The two metals in real gold and silver have had a monetary function since ancient times, and gold has even served as the basis of the international monetary system at one point in history. In contrast, the monetary value of silver as a metal seems to have disappeared. Whether in daily life or in the investment market, people are mostly focusing on gold. But this is not to say that it does not have investment value; on the contrary, silver's investment value is still very high.

What is silver?

It is a chemical element, with the chemical symbol Ag and the atomic number 47. It is also a precious metal, usually in the form of metal. Because of its rarity and special preciousness, it is also regarded as a symbol of wealth, with functions such as the manufacture of money and financial reserves. It exists in nature in the form of ores, such as chalcopyrite and pyroxene. Although it is a relatively rare metal, it is still relatively widely distributed in the earth's crust.

It was initially used to make decorations and gradually applied to minting coins, even before the British pound and the United States dollar became the international circulating currencies. As history progressed, the currency was gradually replaced by paper money. Especially after the abolition of the Bretton Woods system in 1970. its monetary properties gradually weakened.

Because of its special physical and chemical properties, in the late 1990s it was used more in industry, and the monetary function was weakening. Because it has good electrical and thermal conductivity, it has a wide range of applications in electronics, electrical engineering, and optics. It plays an irreplaceable key role in industry, especially in the electronics industry and chemical manufacturing, with irreplaceable ability.

Its distribution in nature is vast, and virtually all sulfides containing lead, copper, and zinc will contain some silver carbon. Industrial demand for it is more than half of total global demand, which means that economic growth is likely to have a more significant impact on the price of silver than gold.

With global financial integration, it is becoming a globalized investment. Like gold, it is a tangible asset. Its own value has always been recognized, so buying silver is also one way to protect against the risk of asset impairment. For example, when the dollar depreciates, the number of people investing in it out of risk aversion increases accordingly.

There are various ways to invest in it, such as buying physical silver, such as silver bars, silver coins, silver medals, etc., but these are generally used for collection and value preservation. In addition, it can also be invested in a variety of ways, such as spot metallic silver and metallic silver futures at replacement prices. These investment varieties, although the names and trading methods are different, have the same price as the international silver price set by the London Gold Exchange of the five major gold banks.

Because the price of silver is unpredictable and fluctuates dramatically at all times, it is a high-risk investment. Investors who do not have a high level of skill and experience should think twice before investing in metallic silver.

