The dollar remained under pressure on Wednesday

2023-12-27

Summary:

Summary:

Dollar weak, euro near 4-month high on Fed rate cut expectations. Holiday-related low trading volumes are expected until the New Year.

EBC Forex Snapshot

27 Dec 2023

The dollar remained under pressure on Wednesday and the euro was close to a

four-month peak, as expectations that the Fed would soon cut interest rates took

hold in the market. With many traders out for holidays, volumes are likely to be

muted until the New Year.

Markets are now pricing in a 79% chance of a rate cut starting in March 2024,

according to CME FedWatch tool, with over 150 basis points of cuts priced in for

next year.

The eurozone economy is set for only modest growth next year despite wages

rising faster than inflation for the first time in three years, according to a

FT poll of economists.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 14 Dec) |

HSBC (as of 27 Dec) |

|

support |

resistance |

support |

resistance |

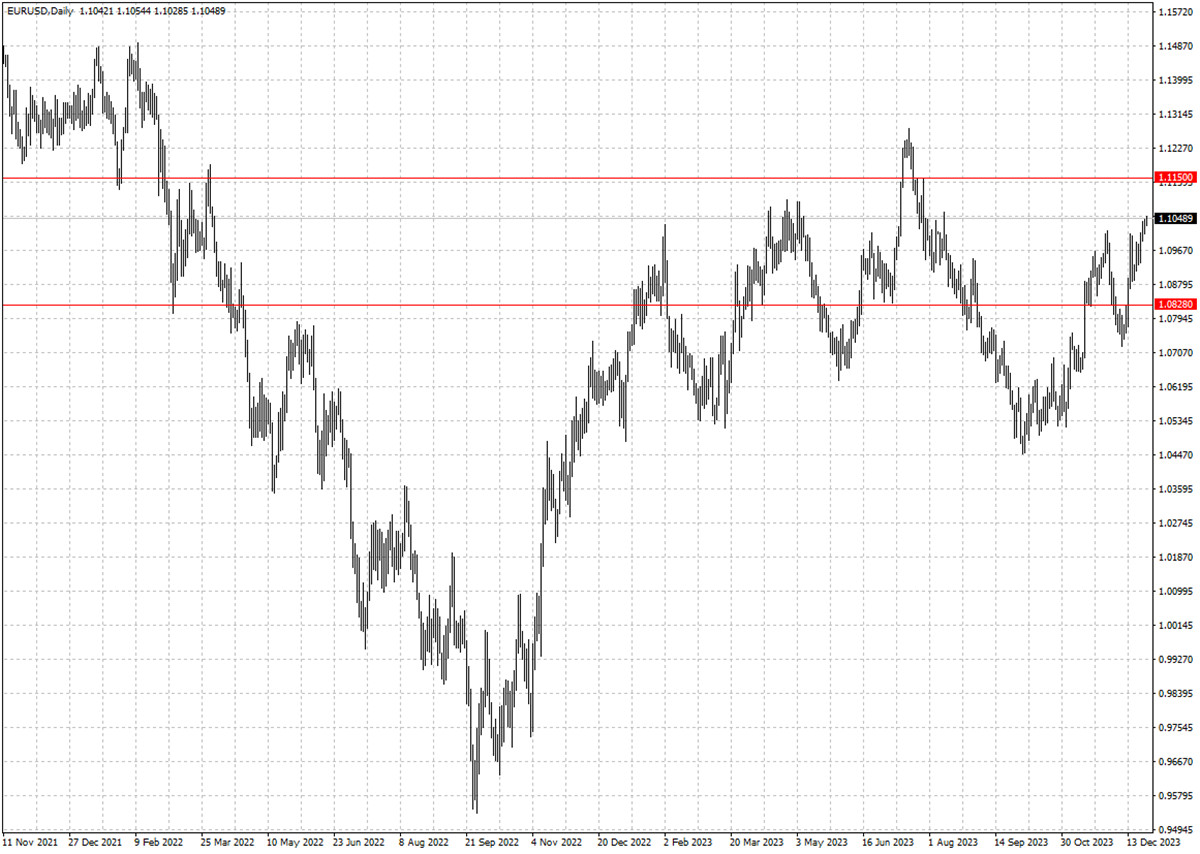

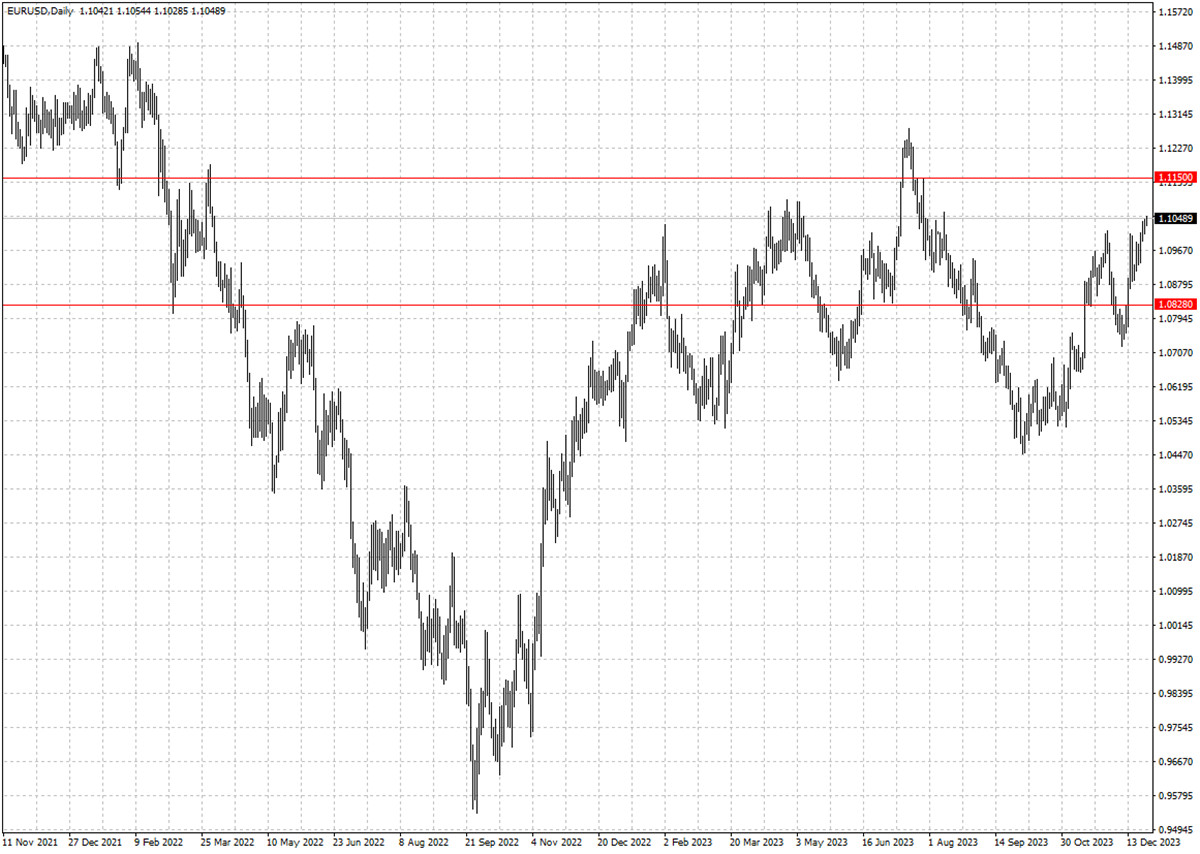

| EUR/USD |

1.0724 |

1.1017 |

1.0828 |

1.1150 |

| GBP/USD |

1.2326 |

1.2848 |

1.2551 |

1.2848 |

| USD/CHF |

0.8667 |

0.8957 |

0.8424 |

0.8732 |

| AUD/USD |

0.6445 |

0.6526 |

0.6622 |

0.6928 |

| USD/CAD |

1.3381 |

1.3695 |

1.3051 |

1.3479 |

| USD/JPY |

139.48 |

147.50 |

139.78 |

146.15 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.