If you've ever thought about stepping into the world of forex trading, you've likely come across the idea of opening a forex trading account. But before you jump in, there are a few things you should understand. The account is essentially a tool that allows you to buy and sell currencies on the foreign exchange market. Think of it like an online bank account, but instead of storing pounds, you're buying and selling different currencies like euros, dollars, or yen.

Once you've familiarised yourself with the basics of forex trading account, the next step is choosing a forex broker that is regulated and offers the services you need.

Why EBC?

EBC Financial Group stands out for several reasons, making it a trusted choice for traders of all levels.

Firstly, EBC is regulated by top-tier authorities like the UK's Financial Conduct Authority (FCA), ensuring your funds are secure and that the broker operates with transparency and integrity. This level of oversight is crucial for peace of mind, especially if you're new to forex.

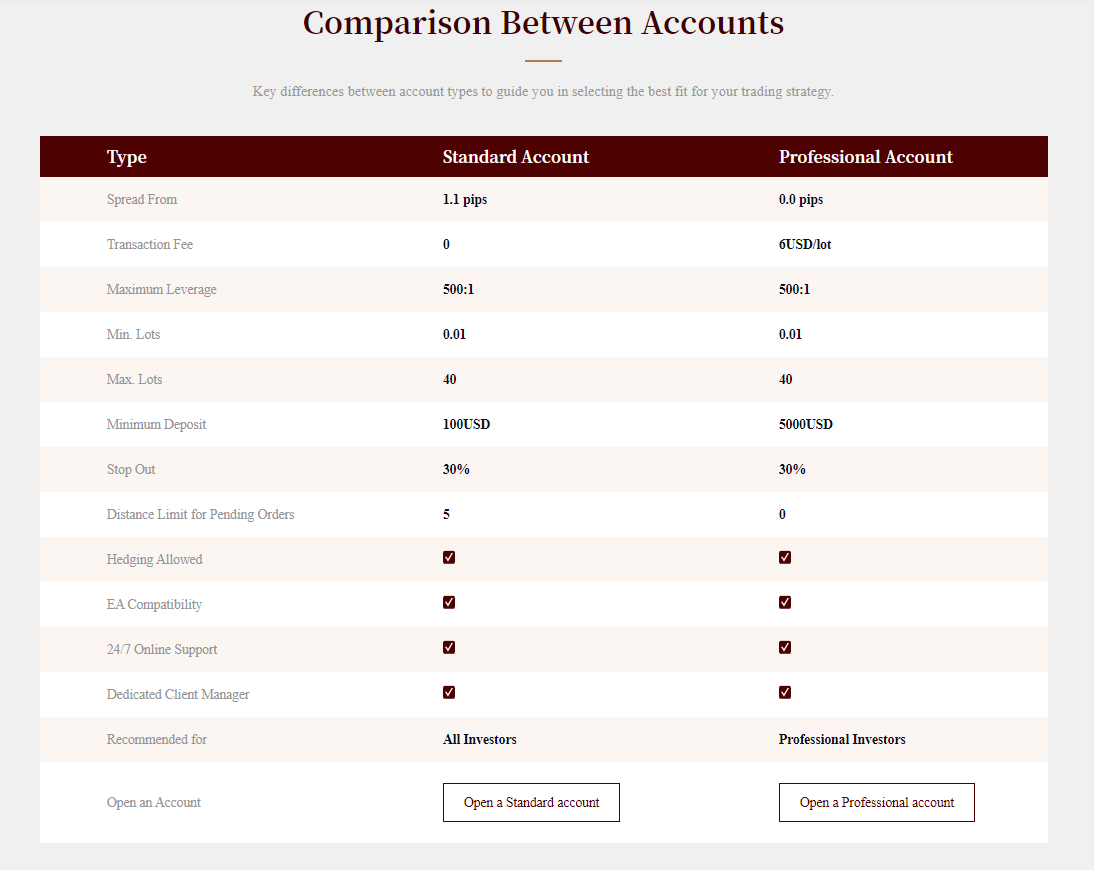

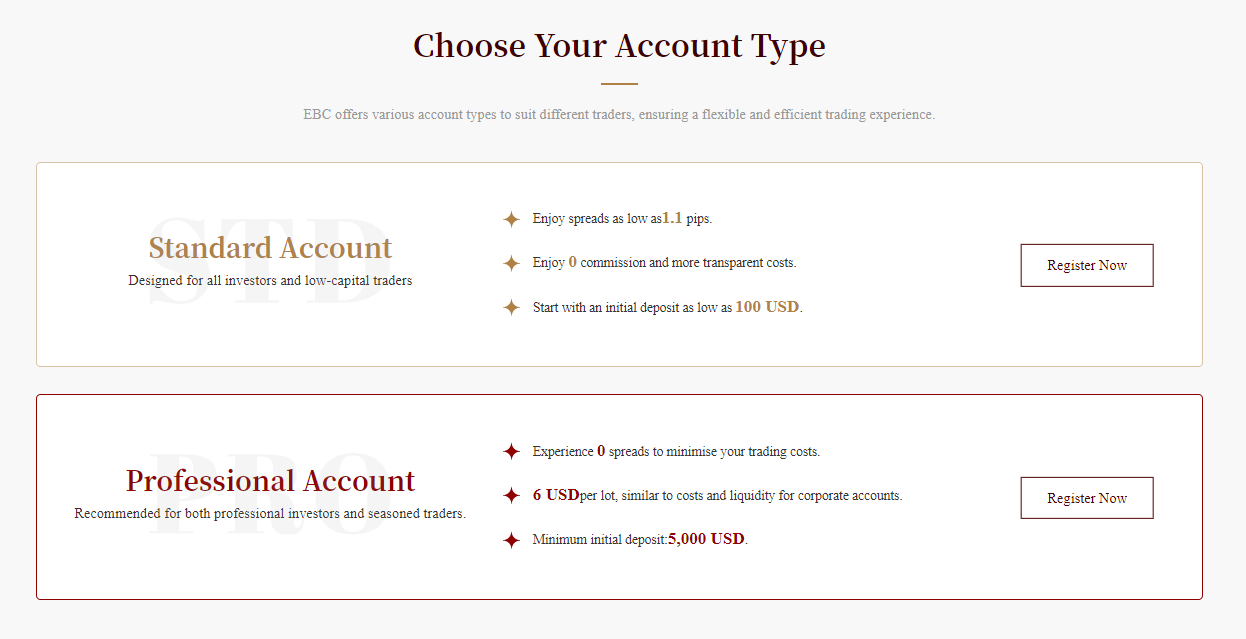

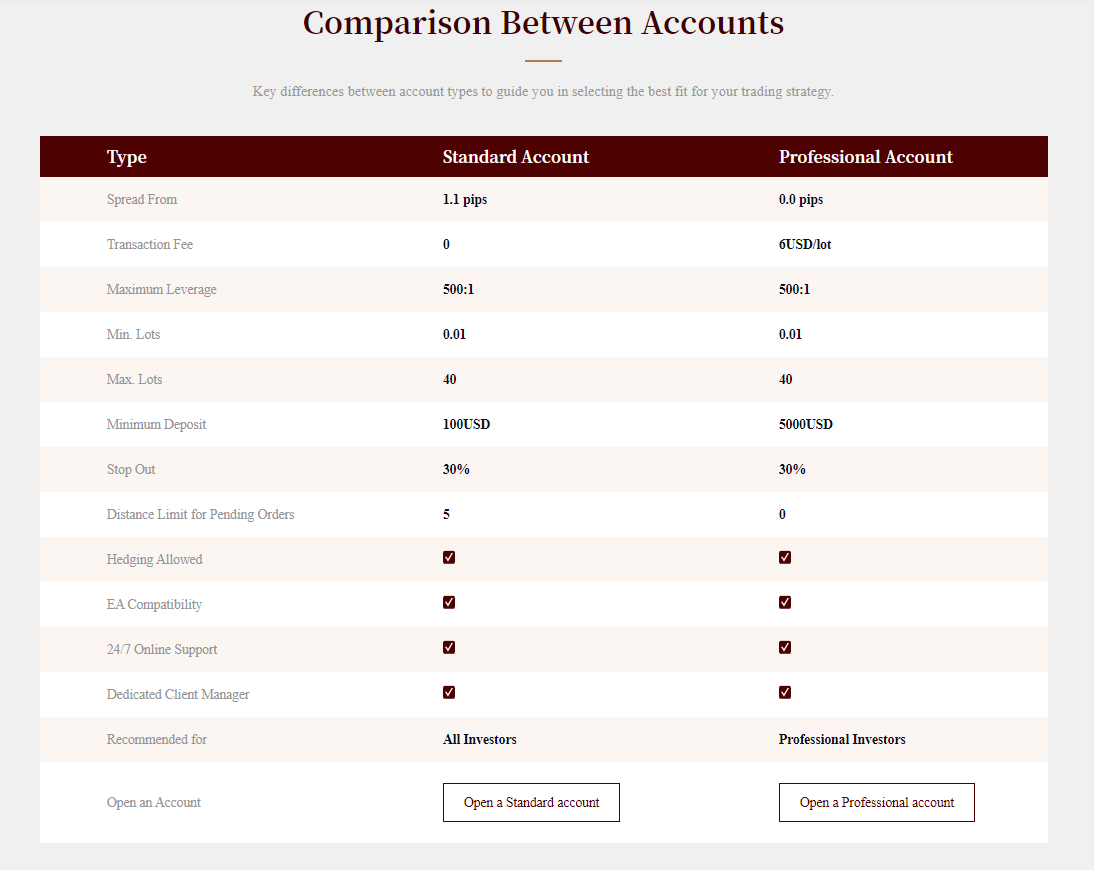

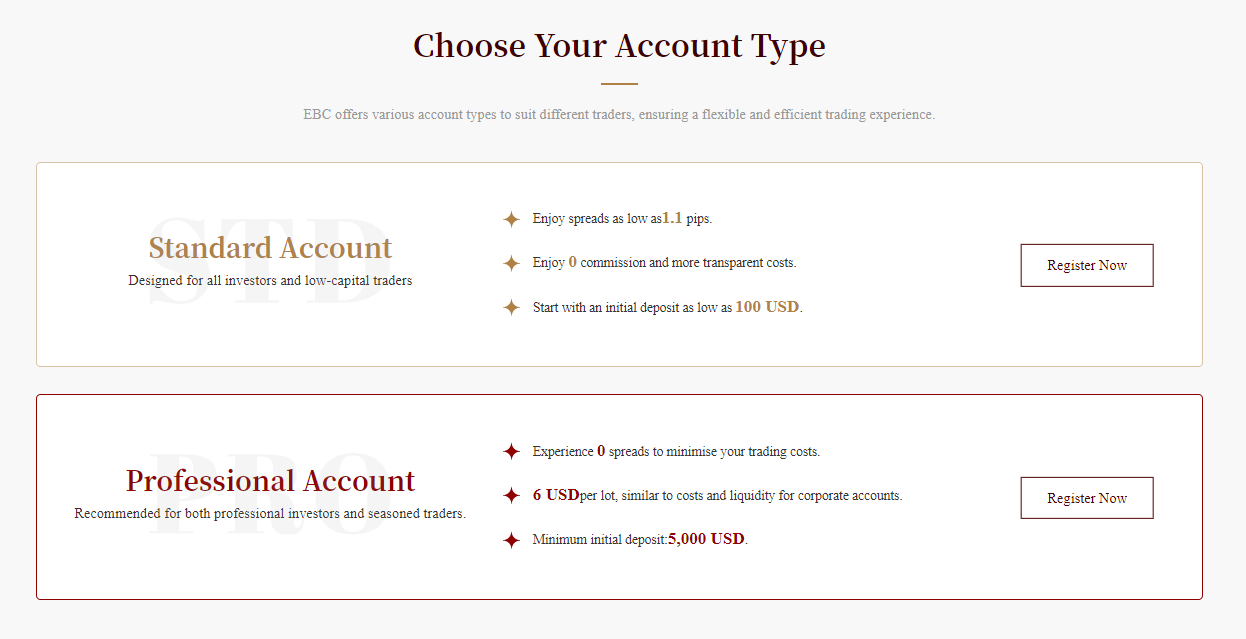

Secondly, EBC offers a variety of account types to suit different needs. Beginners can start with a standard account, while more experienced traders might prefer the professional account for tighter spreads and faster execution.

Secondly, EBC offers a variety of account types to suit different needs. Beginners can start with a standard account, while more experienced traders might prefer the professional account for tighter spreads and faster execution.

Finally, EBC's platforms, MetaTrader 4 and 5. are user-friendly yet powerful, packed with tools like advanced charts, real-time data, and automated trading options. Whether you're on desktop or mobile, these platforms make trading accessible and efficient.

Finally, EBC's platforms, MetaTrader 4 and 5. are user-friendly yet powerful, packed with tools like advanced charts, real-time data, and automated trading options. Whether you're on desktop or mobile, these platforms make trading accessible and efficient.

In short, EBC combines security, flexibility, and cutting-edge technology, making it an excellent choice to start your forex journey.

