Dollar's biggest 2.5-month fall vs. euro Friday

2024-05-17

Summary:

Summary:

The dollar weakened versus the euro this week on signs of lower inflation and a softer US economy, raising Fed rate-cut expectations.

EBC Forex Snapshot, 17 May 2024

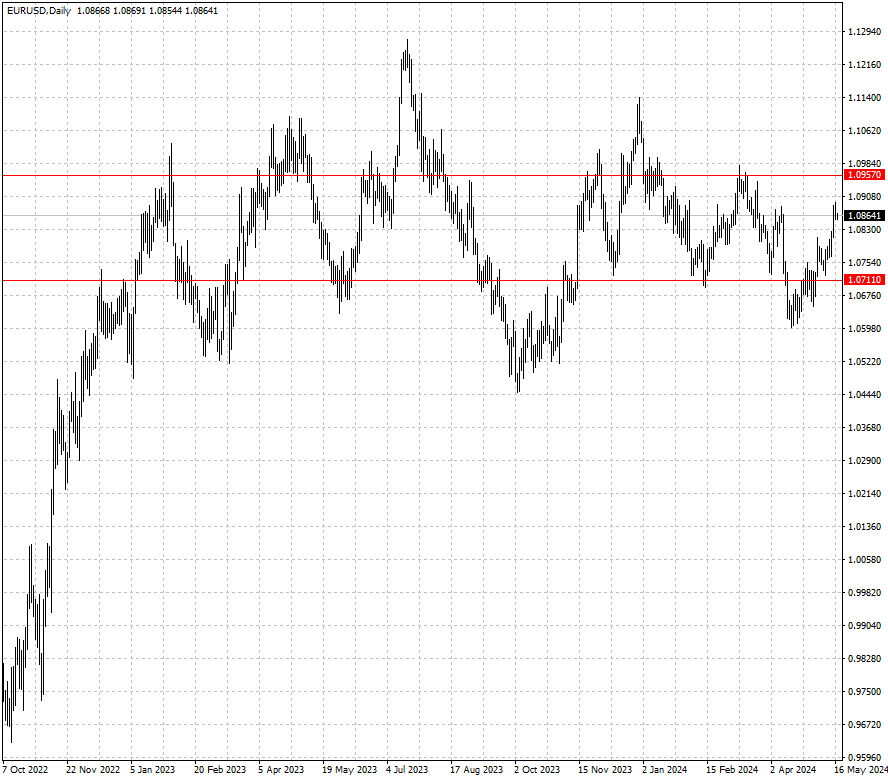

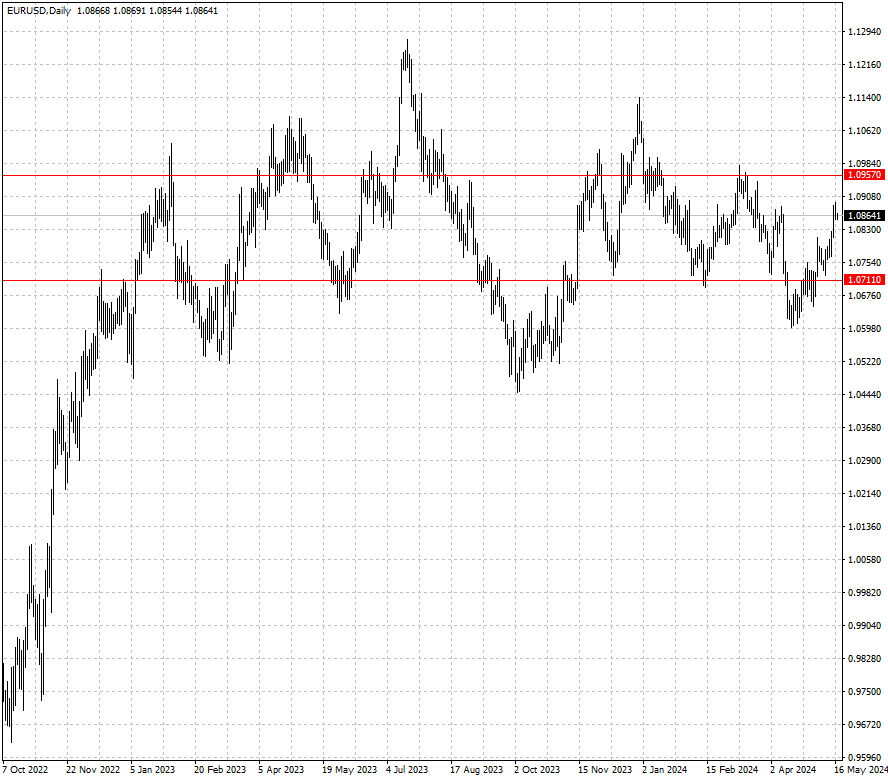

The dollar headed for its largest weekly fall versus the euro in

two-and-a-half months on Friday as signs of cooling inflation and a softening US

economy raised the prospect of rate cuts by the Fed.

Retail sales were flat in April and softer-than-expected, and manufacturing

output unexpectedly fell. Policymakers acknowledged the positive turn this week

though they still sounded cautious.

Seasonally adjusted GDP increased by 0.3% in both the eurozone and the EU in

Q1, compared with the previous quarter. It follows two quarters in which the

bloc shrank by 0.1% and hence a moderate recovery.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 6 May) |

HSBC (as of 17 May) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0601 |

1.0885 |

1.0711 |

1.0957 |

| GBP/USD |

1.2300 |

1.2709 |

1.2506 |

1.2763 |

| USD/CHF |

0.8999 |

0.9244 |

0.8956 |

0.9194 |

| AUD/USD |

0.6443 |

0.6668 |

0.6522 |

0.6773 |

| USD/CAD |

1.3478 |

1.3846 |

1.3542 |

1.3739 |

| USD/JPY |

151.86 |

157.68 |

151.48 |

159.66 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.