US Dollar Slips to Multi-Month Lows on Thursday

2024-05-16

Summary:

Summary:

US core inflation hits a 3-year low, causing the dollar to plummet; the Australian dollar also falls from a 4-month peak due to a weak jobs report.

EBC Forex Snapshot, 16 May 2024

The dollar slips to multi-month lows on Thursday after US core inflation

hit its slowest in three years. The Australian dollar was dragged lower by a

weak jobs report from its four-month high.

Australian employment rose by more than expected in April, data showed on

Thursday, but the jobless rate still climbed to a three-month top. Wage growth

eased for the first time in Q1 since Q4 2022.

Speculative wagers against the Aussie are hovering near a two-year high, but

some strategists say the heavy bets may backfire as a lot of the bad news like

geopolitical risks is already in the price.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 6 May) |

HSBC (as of 16 May) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0601 |

1.0885 |

1.0722 |

1.0968 |

| GBP/USD |

1.2300 |

1.2709 |

1.2519 |

1.2776 |

| USD/CHF |

0.8999 |

0.9244 |

0.8929 |

0.9167 |

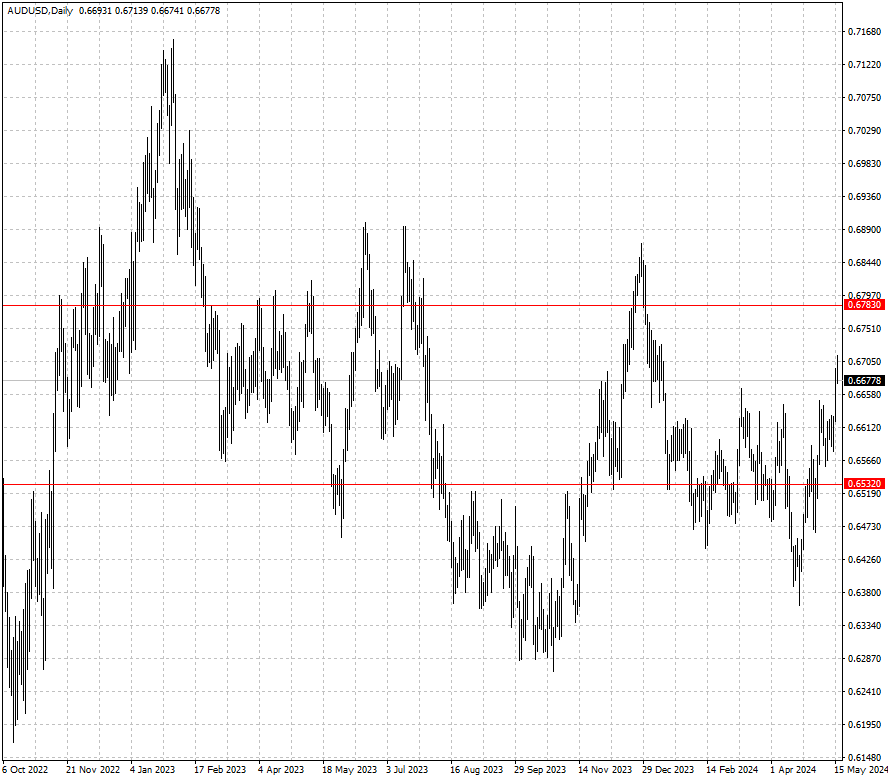

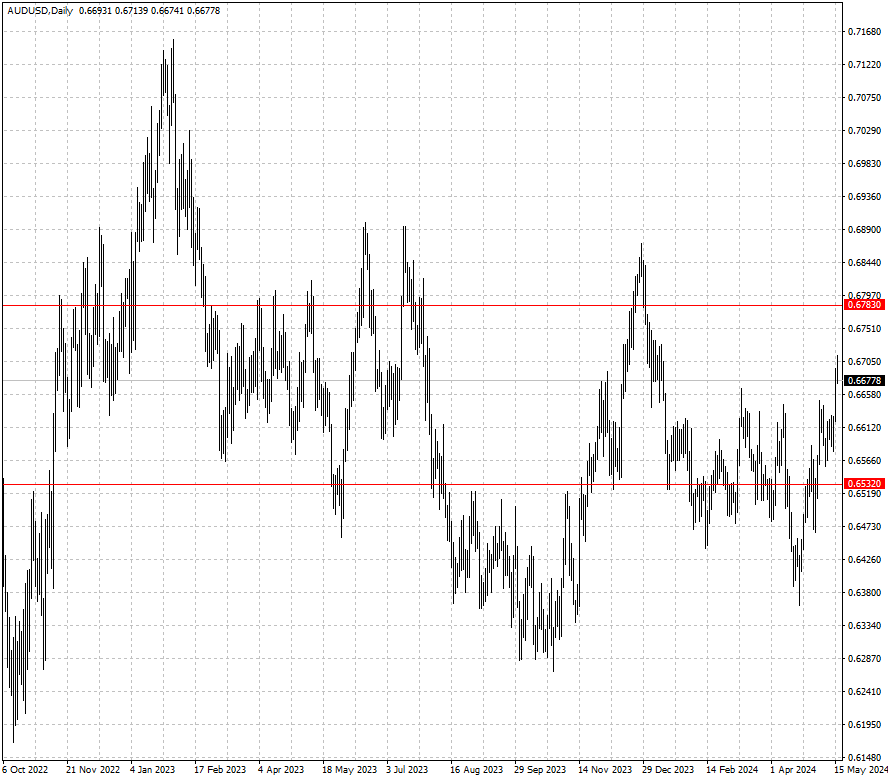

| AUD/USD |

0.6443 |

0.6668 |

0.6532 |

0.6783 |

| USD/CAD |

1.3478 |

1.3846 |

1.3531 |

1.3728 |

| USD/JPY |

151.86 |

157.68 |

151.14 |

159.32 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.