Verizon Communications (NYSE: VZ) is a cornerstone of the US telecommunications sector, known for its robust network, stable dividends, and broad consumer reach.

As investors look for reliable opportunities in a volatile market, many are asking: Is Verizon a good stock to buy in 2025? This article examines the latest analyst views, financial performance, growth outlook, and key risks to help you make an informed decision.

Verizon's Financial Performance in 2025

Verizon delivered a solid start to 2025, reporting strong first-quarter results. The company posted an adjusted earnings per share (EPS) of $1.19, surpassing expectations and up from $1.15 a year earlier. Revenue for Q1 2025 reached $33.5 billion, a 1.5% year-over-year increase, marginally beating forecasts. Net income climbed to $5.0 billion, and adjusted EBITDA hit a record $12.6 billion, reflecting a 4% annual rise.

Wireless service revenue, a key driver for Verizon, grew by 2.7% to $20.8 billion, maintaining industry leadership. The company also saw strong demand for broadband, with significant net additions in both Fios and fixed wireless access. Operational cash flow totalled $7.8 billion for the quarter, up from $7.1 billion in Q1 2024, and free cash flow rose to $3.6 billion, supporting ongoing investments and dividend payments.

Dividend Strength and Income Appeal

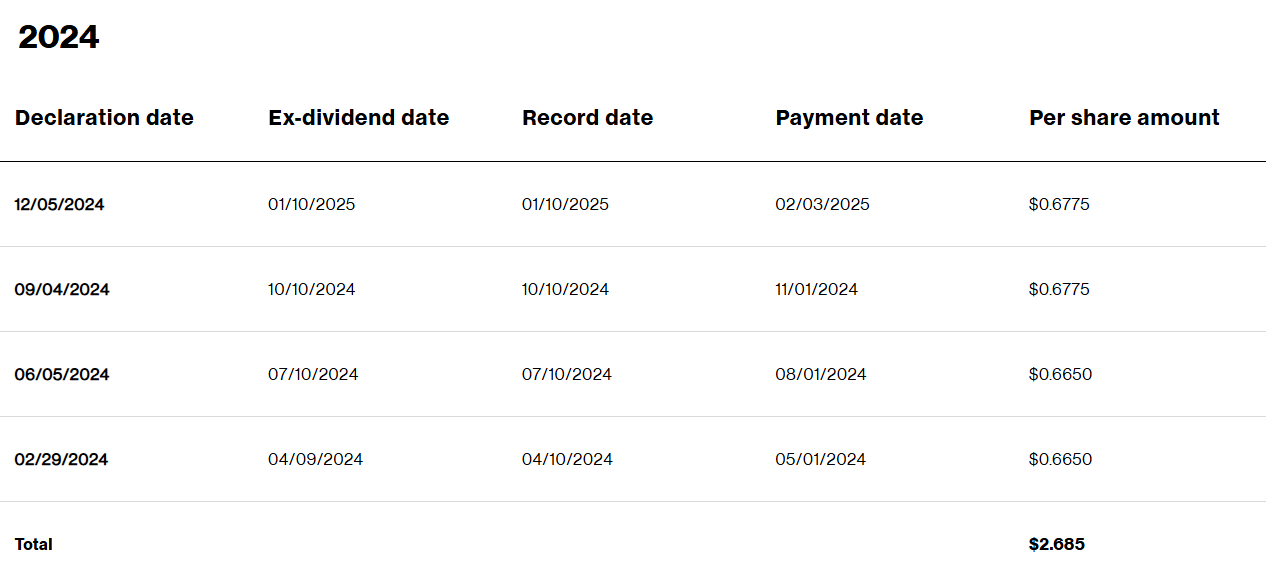

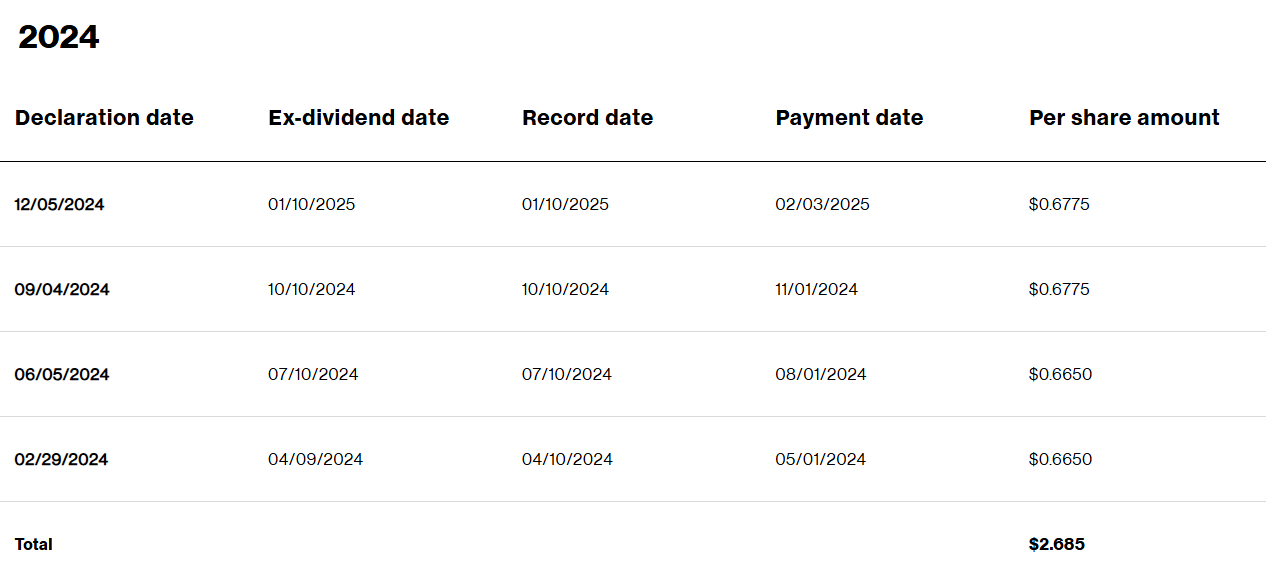

One of Verizon's most attractive features is its dividend. The company has maintained dividend payments for 42 consecutive years, with a current yield of around 6.3%-well above the market average.

