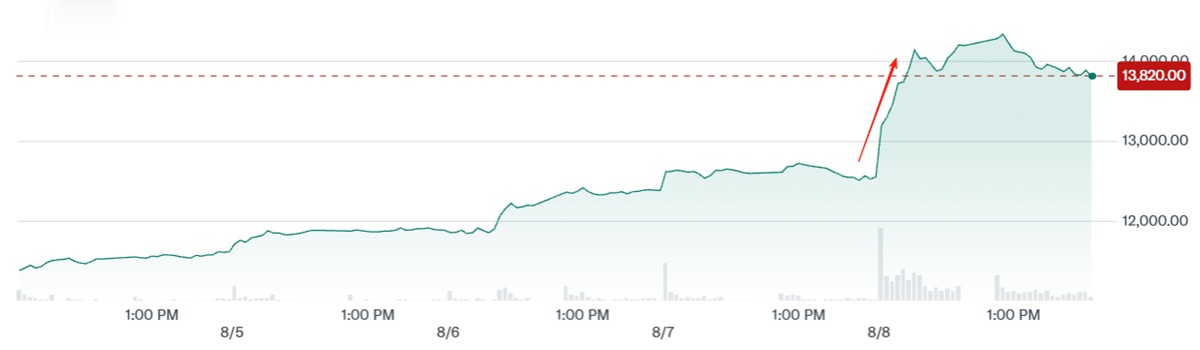

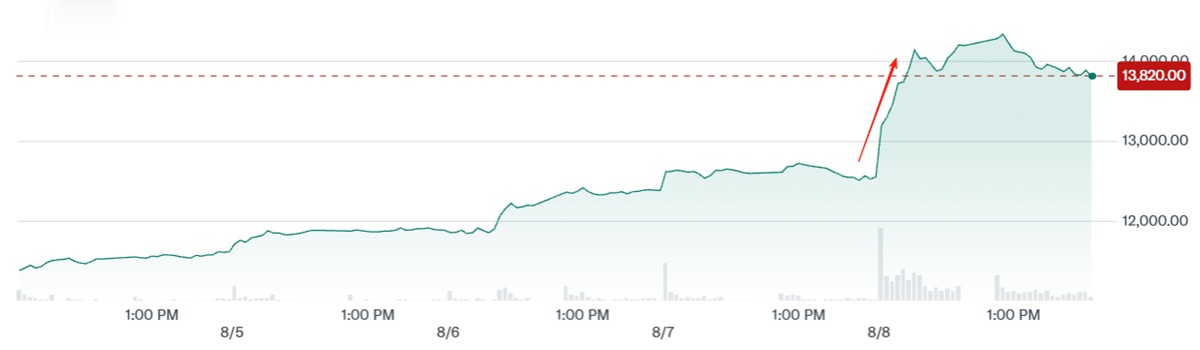

The SoftBank stock price surged to historic highs after the Japanese technology conglomerate delivered a spectacular turnaround in its latest quarterly results. For the first quarter of the 2024 financial year, SoftBank Group reported a net profit of ¥421.82 billion — a dramatic reversal from the ¥174.28 billion loss recorded in the same period last year and far exceeding the market's consensus estimate of ¥127.6 billion. This marks the second consecutive quarter of profitability for the group, bolstering investor confidence in founder and CEO Masayoshi Son's high-stakes investment strategy.

The market reacted instantly. On the Friday following the earnings announcement, the SoftBank stock price jumped as much as 13% intraday, reaching a record high and extending its winning streak to a fourth straight session.

Vision Fund Revival Powers Growth

At the heart of this performance lies the revival of the SoftBank Vision Fund, which posted a profit of ¥451.39 billion for the quarter — a complete turnaround from the losses seen a year earlier. The value of its investment portfolio increased by $4.8 billion, the largest quarterly gain since June 2021.

This surge was largely fuelled by a rebound in global technology valuations and strong results from portfolio companies such as South Korean e-commerce platform Coupang, German online car dealer Auto1 Group, US warehouse automation firm Symbotic, Singapore's ride-hailing group Grab, and Indian food-delivery giant Swiggy.

Strategic Bets on AI and Semiconductor Giants

SoftBank has also been actively increasing its exposure to leading players in artificial intelligence and semiconductor technology. By the end of March, the company had boosted its stake in Nvidia to approximately $3 billion — more than double its position from the previous quarter. It also purchased $330 million worth of Taiwan Semiconductor Manufacturing Company (TSMC) shares and $170 million in Oracle shares.

The timing has been impeccable. Nvidia's share price rose 46% in the three months to June, while TSMC's market capitalisation crossed the $1 trillion mark. These gains generated substantial paper profits for SoftBank, underscoring Masayoshi Son's ability to capture major market trends.

Bold Infrastructure Projects in AI

Beyond equity investments, SoftBank is pursuing ambitious infrastructure projects to cement its role in the AI ecosystem. In partnership with OpenAI, Oracle, and Abu Dhabi's MGX, the group is advancing "Stargate" — a $500 billion hyperscale data centre project in the United States.

Masayoshi Son is also lobbying semiconductor industry leaders, including TSMC, to participate in a proposed $1 trillion AI manufacturing hub in Arizona, which would be the largest project of its kind in history.

Pipeline of Potential IPOs

Several companies in SoftBank's portfolio are preparing to go public, potentially delivering fresh investment returns and liquidity in the coming quarters. Indian eyewear retailer Lenskart has already filed for an IPO, aiming to issue shares worth ₹2.15 billion. Other likely candidates include Japanese mobile payments provider PayPay, Swedish fintech Klarna, and travel platform Klook.

The prospect of multiple successful listings adds further optimism to the outlook for the SoftBank stock price, as these events could unlock substantial value for shareholders.

Analyst Views and Cautionary Notes

Market analysts have noted that while enthusiasm for AI could continue to buoy the SoftBank stock price, certain factors might limit upside potential. Satoru Kikuchi of SMBC Nikko Securities has suggested that the end of SoftBank's share buyback programme — should the company decide to redirect capital towards AI investments — might act as a brake on further gains.

Similarly, Alpha Binwani Capital's founder Ashwin Binwani voiced cautious optimism, highlighting the diversified nature of SoftBank's investments but noting that its long-term fundamentals depend on the sustained success of its multi-sector strategy.

Conclusion

The latest quarterly results have reinforced Masayoshi Son's reputation as a visionary investor capable of making bold, well-timed bets. The Vision Fund's resurgence, strategic stakes in AI leaders like Nvidia and TSMC, and an expanding pipeline of IPOs have all contributed to the meteoric rise in the SoftBank stock price.

Yet, as SoftBank shifts more aggressively into AI infrastructure and hardware, the balance between aggressive expansion and prudent capital management will be key. For now, the market appears convinced, and investors are watching closely to see if Son can turn this momentum into long-term, sustainable growth.

Summary Table

SoftBank Stock Price – Key Facts at a Glance

| Metric |

Details |

| Latest Stock Price Move |

Up 13% on earnings day |

| Quarterly Net Profit |

¥421.82 billion |

| Previous Year (Same Period) |

¥174.28 billion loss |

| Vision Fund Profit |

¥451.39 billion |

| Key AI Investments |

Nvidia, TSMC, Oracle |

| Major AI Project |

"Stargate" $500B data centre |

| Notable Portfolio IPOs |

Lenskart, PayPay, Klarna, Klook |

| Market Outlook |

Positive but watch buyback end and asset sales |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.