In the world of forex trading, managing risk effectively is essential for long-term success. Without a proper strategy, even the most promising trades can quickly turn into costly mistakes. Whether you're an experienced trader or just starting out, mastering forex risk management techniques can make all the difference between surviving the market's volatility and thriving within it.

Forex risk management is about more than just setting stop-loss orders. It involves a comprehensive approach to assessing and managing the risks that arise from fluctuations in currency values. As you advance in your trading career, you'll need to explore more sophisticated techniques to help protect your capital and increase your chances of success.

Leverage and Margin: A Double-Edged Sword

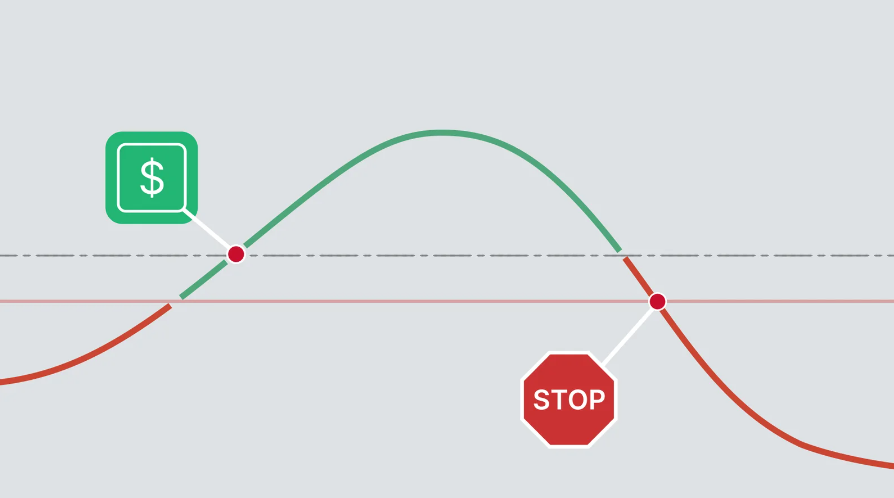

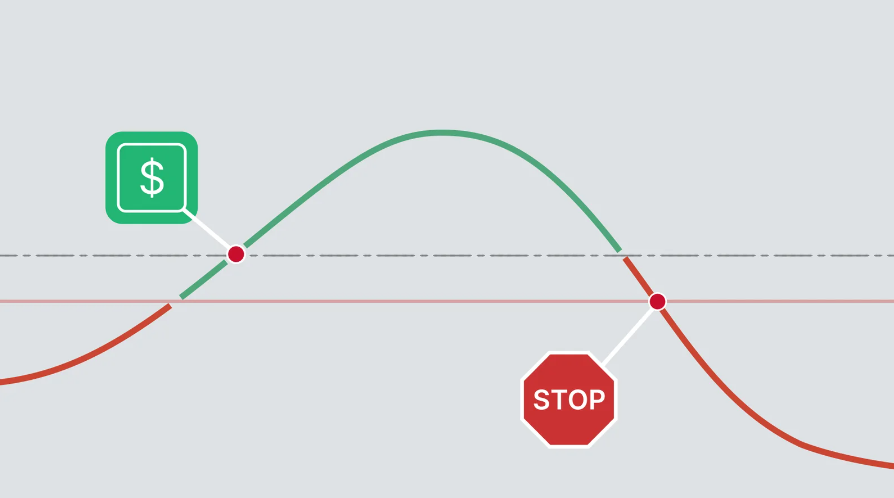

Leverage is a powerful tool in forex, allowing traders to control large positions with relatively small amounts of capital. But as any experienced trader will tell you, leverage is a double-edged sword. While it can amplify your gains, it can just as easily magnify your losses.

Leverage in forex trading means you can control a much larger position than your initial deposit would typically allow. For example, a 50:1 leverage ratio means that for every £1 in your account, you can trade £50 worth of currency. While this can increase the potential for profit, it also means that small market movements against your position can lead to significant losses.

To manage forex risk effectively with leverage, it's essential to use it cautiously. Start with lower leverage ratios, such as 10:1 or 20:1. until you become more familiar with the risks involved. Risk management in forex involves determining your risk tolerance and ensuring that your leverage doesn't exceed it. It's also vital to keep track of your margin level, which is the amount of equity you have in your account relative to your position size. If the market moves unfavourably, your broker may issue a margin call, requiring you to deposit more funds or close positions to maintain your leverage.

By using leverage carefully and responsibly, you can take advantage of the opportunities in the market without exposing yourself to unnecessary risks.

Risk-Reward Ratio: A Key Metric for Success

No discussion of forex risk management would be complete without mentioning the risk-reward ratio. This metric is a fundamental concept for any trader looking to make profitable and calculated decisions. The risk-reward ratio compares the potential profit of a trade to the potential loss, helping you determine whether the trade is worth taking.

For example, if you're willing to risk £100 on a trade and your potential reward is £300. your risk-reward ratio would be 1:3. The goal is to always aim for a positive ratio that ensures the potential reward outweighs the risk. A common rule of thumb is to look for a risk-reward ratio of at least 1:2. meaning that for every £1 you risk, you should aim for at least £2 in profit.

The importance of a positive risk-reward ratio in forex risk management cannot be overstated. Even if you win only half of your trades, a good risk-reward ratio can still lead to consistent profits. On the other hand, if your risk-reward ratio is too low, your profits may not be able to cover the losses over time.

When setting up your trades, always ensure that your stop-loss and take-profit orders align with your desired risk-reward ratio. If the potential reward doesn't justify the risk, it's best to skip the trade and look for a better opportunity.

Monitoring and Adjusting Risk in Real-Time

Even with the best forex risk management strategy in place, the market's volatility can throw unexpected challenges your way. This is why it's crucial to continually monitor and adjust your risk management approach in real-time. Tools such as volatility indicators and real-time news sources can help you stay informed and adapt to changing market conditions.

Volatility indicators can measure how much a currency pair's price fluctuates over a given period. If you notice that volatility is particularly high, you might decide to reduce your position size, adjust your stop-loss levels, or use a lower leverage ratio to protect your capital. On the other hand, during periods of low volatility, you may feel more comfortable with a larger position or more aggressive trading strategies.

In addition to volatility, keeping an eye on economic news is crucial for adjusting your risk strategy. High-impact news events, such as interest rate decisions, geopolitical developments, or economic data releases, can cause sudden and significant price movements. A major economic announcement can swiftly turn a trade from profitable to a loss if you’re not prepared. Many traders use an economic calendar to anticipate these events and adjust their positions accordingly.

Being able to monitor and adjust your risk in real-time is an essential skill for any trader who wants to remain competitive in the forex market. As you gain more experience, you'll develop a better understanding of how market conditions can shift, enabling you to fine-tune your risk management in forex strategies on the fly.

Final Thoughts on Forex Risk Management

Incorporating advanced forex risk management techniques into your trading strategy can significantly improve your chances of long-term success. From hedging to managing leverage, understanding risk-reward ratios, and being able to adapt to market changes in real-time, each of these strategies plays a crucial role in helping you navigate the complexities of forex trading.

Ultimately, risk management in forex is not about avoiding risk but about controlling it. By carefully assessing your trades, using appropriate tools, and staying disciplined, you can protect your capital while still seizing opportunities for growth. As you continue to develop your trading skills, remember that a well-thought-out Risk Management Plan is the foundation of any successful forex strategy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.