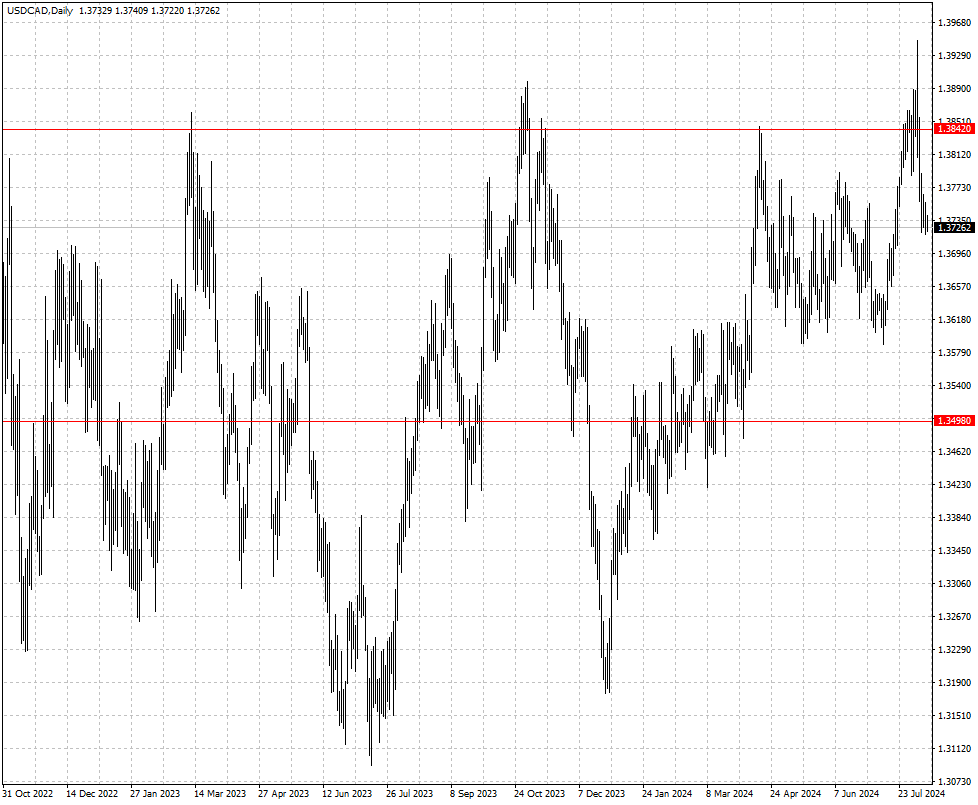

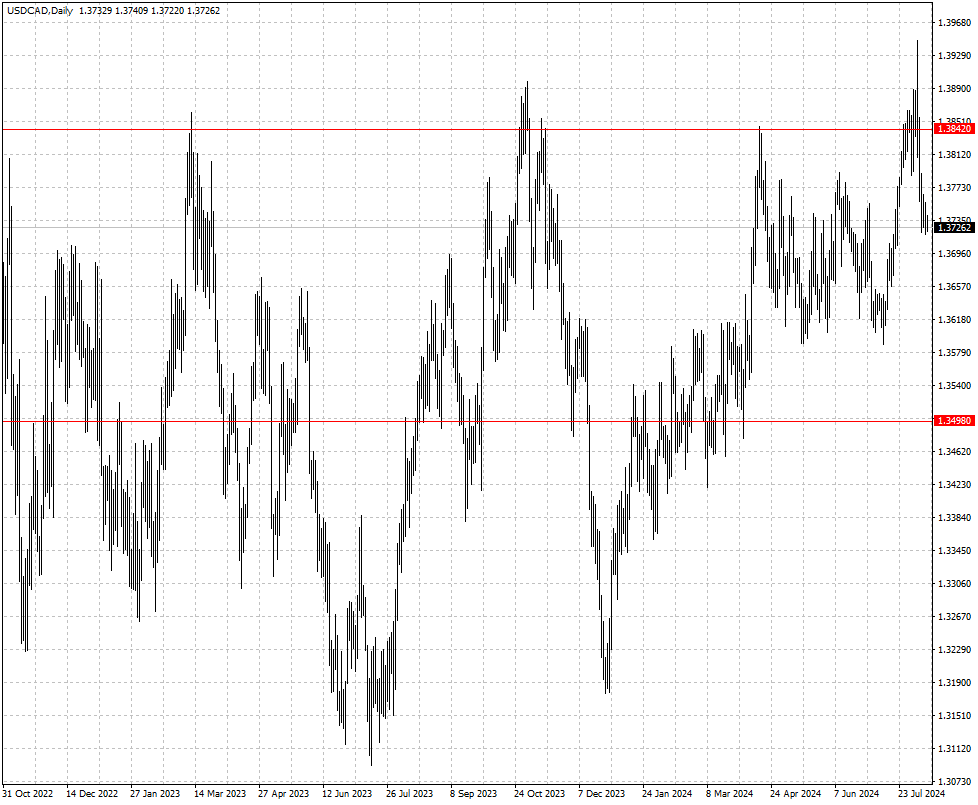

Canadian Dollar Nears Four-Month High

2024-08-22

Summary:

Summary:

The dollar hovered near one-year lows as Fed minutes signaled upcoming rate cuts. Many officials noted that US payroll gains might be overstated.

EBC Forex Snapshot, 22 Aug 2024

The dollar hovered near one-year lows on Thursday as Fed minutes signalled

that interest rate cuts are set to begin in a few weeks' time. On the labour

market, "many" officials noted that US payroll gains might be overstated.

Markets are fully pricing in a September cut, which would be the first since

the emergency easing in the early days of the Covid crisis. Currency markets see

a US easing cycle as having further to run than other countries.

The Canadian dollar traded around its four-month high despite the risk of a

railway stoppage. Analysts say the BOC has shifted its focus from suppressing

inflation to boosting the economy.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 19 Aug) |

HSBC (as of 21 Aug) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0796 |

1.1068 |

1.0893 |

1.1250 |

| GBP/USD |

1.2673 |

1.2946 |

1.2777 |

1.3167 |

| USD/CHF |

0.8333 |

0.8827 |

0.8385 |

0.8741 |

| AUD/USD |

0.6363 |

0.6799 |

0.6474 |

0.6880 |

| USD/CAD |

1.3597 |

1.3946 |

1.3498 |

1.3842 |

| USD/JPY |

145.89 |

150.00 |

140.98 |

150.21 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.