The Australian Dollar was Boosted on Monday

2024-06-03

Summary:

Summary:

The dollar is steady as traders bet on stable US inflation for a potential Fed rate cut; the Aussie trims gains from Asian factory growth.

EBC Forex Snapshot, 3 Jun 2024

The dollar was broadly steady on Monday as traders wagered that US inflation

may have stabilised enough for the Fed to cut rates later, while the Aussie pare

earlier gains from factory growth across Asia.

The greenback posted its first monthly decline of the year in May with

markets pricing in 37 bps of cuts this year from the Fed. Focus will be on the

ISM manufacturing survey later in the day.

China's Caixin survey reported its factory index increased to 51.7 in May, a

two-year high. Japan's factory activity expanded for the first time in a year,

and South Korea’s grew at the fastest pace in two years.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 27 May) |

HSBC (as of 3 Jun) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0793 |

1.0895 |

1.0773 |

1.0902 |

| GBP/USD |

1.2300 |

1.2803 |

1.2563 |

1.2857 |

| USD/CHF |

0.8988 |

0.9244 |

0.8950 |

0.9123 |

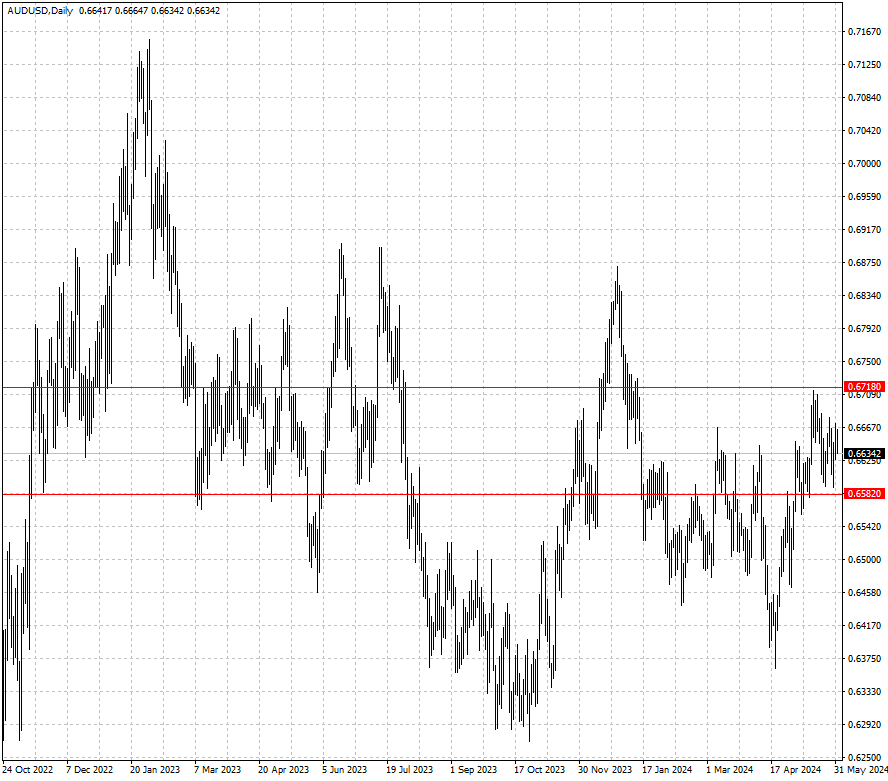

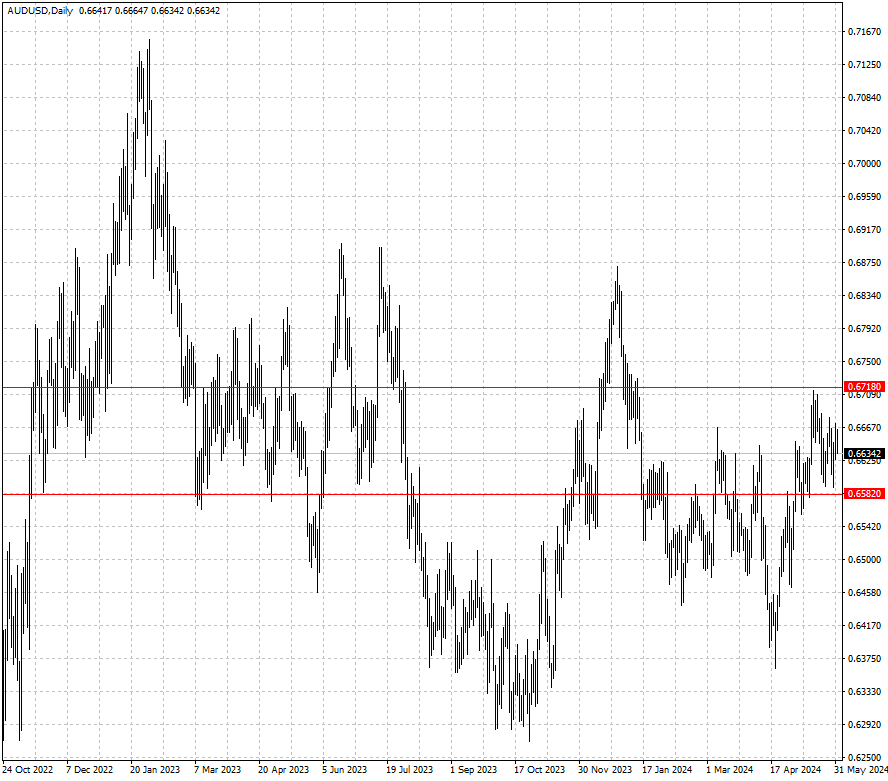

| AUD/USD |

0.6563 |

0.6729 |

0.6582 |

0.6718 |

| USD/CAD |

1.3478 |

1.3846 |

1.3561 |

1.3717 |

| USD/JPY |

152.12 |

157.68 |

154.67 |

158.86 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.