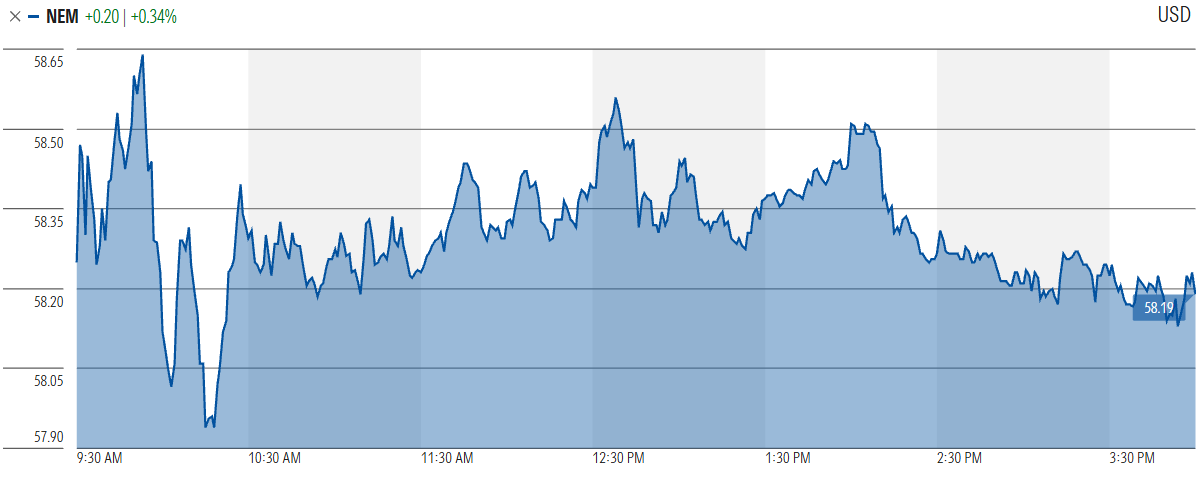

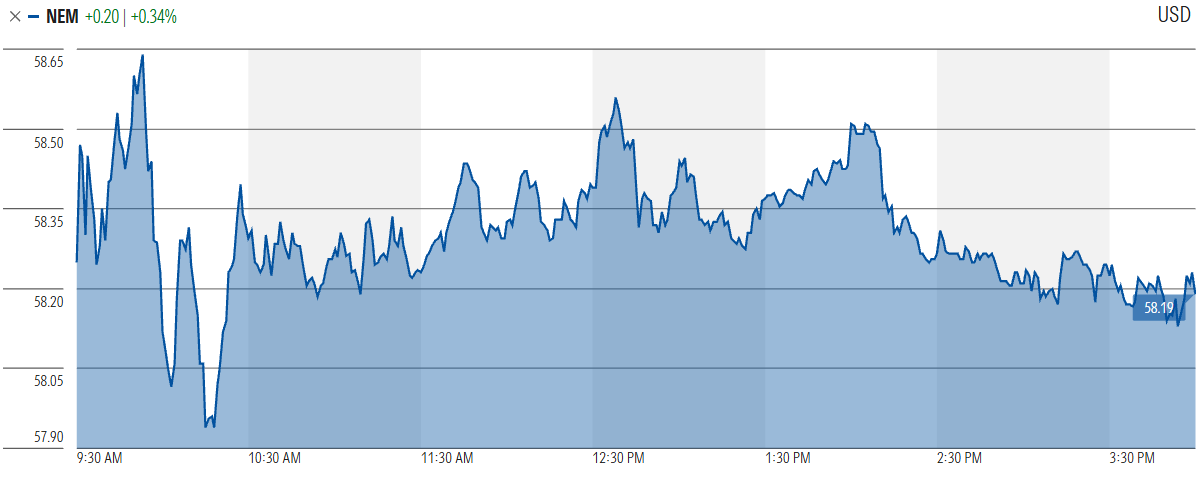

With global investors piling into safe‑haven assets, Newmont Corporation Stock is again under the microscope. The world's largest listed gold miner will release its second‑quarter (Q2) 2025 results after the US market closes on Thursday, 24 July. Expectations point to another robust quarter as record‑high bullion prices offset lingering production hiccups and higher input costs.

Headline Numbers to Watch

A clear beat on either line—particularly if accompanied by firmer cost guidance—could propel the shares to fresh 52‑week highs.

Gold‑Price Tailwind

Spot gold spent most of the quarter oscillating between US $3.300 and US $3.400 per ounce, touching US $3.368 on 21 July as the dollar eased. Every US $100 shift in bullion typically moves Newmont's annual free cash flow by roughly US $550 million, so the current range offers a powerful earnings lever.

Production Plateau: Quality over Quantity

Management's pivot towards Tier 1. long‑life assets has stalled overall output:

Strategic high‑grade bias – lower tonnage but richer ore.

Nevada Gold Mines setbacks – maintenance overruns and sequencing delays.

Recently acquired Lihir and Peñasquito – lower grams‑per‑tonne than legacy pits.

Ageing Merian and Suriname complexes – natural grade decline.

Investors will scrutinise any commentary on remediation progress; even modest quarter‑on‑quarter volume growth could act as a near‑term catalyst.

Copper: The Second Engine

Copper currently provides ~10 % of group turnover, but Newmont aims to double that share within five years through expansions at Red Chris (Canada) and the Yanacocha sulphides project (Peru). Copper not only taps the electric‑vehicle theme; it also emerges as a by‑product at several gold pits, lowering unit costs via co‑revenue credits—a margin enhancer in its own right.

What Traders Should Monitor on 24 July

| Item |

Why It Matters |

| All‑in sustaining cost (AISC) |

Q1 AISC printed at US $1,620/oz; each US $50 swing changes operating leverage materially. |

| Production guidance for H2 2025 |

Management says volume weakness is "transitional"; confirmation could spark multiple re‑rating. |

| Balance‑sheet discipline |

Net‑debt/EBITDA sits under 1 ×; capacity exists for buy‑backs if cash keeps gushing. |

| Copper project timelines |

Slippage would delay diversification benefits and blunt the EV narrative. |

| Dividend stance |

The base payout is US $1.00 per year, with a gold‑price‑linked top‑up. Revision signals confidence. |

Conclusion

At first glance Newmont Corporation Stock looks priced for perfection: a low‑teens forward P/E despite visible production headwinds. Yet with bullion holding above US $3.300/oz and copper quietly assuming a larger earnings role, the company enjoys a dual‑commodity cushion that few peers can match.

If management can pair Thursday's expected top‑line beat with credible volume recovery plans and clearer copper milestones, the shares could punch through their April peak and extend their run. Conversely, any guidance wobble—particularly on Nevada or Lihir—would expose the name to profit‑taking after a 40 % YTD rally.

Either way, next week's print is set to recalibrate the risk–reward profile for the sector's bell‑wether. Traders may wish to keep tight stops yet remain nimble; volatility is almost certain, direction less so—until 24 July spells it out.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.