The dollar rebound was capped on Monday

2024-08-19

Summary:

Summary:

On Monday, the US dollar struggled in a tight range as investors awaited new clues on interest rate outlooks for the week.

EBC Forex Snapshot, 19 Aug 2024

The US dollar was struggling to make headway on Monday, though it traded in a

tight range as investors awaited fresh catalysts this week that could offer

clues on the outlook for interest rates.

The yen rose amid elevated volatility. Hedge funds turned bullish on Japan’s

currency for the first time since 2021 after a blow-up of a popular yen trade as

the BOJ is expected to keep raising interest rates.

However, the political uncertainty left by PM Fumio Kishida's decision to

step down will likely lead to a pause, rather than a full stop, to the central

bank’s monetary tightening.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 12 Aug) |

HSBC (as of 19 Aug) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0796 |

1.1017 |

1.0853 |

1.1125 |

| GBP/USD |

1.2613 |

1.2894 |

1.2753 |

1.3044 |

| USD/CHF |

0.8333 |

0.8827 |

0.8435 |

0.8880 |

| AUD/USD |

0.6363 |

0.6653 |

0.6446 |

0.6786 |

| USD/CAD |

1.3590 |

1.3977 |

1.3579 |

1.3860 |

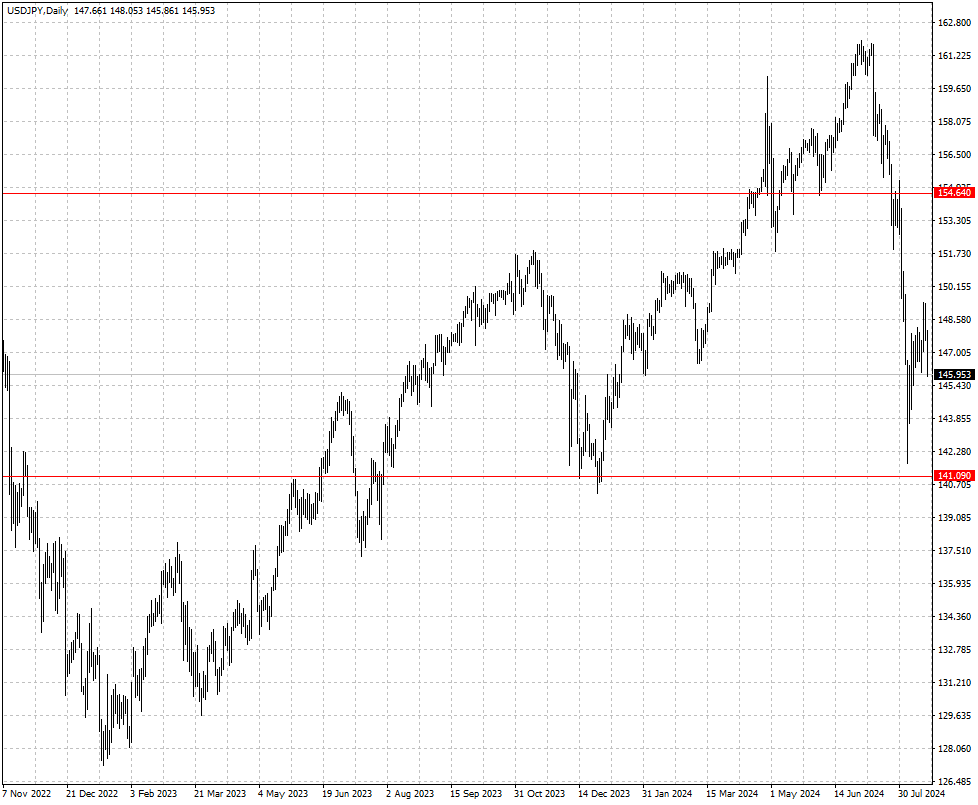

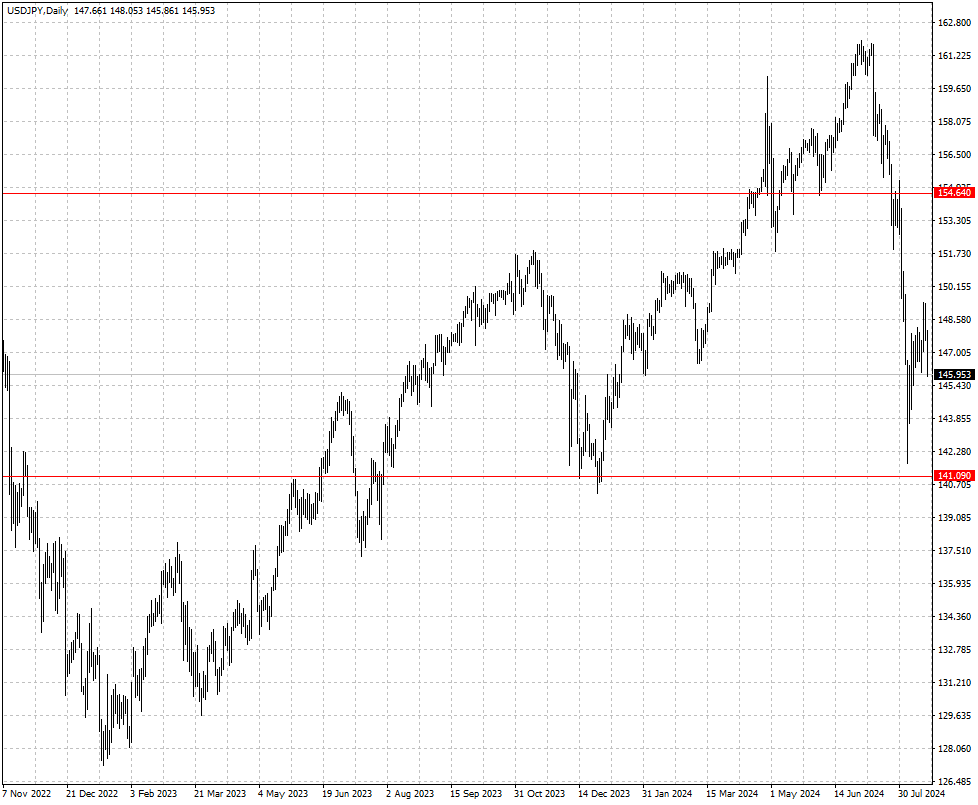

| USD/JPY |

141.70 |

147.90 |

141.09 |

154.64 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.