Day trading is the practice of buying and selling financial instruments—such as stocks, currencies, or commodities—within a single trading day, with the goal of profiting from short-term price movements. While this approach offers the potential for quick returns, it also requires discipline, strategy, and a solid understanding of the markets.

This approach of trading can be an exciting way to participate in the financial markets, but it is not without its challenges. The fast-paced nature of day trading can easily lead to impulsive decisions and emotional reactions, both of which can result in significant losses. Success in this arena requires more than just following trends or making educated guesses. It demands a clear, structured approach and a set of rules to keep you grounded.

Whether you're just starting out or looking to refine your approach, understanding and adhering to key day trading principles is essential.

Establish a Clear Trading Plan and Stick to It

Before making your first trade, it is essential to have a clear trading plan in place. This plan should outline your goals, strategy, risk management techniques, and the criteria you will use to enter and exit trades. Having a defined plan helps you avoid making impulsive decisions driven by emotion or external pressures.

A well-structured plan also provides clarity during times of market volatility. It allows you to act decisively based on pre-determined criteria, rather than being swayed by fleeting market sentiment. Sticking to your plan is vital, as it ensures consistency in your approach and limits the potential for costly errors.

Control Your Emotions to Prevent Impulsive Decisions

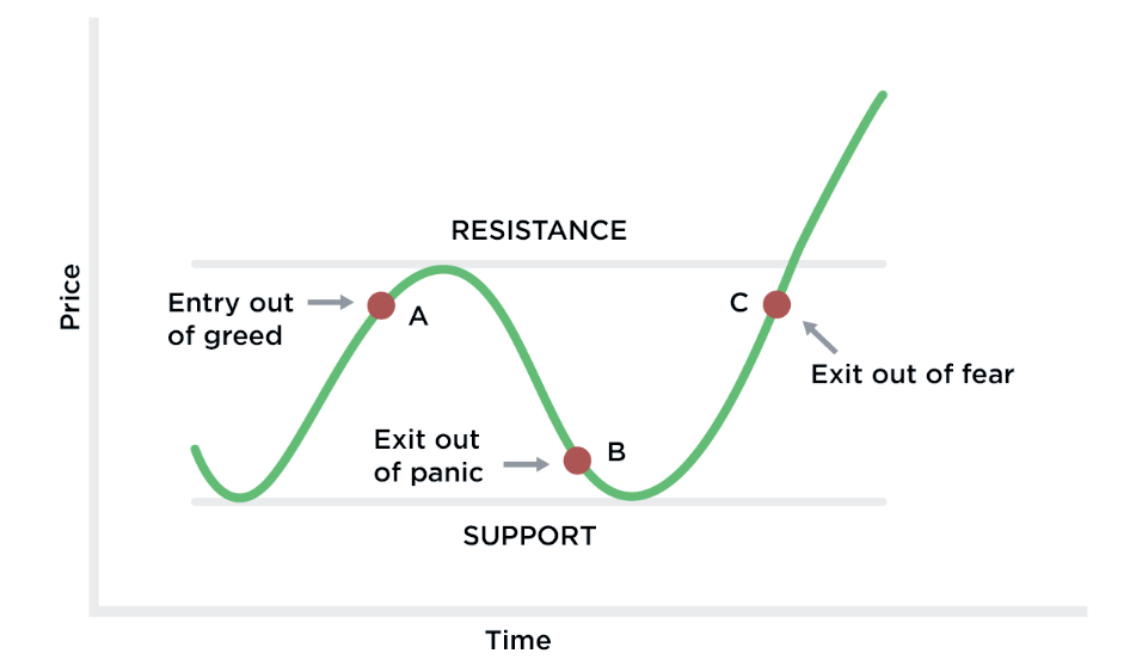

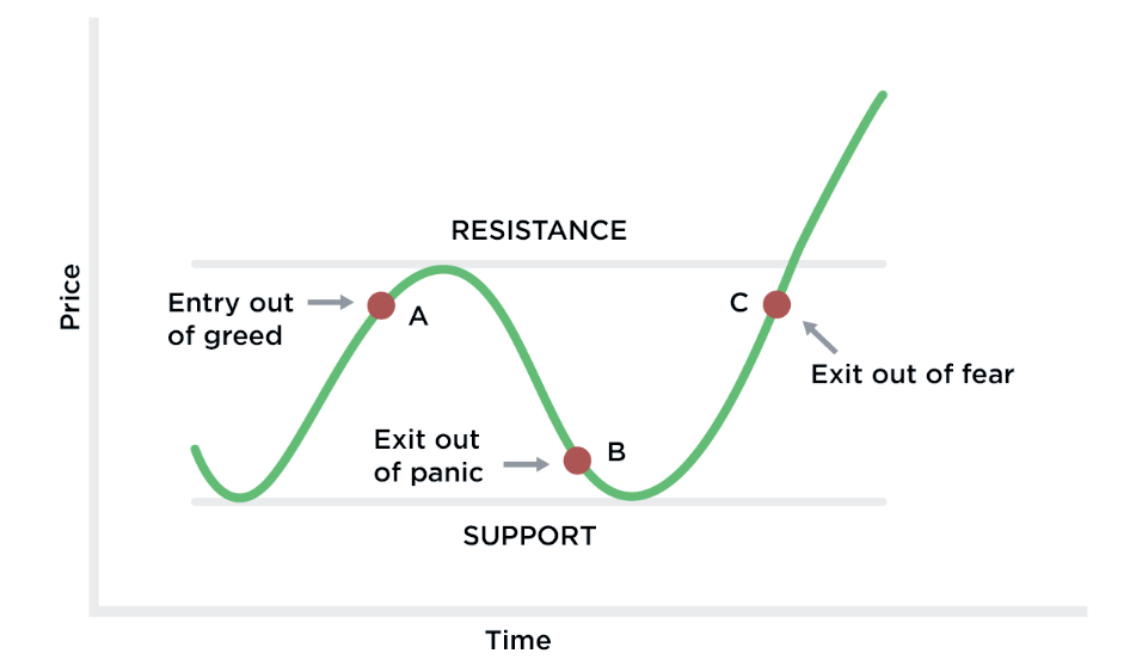

One of the greatest challenges in day trading is managing your emotions. Fear and greed are powerful forces that can cloud your judgment and lead to poor decision-making. For instance, fear may cause you to exit a trade too early, locking in smaller profits or even realising losses, while greed may push you to hold onto a winning trade longer than necessary, hoping for more substantial gains.

Maintaining emotional control is key to staying disciplined. Successful traders learn how to recognise when their emotions are influencing their decisions and make conscious efforts to remain objective. Emotional trading often results in erratic decisions, so it's important to stay calm and follow your plan, regardless of how the market behaves.

Maintaining emotional control is key to staying disciplined. Successful traders learn how to recognise when their emotions are influencing their decisions and make conscious efforts to remain objective. Emotional trading often results in erratic decisions, so it's important to stay calm and follow your plan, regardless of how the market behaves.

Set Realistic Profit Targets and Stop-Loss Levels

Setting realistic profit targets and stop-loss levels is a fundamental aspect of any day trading strategy. By defining these levels before you enter a trade, you take the guesswork out of when to exit a position. A profit target represents the price at which you plan to sell and realise your profits, while a stop-loss is the level at which you will exit the trade to minimise losses.

These levels should be set based on your risk tolerance and market conditions. Setting them too aggressively—either expecting large profits or expecting to avoid any losses—can lead to unrealistic expectations. Ensuring that your targets and stop-loss levels align with your strategy will provide clear guidelines for managing each trade, allowing you to take a disciplined approach rather than reacting emotionally to market fluctuations.

