EBC Forex Snapshot

28 Dec 2023

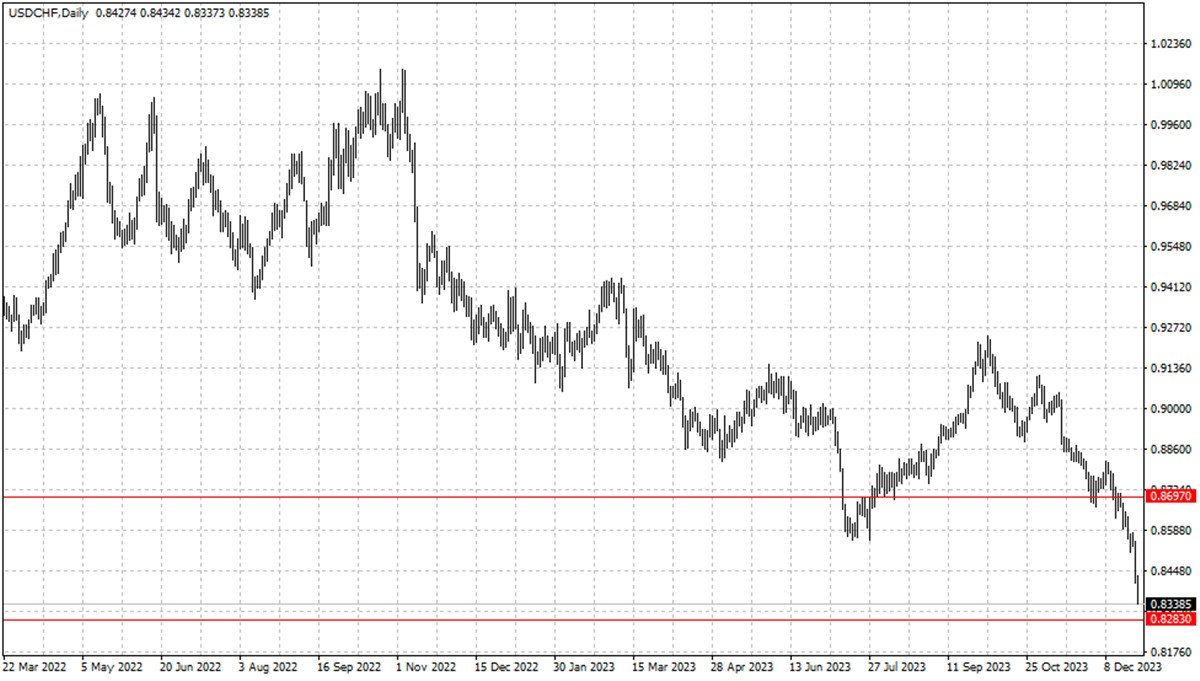

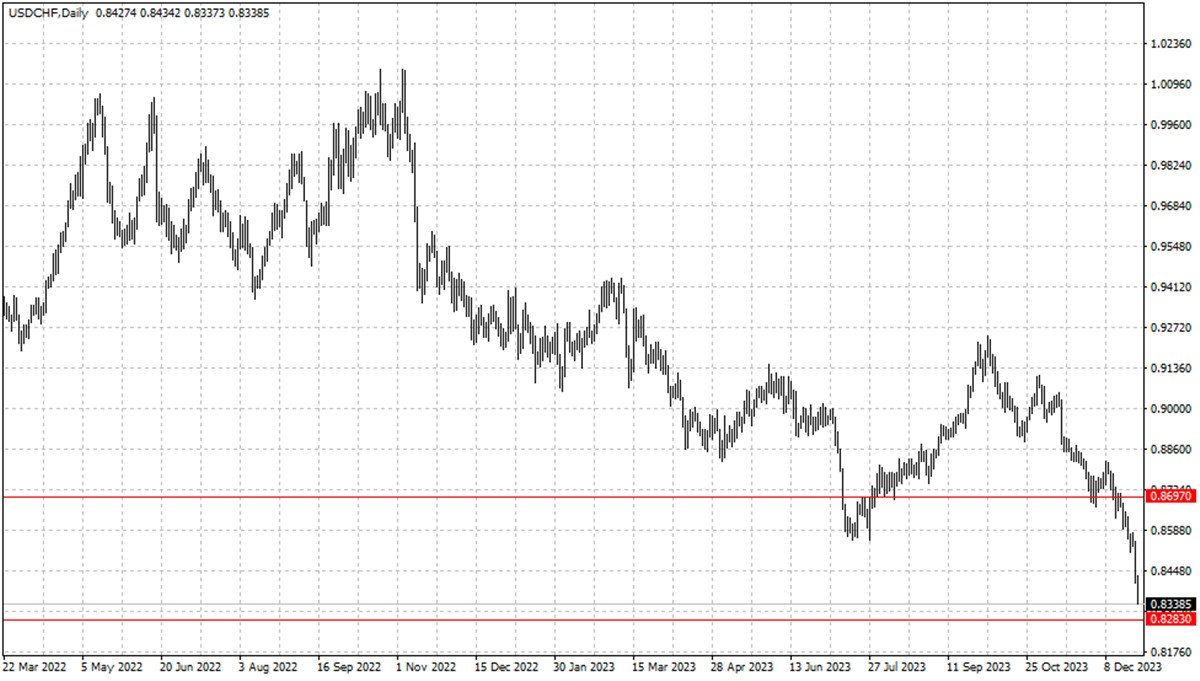

The dollar nursed steep losses on Thursday and was headed for a yearly

decline, while the Swiss franc perched at a nine-year peak and the euro at a

five-month high.

Investor focus remains on the timing of the interest rate cuts from the Fed,

with markets pricing in a 88% chance of a cut in March 2024, according to CME

FedWatch tool. Some analysts remain unconvinced.

Swiss inflation is now back below 2%, meaning that the SNB is the only major

central bank currently hitting its inflation target.

However, the return of meaningful positive interest rates among the major G10

currencies means that carry trades are likely to come back into fashion, which

could weigh down the currency.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 14 Dec) |

HSBC (as of 28 Dec) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0724 |

1.1017 |

1.0843 |

1.1243 |

| GBP/USD |

1.2326 |

1.2848 |

1.2590 |

1.2905 |

| USD/CHF |

0.8667 |

0.8957 |

0.8283 |

0.8697 |

| AUD/USD |

0.6445 |

0.6526 |

0.6632 |

0.6959 |

| USD/CAD |

1.3381 |

1.3695 |

1.3048 |

1.3492 |

| USD/JPY |

139.48 |

147.50 |

139.65 |

145.29 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.