The dollar rose on the year's first trade

2024-01-02

Summary:

Summary:

The dollar rose on the first trading day of the year, with attention on this week's economic data for clues on the Fed's next move.

EBC Forex Snapshot

2 Jan 2024

The dollar crept higher on the first trading day of the year as attention

turned to economic data this week that may provide clues on the Fed's next

move.

Markets are now pricing in an 86% chance of interest rate cuts to start from

March, according to CME FedWatch tool, with over 150 bps of easing anticipated

in the year. Meanwhile, the BOE is also expected to cut rates by 144 bps in

contrast.

Sterling clocked its best performance last year since 2017 although a

stagnant economy and political uncertainty means another gain of 5% will be

unlikely.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 18 Dec) |

HSBC (as of 28 Dec) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0724 |

1.1017 |

1.0843 |

1.1243 |

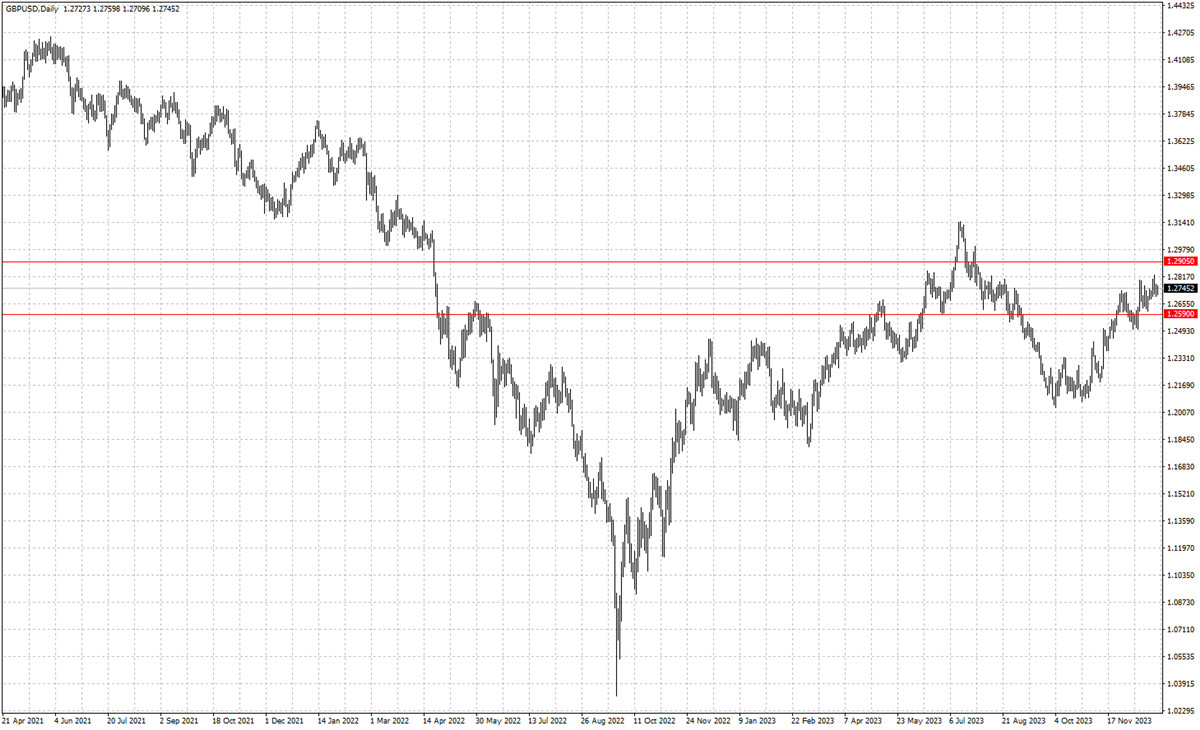

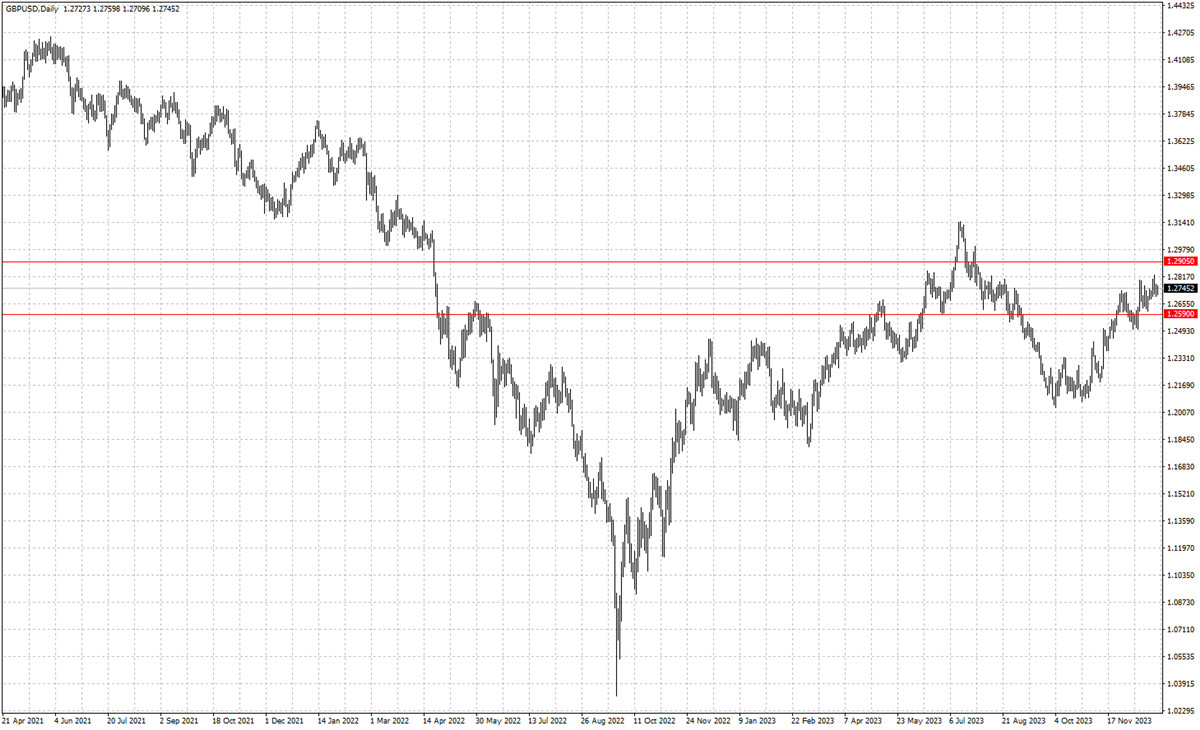

| GBP/USD |

1.2326 |

1.2848 |

1.2590 |

1.2905 |

| USD/CHF |

0.8667 |

0.8957 |

0.8283 |

0.8697 |

| AUD/USD |

0.6526 |

0.6750 |

0.6632 |

0.6959 |

| USD/CAD |

1.3381 |

1.3695 |

1.3048 |

1.3492 |

| USD/JPY |

139.48 |

147.50 |

139.65 |

145.29 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.