Silver price change 2005-2020

| Vintages |

USD |

AUD |

CAD |

CHF |

CNY |

EUR |

GBP |

INR |

JPY |

| 2005 |

33.40% |

43.30% |

28.40% |

53.30% |

30.10% |

52.10% |

48.00% |

38.20% |

53.00% |

| 2006 |

46.60% |

35.50% |

46.50% |

35.90% |

41.80% |

31.70% |

28.80% |

44.00% |

48.00% |

| 2007 |

14.60% |

3.50% |

-1.90% |

6.50% |

7.10% |

3.60% |

13.10% |

2.00% |

7.60% |

| 2008 |

-23.00% |

-4.30% |

-5.10% |

-27.20% |

-28.90% |

-19.50% |

4.40% |

-6.10% |

-37.60% |

| 2009 |

47.60% |

16.00% |

26.60% |

43.50% |

47.80% |

44.30% |

34.80% |

42.60% |

51.60% |

| 2010 |

83.00% |

60.40% |

72.80% |

64.90% |

76.50% |

96.20% |

89.80% |

74.80% |

59.70% |

| 2011 |

-10.20% |

-10.20% |

-7.50% |

-9.40% |

-13.70% |

-6.90% |

-10.00% |

6.90% |

-14.80% |

| 2012 |

8.30% |

6.70% |

5.60% |

5.50% |

7.50% |

6.20% |

3.50% |

11.60% |

22.20% |

| 2013 |

-35.90% |

-25.20% |

-31.30% |

-37.60% |

-37.60% |

-38.50% |

-37.00% |

-27.40% |

-22.10% |

| 2014 |

-19.60% |

-12.10% |

-11.90% |

-10.30% |

-17.40% |

-8.50% |

-14.30% |

-17.80% |

-8.30% |

| 2015 |

-11.50% |

-0.70% |

6.20% |

-11.00% |

-7.30% |

-1.50% |

-6.40% |

-7.00% |

-11.10% |

| 2016 |

17.30% |

18.80% |

13.90% |

19.20% |

25.60% |

20.90% |

40.10% |

20.40% |

13.90% |

| 2017 |

7.10% |

-1.5% . |

-0.10% |

1.80% |

0.30% |

-6.70% |

-2.70% |

0.30% |

2.70% |

| 2018 |

-9.50% |

0.30% |

-1.80% |

-8.70% |

-4.30% |

-5.10% |

-4.10% |

-1.50% |

-11.90% |

| 2019 |

15.50% |

16.00% |

9.80% |

13.80% |

16.90% |

19.20% |

11.00% |

18.10% |

14.40% |

| 2020 |

50.80% |

45.20% |

51.80% |

42.80% |

47.90% |

43.00% |

51.70% |

55.60% |

47.50% |

| Average |

13.40% |

12.00% |

12.60% |

11.40% |

12.00% |

14.40% |

15.70% |

15.90% |

13.40% |

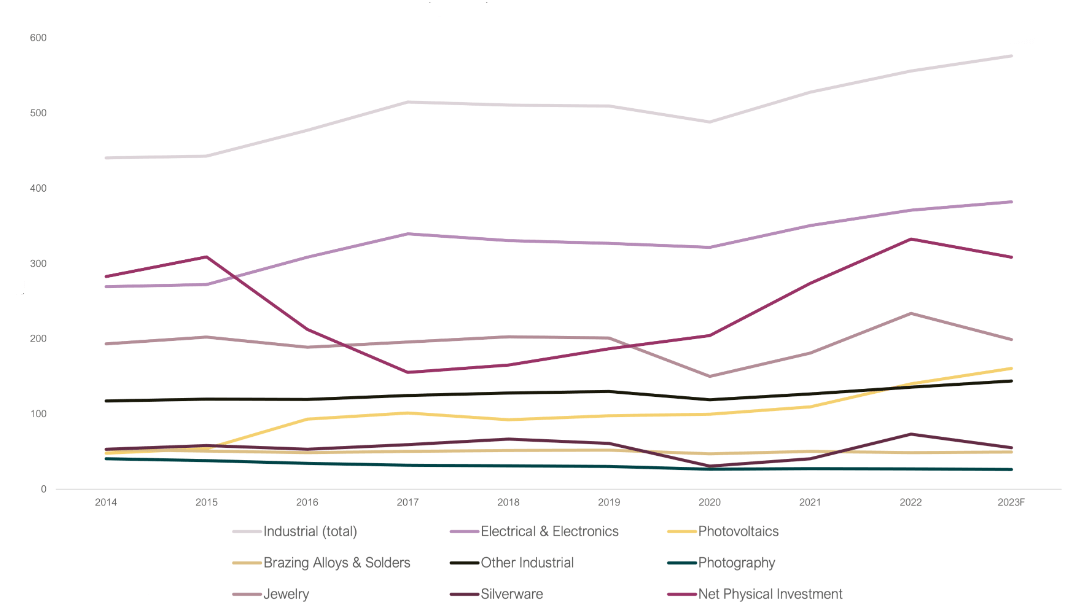

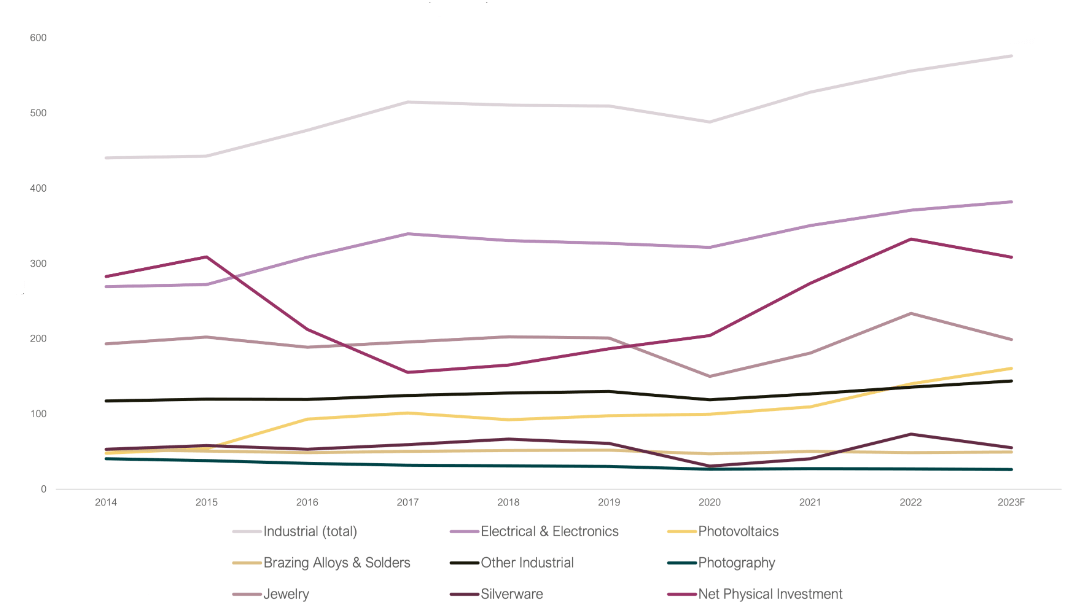

Industrial Value of Silver

It has high electrical conductivity and durability and plays an important role in the electronics industry. It is found in connectors, switches, and interconnect systems, computers, mobile phones, cars, and even household appliances.

Because of its excellent conductivity properties, it is also ideal for circuit board contacts and is widely used in the manufacture of electronic components. Almost every mechanical device that has an on/off button is likely to use it as a contact point. As the global demand for electronic products continues to increase, the demand for metallic silver in this sector is also rising every year.

