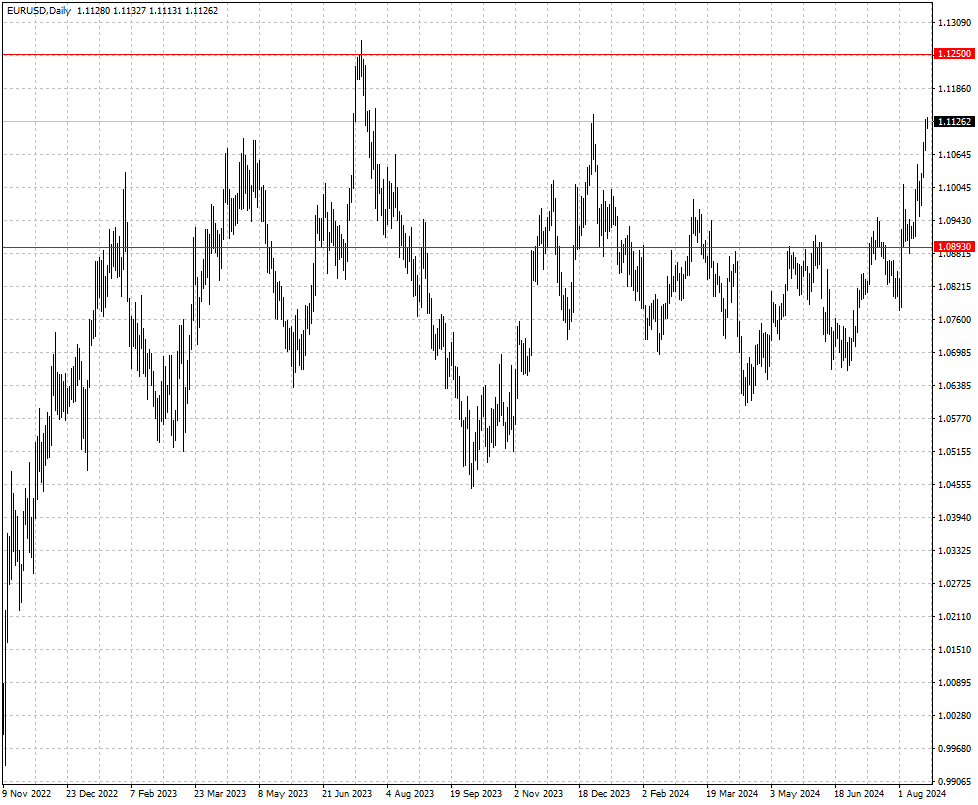

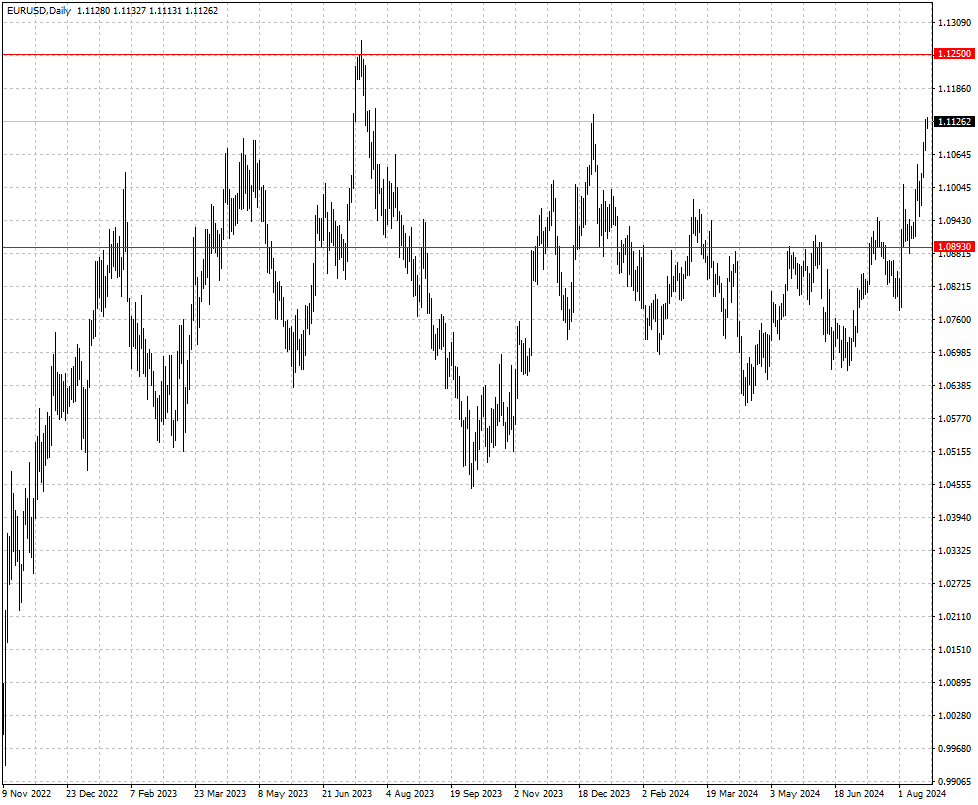

Dollar Reaches Yearly Low Against Euro

2024-08-21

Summary:

Summary:

The dollar hit a yearly low against the euro, with traders eyeing US payroll revisions. US bond yields fell to their lowest since early August.

EBC Forex Snapshot, 21 Aug 2024

The dollar slipped to its lowest this year versus the euro on Wednesday as

traders braced for potentially crucial revisions to US payrolls data later in

the day. US bond yields hit the lowest since early August.

While prices for consumer goods remain significantly elevated, the low

unemployment rate has been driving wage increases, particularly among low-wage

Americans.

Eurozone inflation was confirmed at 2.6% year-on-year in July. Markets see a

90% chance of a 25 bps cut by the ECB in September and see at least one more

move before the end of the year.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 19 Aug) |

HSBC (as of 21 Aug) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0796 |

1.1068 |

1.0893 |

1.1250 |

| GBP/USD |

1.2673 |

1.2946 |

1.2777 |

1.3167 |

| USD/CHF |

0.8333 |

0.8827 |

0.8385 |

0.8741 |

| AUD/USD |

0.6363 |

0.6799 |

0.6474 |

0.6880 |

| USD/CAD |

1.3597 |

1.3946 |

1.3498 |

1.3842 |

| USD/JPY |

145.89 |

150.00 |

140.98 |

150.21 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.