These levels should be set based on your risk tolerance and market conditions. Setting them too aggressively—either expecting large profits or expecting to avoid any losses—can lead to unrealistic expectations. Ensuring that your targets and stop-loss levels align with your strategy will provide clear guidelines for managing each trade, allowing you to take a disciplined approach rather than reacting emotionally to market fluctuations.

Practice Proper Risk Management: Know How Much to Risk per Trade

Risk management is perhaps the most important rule in day trading. Without proper risk management, it's all too easy to wipe out your capital with a few bad trades. A general rule of thumb is to risk no more than 1-2% of your total trading capital on any single trade. This ensures that even if you experience a string of losses, your overall account balance remains intact and you can continue trading.

For example, if you have a trading account with £10.000. your maximum risk per trade should be between £100 and £200. By limiting your risk per trade, you preserve your capital and protect yourself from significant losses that could derail your trading journey.

Stay Focused on High-Quality Setups and Avoid Overtrading

Overtrading is a common pitfall for beginners. It's easy to get caught up in the excitement of trading and feel the urge to take advantage of every potential opportunity. However, this approach often leads to poor results. Rather than looking for constant trades, focus on identifying high-quality setups that fit your predefined criteria.

Quality trades are those that align with your strategy and have a higher probability of success. Avoid entering trades based purely on market noise or a fleeting opportunity. Overtrading often results from emotional impulses, such as the desire to make up for previous losses or to keep pace with the market. Remember, in day trading, quality matters far more than quantity.

By following these essential rules, beginners can take a structured and disciplined approach to day trading. Although the financial markets can be unpredictable, having a well-defined plan and adhering to clear principles can help you stay grounded and focused, improving your chances of long-term success. As you gain experience, you'll refine your approach, but these core rules will remain the foundation of your trading strategy. The key to success in day trading is not about predicting every market move, but rather managing your risk and staying disciplined in your approach.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Maintaining emotional control is key to staying disciplined. Successful traders learn how to recognise when their emotions are influencing their decisions and make conscious efforts to remain objective. Emotional trading often results in erratic decisions, so it's important to stay calm and follow your plan, regardless of how the market behaves.

Maintaining emotional control is key to staying disciplined. Successful traders learn how to recognise when their emotions are influencing their decisions and make conscious efforts to remain objective. Emotional trading often results in erratic decisions, so it's important to stay calm and follow your plan, regardless of how the market behaves. These levels should be set based on your risk tolerance and market conditions. Setting them too aggressively—either expecting large profits or expecting to avoid any losses—can lead to unrealistic expectations. Ensuring that your targets and stop-loss levels align with your strategy will provide clear guidelines for managing each trade, allowing you to take a disciplined approach rather than reacting emotionally to market fluctuations.

These levels should be set based on your risk tolerance and market conditions. Setting them too aggressively—either expecting large profits or expecting to avoid any losses—can lead to unrealistic expectations. Ensuring that your targets and stop-loss levels align with your strategy will provide clear guidelines for managing each trade, allowing you to take a disciplined approach rather than reacting emotionally to market fluctuations.