How to Open a Forex Trading Account with EBC

Opening a forex trading account with EBC is a simple process, but there are a few things you'll need to prepare beforehand. First, make sure you have a reliable internet connection and a device (computer, tablet, or smartphone) to access the trading platform. Next, gather the necessary documents for verification. These typically include:

A valid government-issued ID (such as a passport or driver's licence).

Proof of address (like a utility bill or bank statement no older than three months).

Having these ready will speed up the process and get you trading sooner.

Step 1: Choosing the Right Account Type

EBC offers two account types to cater to different needs: the Standard Account or the Professional Account. Each has its own set of benefits, depending on your trading experience and objectives.

Standard Account: This is the ideal option for most traders, especially beginners. It offers access to a wide range of currency pairs and other assets, with flexible leverage options. If you're new to forex trading or prefer a more straightforward approach, this account is perfect for you. It provides all the essential features you need to get started without overwhelming you with complex tools.

Professional Account: This account is designed for more experienced traders who want to take advantage of higher leverage and additional trading features. To open a Professional Account, you'll need to meet certain criteria, such as having a proven track record in forex trading and a higher level of financial knowledge. This account type is more suited to those who are comfortable with advanced trading strategies and want to take a more active role in the markets.

Step 2: Registering Your Account

Once you've decided on an account type, head over to the EBC website. Look for the "Open an Account" button, which will take you to the registration page. Here, you'll need to fill out a form with your personal details, such as your name, address, and contact information. You'll also be asked about your financial background and trading experience. Don't worry if you're a beginner—this information helps EBC tailor their services to your needs.

Step 3: Verifying Your Identity

After submitting your application, the next step is verification. This is a standard procedure designed to protect both you and the broker from fraud. You'll need to upload copies of your ID and proof of address. EBC's team will review these documents and once approved (usually within 1-2 business days), your account will be ready to use.

Step 4: Funding Your Account

With your account set up and verified, it's time to fund it. EBC offers a variety of payment methods, including bank transfers, credit/debit cards, and e-wallets. Check the minimum deposit requirement for your chosen account type—this is the amount you'll need to start trading. Once your deposit is processed, the funds will appear in your account, and you're all set to begin.

Step 5: Downloading the Trading Platform

EBC supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular trading platforms in the industry. These platforms are available for desktop, web, and mobile devices, so you can trade wherever you are. After downloading the platform, log in using the credentials provided by EBC. Take some time to familiarise yourself with the interface—there are plenty of tutorials available if you need help.

Step 6: Placing Your First Trade

Now for the exciting part—placing your first trade! Start by researching the currency pairs you're interested in. For beginners, major pairs like EUR/USD or GBP/USD are a good place to start, as they tend to be more stable and liquid. Once you've made your decision, enter the trade size, set your stop-loss and take-profit levels (to manage risk), and click "Buy" or "Sell." Congratulations—you're now a forex trader!

Tips for Success

While forex trading can be rewarding, it's important to approach it with caution, especially if you're new. Here are a few tips to keep in mind:

Start Small: Begin with a demo account or trade with small amounts until you gain confidence.

Educate Yourself: Take advantage of EBC's educational resources, such as webinars, articles, and tutorials.

Manage Risk: Never invest more than you can afford to lose and always use risk management tools like stop-loss orders.

Stay Informed: Keep an eye on global news and economic events, as these can impact currency prices.

Opening a forex trading account with EBC Financial Group is a straightforward and secure process, designed to cater to traders of all experience levels. With its strong regulatory oversight, diverse account options, and advanced trading platforms, EBC provides a reliable foundation for your forex trading journey.

As you begin, remember that success in forex trading requires patience, discipline, and continuous learning. Take advantage of EBC's resources and tools to build your knowledge and refine your strategies.

If you're ready to take the next step, visit EBC's website to open your account and start exploring the opportunities in the global forex market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Secondly, EBC offers a variety of account types to suit different needs. Beginners can start with a standard account, while more experienced traders might prefer the professional account for tighter spreads and faster execution.

Secondly, EBC offers a variety of account types to suit different needs. Beginners can start with a standard account, while more experienced traders might prefer the professional account for tighter spreads and faster execution. Finally, EBC's platforms, MetaTrader 4 and 5. are user-friendly yet powerful, packed with tools like advanced charts, real-time data, and automated trading options. Whether you're on desktop or mobile, these platforms make trading accessible and efficient.

Finally, EBC's platforms, MetaTrader 4 and 5. are user-friendly yet powerful, packed with tools like advanced charts, real-time data, and automated trading options. Whether you're on desktop or mobile, these platforms make trading accessible and efficient.