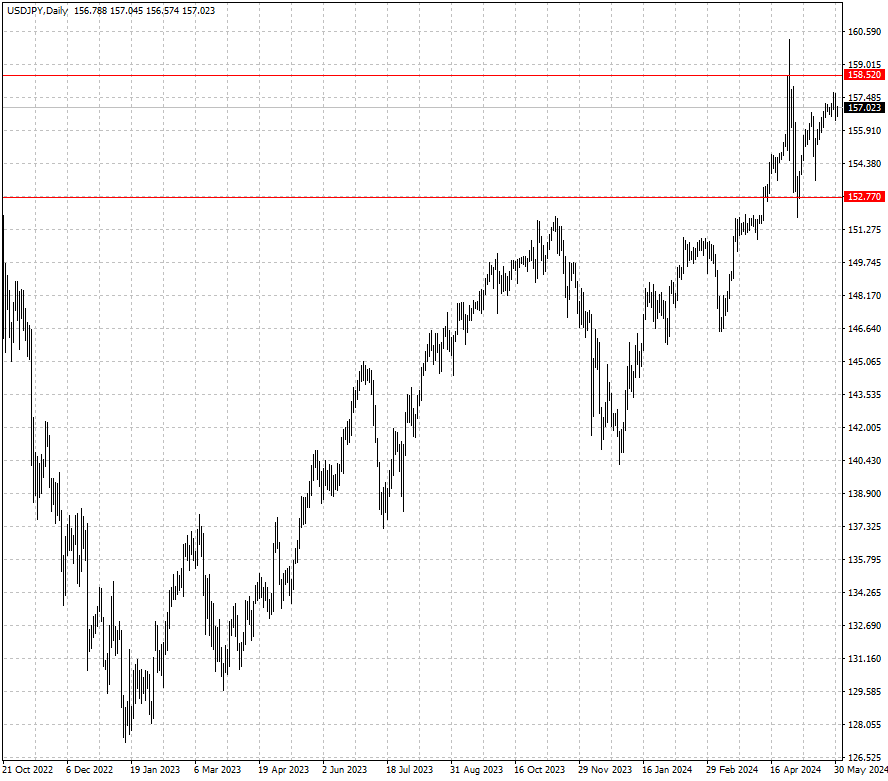

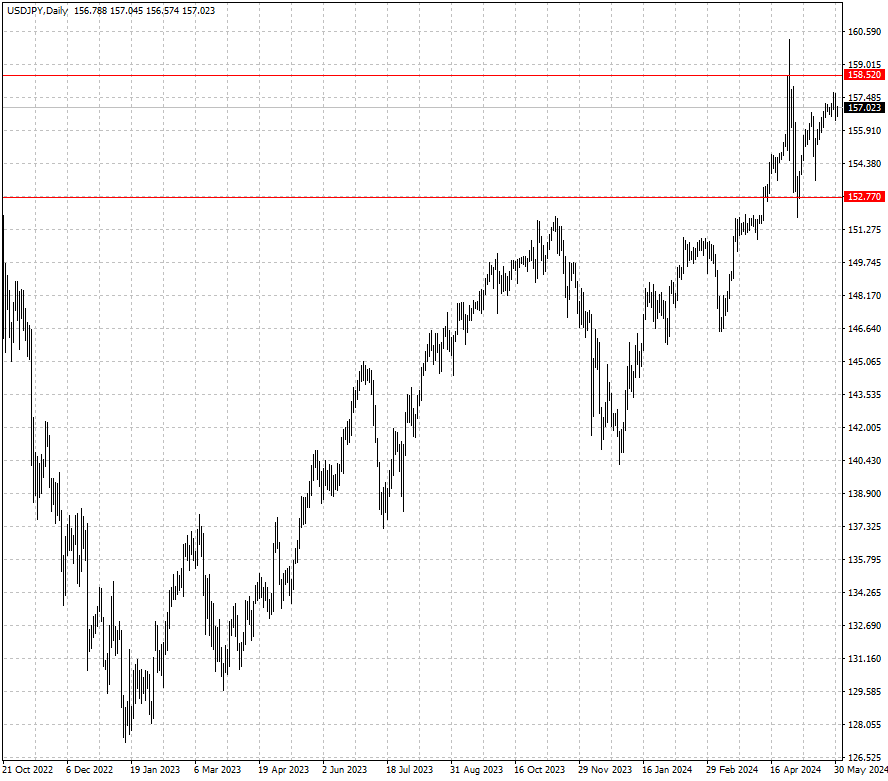

Yen Hits 4-Week Low in Friday Trading

2024-05-31

Summary:

Summary:

The dollar steadied Friday after a Q1 US GDP revision hinted at Fed rate cuts. The yen stayed above its four-week low on stable price growth.

EBC Forex Snapshot, 31 May 2024

The dollar steadied on Friday after a downward revision to US GDP for Q1

suggested room for the Fed to cut interest rates this year. The yen remained off

its four-week low on stable price growth.

Markets currently priced in a 55% chance of rate cuts to begin in September,

according to the CME Group's FedWatch Tool. The downgrade followed recent

softness in readings of retail sales and equipment spending.

Data showed core consumer inflation in Tokyo accelerated in May but price

growth excluding the effect of fuel eased, heightening uncertainty on the timing

of the BOJ's next rate hike.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 27 May) |

HSBC (as of 31 May) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0793 |

1.0895 |

1.0766 |

1.0896 |

| GBP/USD |

1.2300 |

1.2803 |

1.2557 |

1.2851 |

| USD/CHF |

0.8988 |

0.9244 |

0.8959 |

0.9132 |

| AUD/USD |

0.6563 |

0.6729 |

0.6569 |

0.6705 |

| USD/CAD |

1.3478 |

1.3846 |

1.3596 |

1.3752 |

| USD/JPY |

152.12 |

157.68 |

154.33 |

158.52 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.