The dollar is at a one-month low against the euro

2024-05-15

Summary:

Summary:

The dollar hit a 1-month low vs. the euro before the US inflation report. Q1's high consumer prices spur a Fed rate cut reassessment.

EBC Forex Snapshot, 15 May 2024

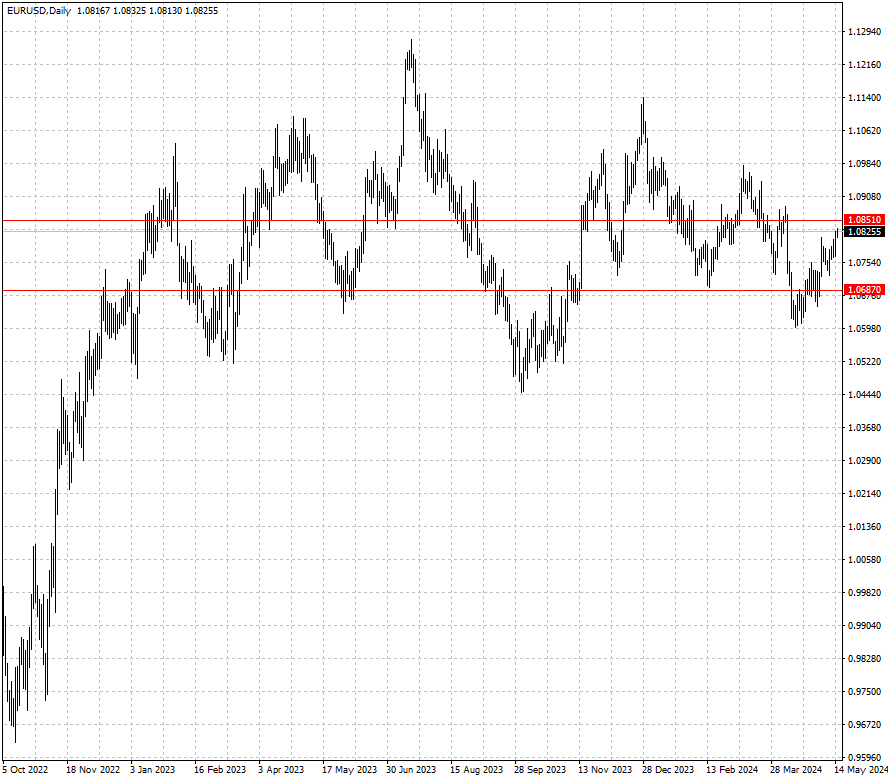

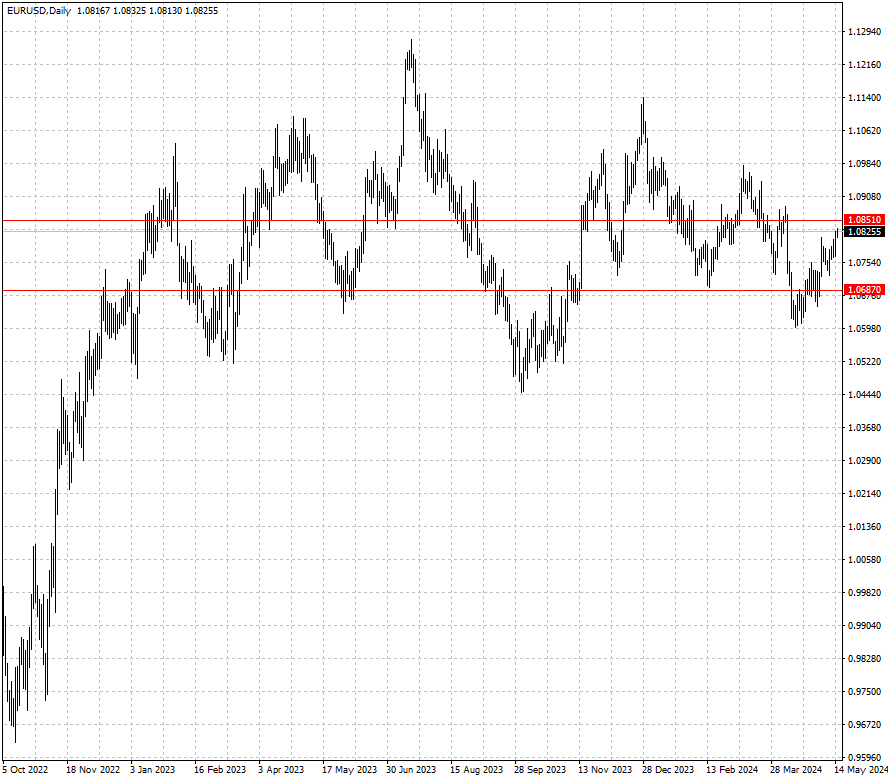

The dollar dipped to a one-month low against the euro on Wednesday ahead of a

key US inflation report. Higher-than-expected consumer prices in Q1 were the

driving force for a sharp repricing of Fed's rate cuts.

Fed Chair Jerome Powell gave a bullish assessment on Tuesday with an outlook

for continued above-trend growth and confidence in falling inflation remains

largely intact.

Some ECB Bank officials deemed it appropriate to cut interest rates when they

convened last month, an account of their meeting showed. But views remain

divided regarding how quickly to lower borrowing costs.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 6 May) |

HSBC (as of 14 May) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0601 |

1.0885 |

1.0687 |

1.0851 |

| GBP/USD |

1.2300 |

1.2709 |

1.2440 |

1.2654 |

| USD/CHF |

0.8999 |

0.9244 |

0.8983 |

0.9202 |

| AUD/USD |

0.6443 |

0.6668 |

0.6498 |

0.6682 |

| USD/CAD |

1.3478 |

1.3846 |

1.3587 |

1.3763 |

| USD/JPY |

151.86 |

157.68 |

152.02 |

160.20 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.