The Australian Dollar Continued Its Gains

2024-08-16

Summary:

Summary:

The dollar eased slightly, ending its biggest rally since July 18, as stronger-than-expected retail sales eased recession fears.

EBC Forex Snapshot, 16 Aug 2024

The dollar eased a touch, snapping the overnight rally which was biggest the

since 18 July, as stronger-than-expected retail sales all but eliminated fears

about a recession.

Atlanta Fed president Raphael Bostic, who had supported a rate cut, said in

an interview that the Fed cannot "afford to be late" to ease monetary policy

amid signs of cooling in the labour market.

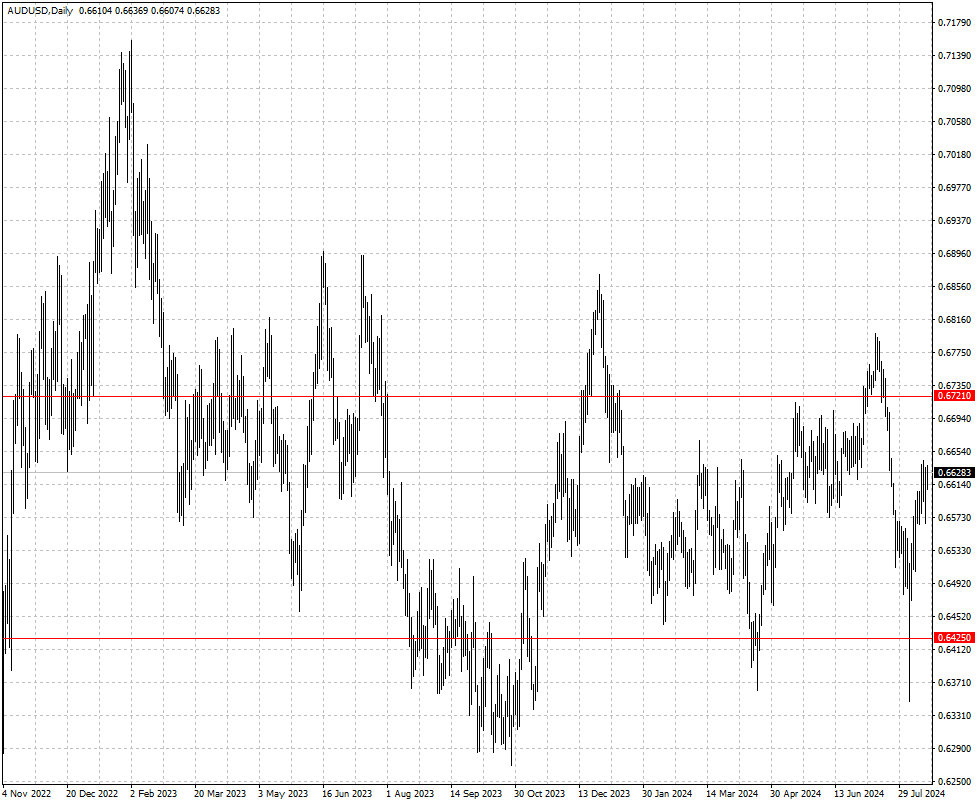

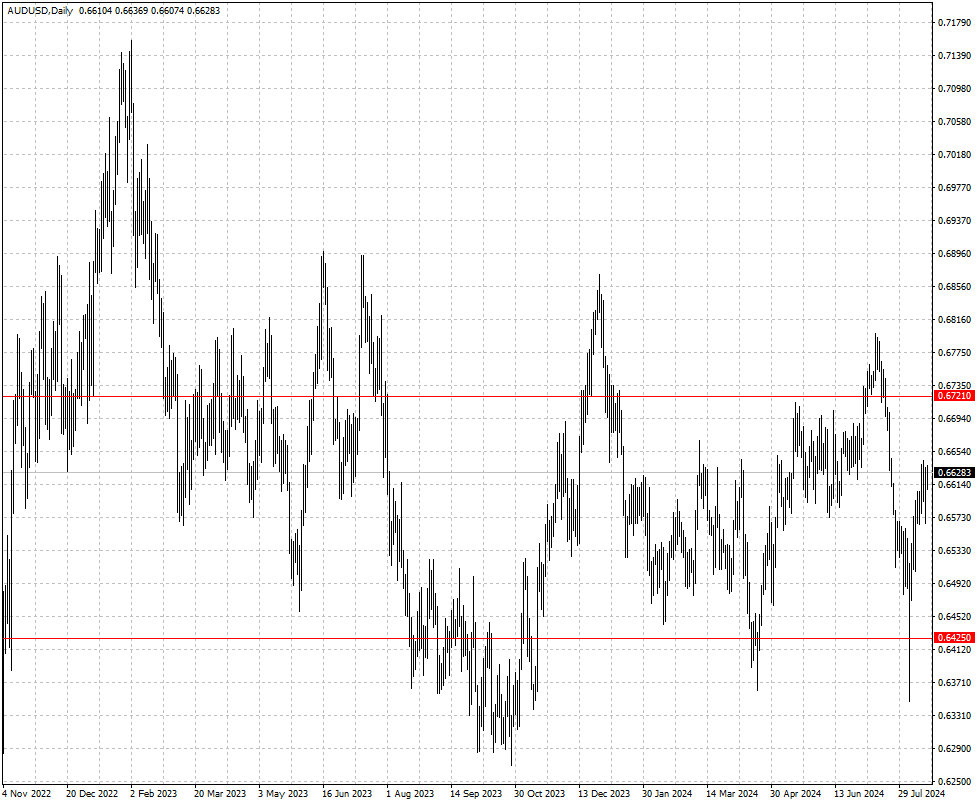

The Australian dollar extended its gains from the last session. Australia's

unemployment rate ticked higher last month, even as employers added about three

times as many jobs as expected.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 12 Aug) |

HSBC (as of 16 Aug) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0796 |

1.1017 |

1.0815 |

1.1087 |

| GBP/USD |

1.2613 |

1.2894 |

1.2713 |

1.2939 |

| USD/CHF |

0.8333 |

0.8827 |

0.8479 |

0.8924 |

| AUD/USD |

0.6363 |

0.6653 |

0.6425 |

0.6721 |

| USD/CAD |

1.3590 |

1.3977 |

1.3627 |

1.3887 |

| USD/JPY |

141.70 |

147.90 |

142.22 |

155.77 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.