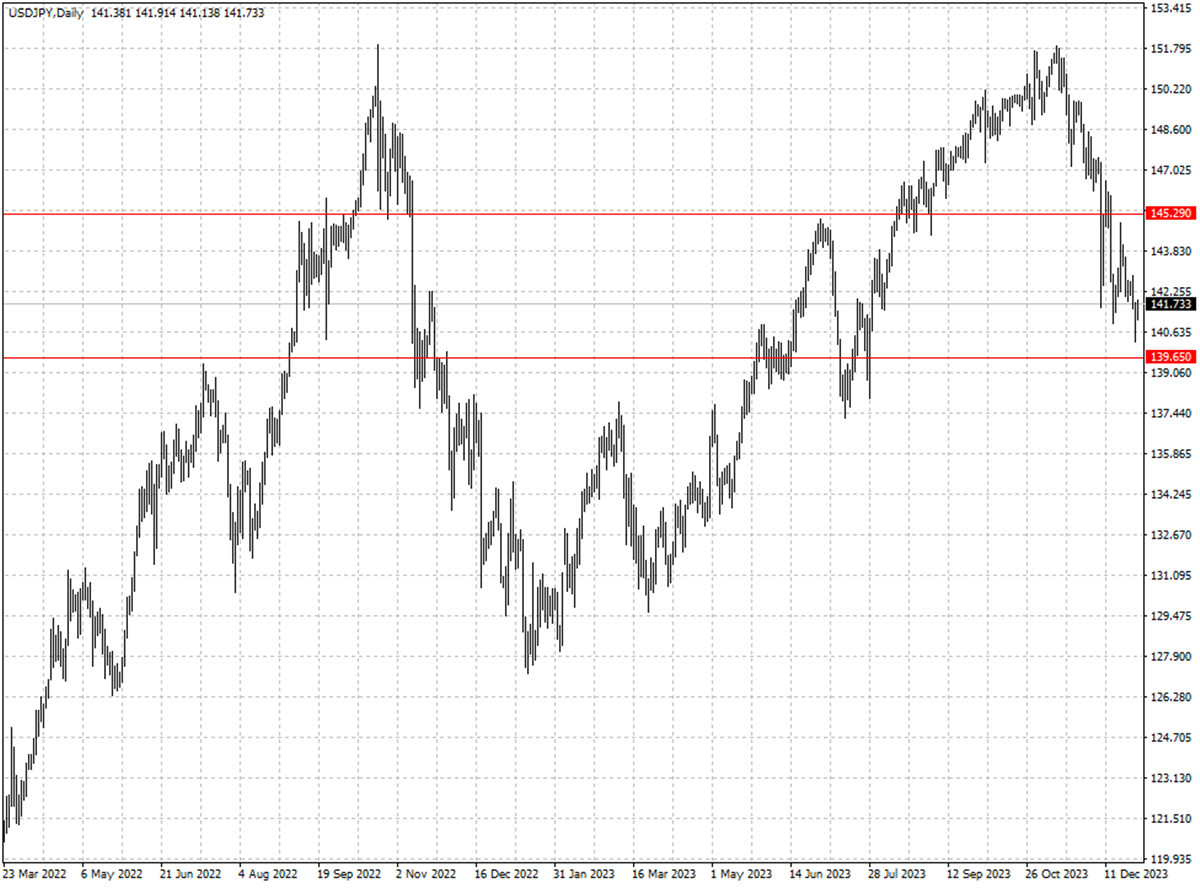

| USD/JPY |

139.48 |

147.50 |

139.65 |

145.29 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.