The dollar consolidated on Monday

2024-05-13

Summary:

Summary:

The dollar steadied on Monday with softer US payrolls, easing inflation fears. Markets anticipate 61.2% odds of Fed rate cuts in September.

EBC Forex Snapshot, 13 May 2024

The dollar consolidated on Monday as a softer-than-expected US payrolls

report eased concerns about resurgent price growth. Markets have priced in a

61.2% chance of Fed's rate cuts in September.

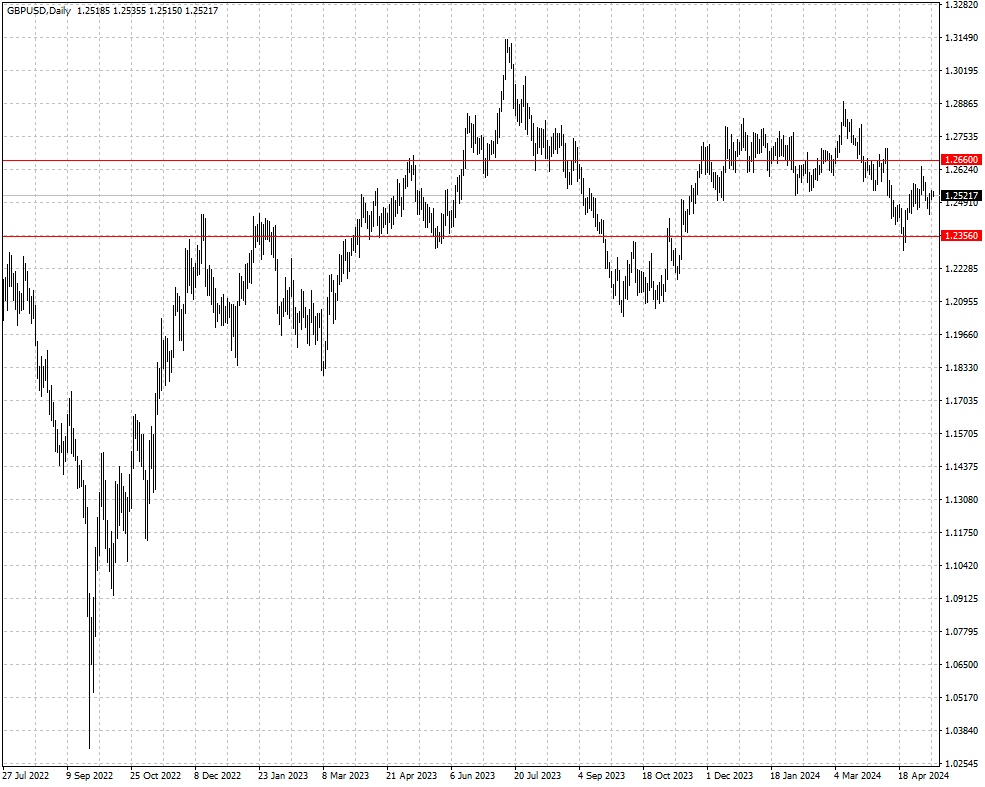

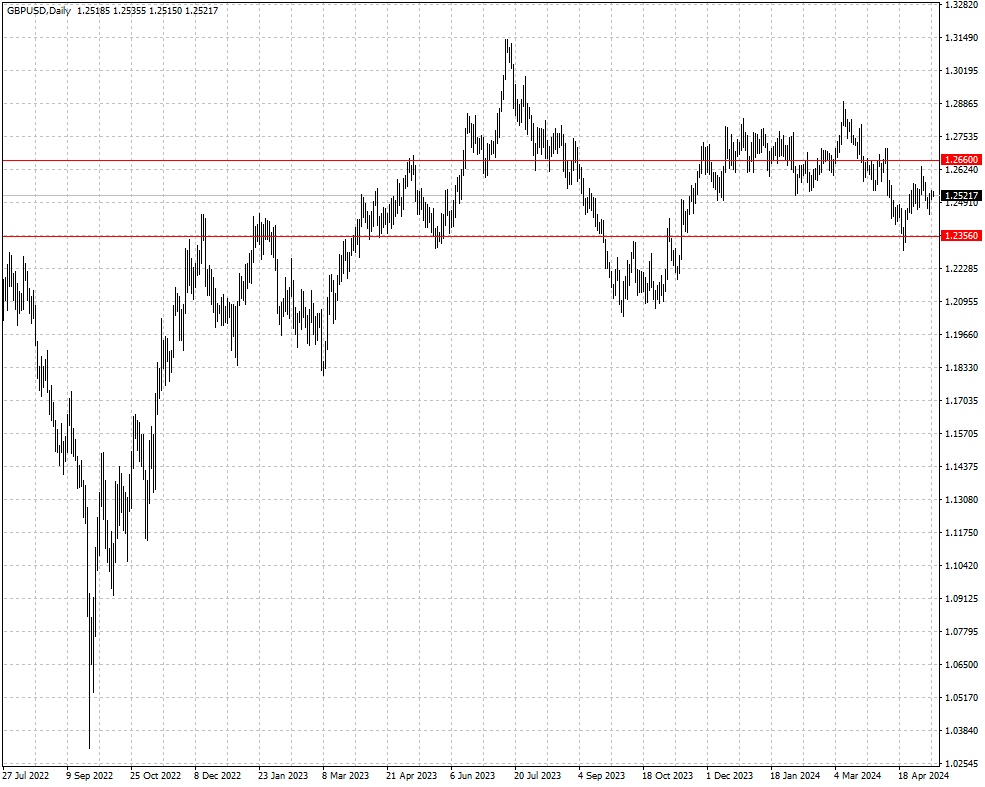

Sterling was flat after a GDP-driven rise. The UK economy grew by the most in

nearly three years in Q1, while the service sector grew for the first time

within a year.

Speculative short position on sterling reached a 16-month high, data from the

CFTC shows. Traders are betting the BOE will deliver at least two quarter-point

rate cuts by the end of the year.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 6 May) |

HSBC (as of 13 May) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0601 |

1.0885 |

1.0667 |

1.0842 |

| GBP/USD |

1.2300 |

1.2709 |

1.2356 |

1.2660 |

| USD/CHF |

0.8999 |

0.9244 |

0.8971 |

0.9190 |

| AUD/USD |

0.6443 |

0.6668 |

0.6478 |

0.6686 |

| USD/CAD |

1.3478 |

1.3846 |

1.3591 |

1.3767 |

| USD/JPY |

151.86 |

157.68 |

151.70 |

159.88 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.