In January 2025, Verizon announced a quarterly dividend of $2.71 per share, marking its 18th consecutive year of increases. For income-focused investors, this consistency and yield are significant draws.

Analyst Ratings and Price Targets

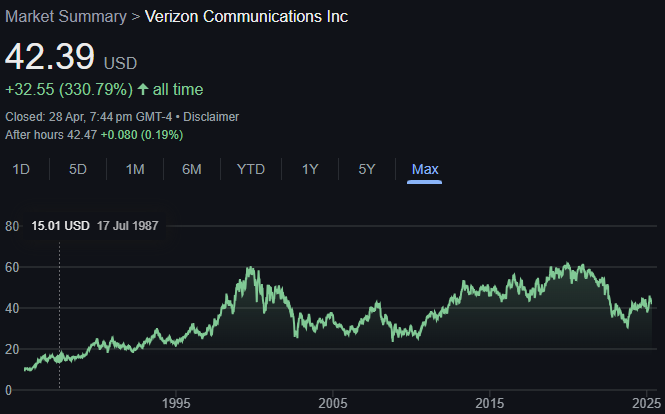

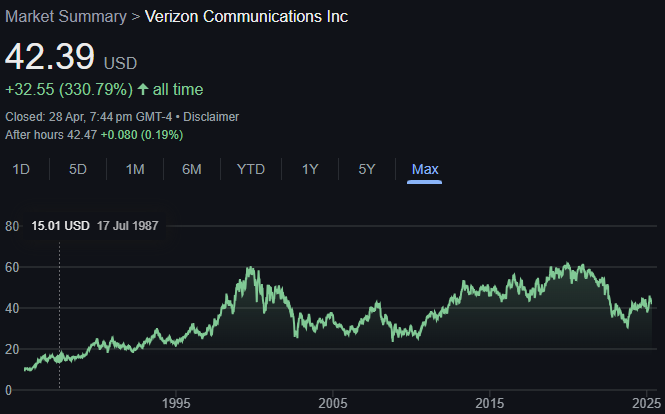

Wall Street analysts are moderately positive on Verizon's prospects for 2025. According to MarketBeat, the consensus 12-month price target is $47.41, with estimates ranging from $40.00 to $56.00. This suggests an upside of nearly 12% from recent trading levels around $42.39. Of 18 analysts, the split is 9 “hold,” 7 “buy,” and 2 “strong buy” ratings, resulting in a consensus “moderate buy” recommendation.

Recent upgrades have come from major firms like Oppenheimer and Scotiabank, with targets in the mid-to-high $40s and low $50s. Some long-term forecasts see Verizon potentially reaching $50–$55 by 2027 if growth continues and debt remains under control.

Growth Outlook and Strategic Initiatives

Verizon's 2025 guidance remains confident, with expectations for wireless service revenue growth of 2.0%–2.8%, adjusted EBITDA growth of 2.0%–3.5%, and adjusted EPS growth of up to 3%.

The company is investing heavily in 5G infrastructure, broadband expansion, and innovative offerings like customisable MyPlan options for consumers and businesses.

Verizon's focus on customer segmentation, cost control, and new technology partnerships (including AI and private 5G networks) positions it for steady, if unspectacular, growth.

Key Risks and Challenges

Despite its strengths, Verizon faces notable challenges:

Subscriber Losses: The company reported a loss of 356,000 postpaid phone subscribers in Q1 2025, reflecting intense competition from rivals like T-Mobile and AT&T.

Competitive Pressures: Aggressive promotions and price wars in the wireless sector may continue to impact margins and subscriber growth.

Modest Revenue Growth: As a mature business, Verizon's revenue growth is incremental, not explosive.

Debt Load: Verizon's net unsecured debt at the end of Q1 2025 was $115.1 billion. While manageable, ongoing debt reduction remains a priority.

Technical and Sentiment Analysis

Technical indicators currently show mixed signals. The stock is trading close to its 50-day and 200-day moving averages, with a recent bearish sentiment and a Fear & Greed Index reading of 39 (“Fear”).

Some short-term forecasts predict a slight dip or sideways movement, suggesting it may not be the best time for momentum traders to buy in. However, for long-term, income-oriented investors, the fundamentals remain appealing.

Is Verizon a Good Stock to Buy in 2025?

Verizon offers a compelling case for conservative, income-focused investors. Its industry-leading wireless service revenue, strong free cash flow, and reliable dividend make it a solid defensive holding. Analyst consensus points to moderate upside, with the potential for improved returns if subscriber trends stabilise and cost controls persist.

However, those seeking high growth or rapid capital appreciation may find better opportunities elsewhere, especially in sectors with greater earnings momentum. Investors should also monitor competitive dynamics and Verizon's ability to innovate in a fast-evolving telecom landscape.

Conclusion

Verizon remains a stable, income-generating stock with moderate growth prospects for 2025. Analyst views are cautiously optimistic, highlighting the company's financial resilience, dividend strength, and ongoing investments in network and technology.

For those prioritising yield and stability over high growth, Verizon is a worthy candidate for consideration in a diversified portfolio.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.