The dollar weakened in early Asian trading on Friday

2024-05-10

Summary:

Summary:

In early Asian trading, the dollar weakened on data indicating a cooling labor market. The pound rebounded from its lowest point since April 24.

EBC Forex Snapshot, 10 May 2024

The dollar had a soft tone in early Asian trading on Friday on the back of

soft data showing further signs of a cooling labour market. Sterling recovered

from the lowest level since 24 April.

Initial filings for unemployment benefits in the US have hit their highest

level since late August 2023. The increase follows a weaker-than-expected NFP

report which fuelled rate cut expectations.

The BOE held its benchmark interest rate steady as expected, but more

officials on the MPC backed a rate cut. New forecasts project that price

pressures will fall below the target within two years.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 6 May) |

HSBC (as of 10 May) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0601 |

1.0885 |

1.0665 |

1.0855 |

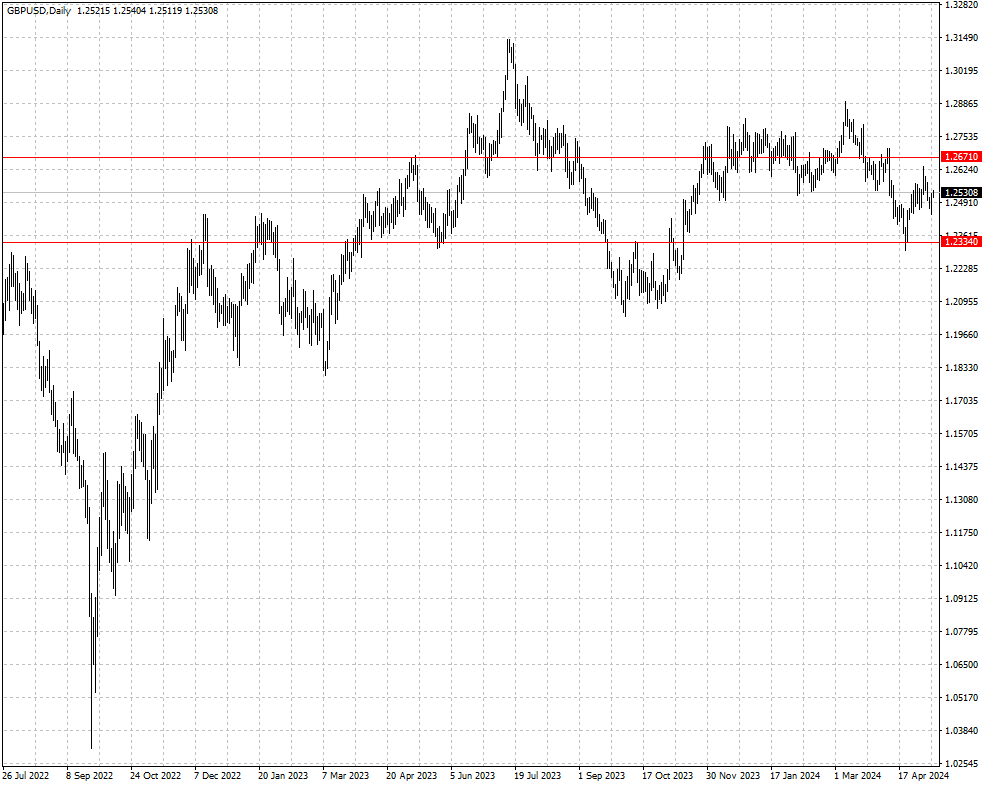

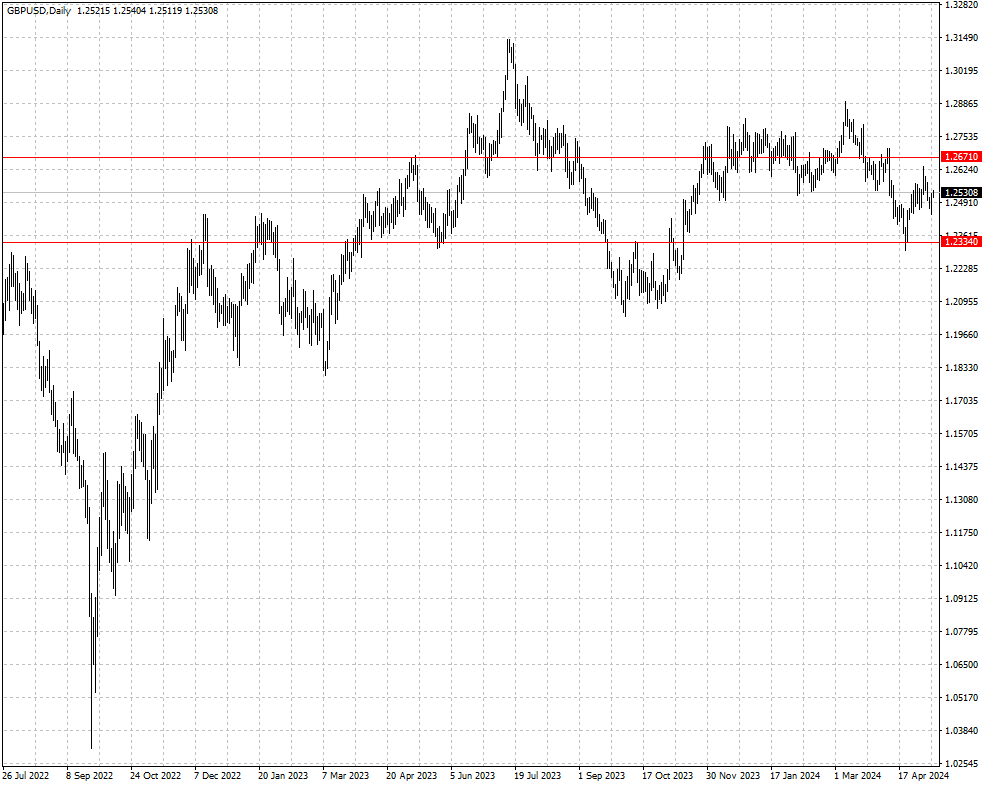

| GBP/USD |

1.2300 |

1.2709 |

1.2334 |

1.2671 |

| USD/CHF |

0.8999 |

0.9244 |

0.8967 |

0.9186 |

| AUD/USD |

0.6443 |

0.6668 |

0.6468 |

0.6709 |

| USD/CAD |

1.3478 |

1.3846 |

1.3594 |

1.3770 |

| USD/JPY |

151.86 |

157.68 |

151.53 |

159.71 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.