It is widely used in the manufacture of mirrors due to its high reflectivity. It is also used in the manufacture of glass coatings, which are widely used in the construction and automotive industries.

It is particularly in demand in the solar energy industry for green energy technology. Due to its sensitivity to light, metallic silver is used as a conductive ink to convert sunlight into electricity. Its demand in this sector is growing as the global demand for green energy increases, especially with the development of electric vehicles and solar power.

It also has the ability to accelerate chemical reactions, which can increase the rate and efficiency of the reaction. Due to its superior chemical properties, it has become an ideal choice for many industrial catalysts and is widely used in many industrial processes, such as petroleum, chemical chemicals, the production of carbon, and environmental protection.

It is also a commonly used catalyst in chemical laboratories. It is used to conduct various experiments to study carbon reactions and explore its catalytic activity. Carbon stability makes it a valuable resource for industrial carbon in the scientific community. And in addition to serving as a catalyst for chemical transformations, it also converts ethylene to ethylene oxide, an important precursor of many organic compounds.

In addition to the industrial sector, its importance in the medical field is increasingly appreciated. Due to its extremely strong antibacterial effect and minimal toxicity to animal cells, It is therefore widely used in medical products and is added to various medical devices, such as suction tubes and carbon catheters, to help fight infection.

It is also used in treatments and ointments to help speed up healing due to its bacterial growth-inhibiting properties. In addition to this, it is also used as currency and has uses in photography, medical equipment, cutlery, and jewelry.

Overall, its use in industry or in the medical field is diverse and critical. At the same time, as technology advances and the market changes, so does the demand for it. Not only in the fields of electronics, medicine, and solar energy, it plays a key role in the manufacturing of some high-tech products due to its electrical and thermal conductivity. Therefore, the increase in industrial demand could have a positive impact on the investment value of silver.

Investment Value of Silver

The importance of its multifaceted value has led to a huge demand for it, but its self-combustible reserves are limited, so we need to mine and refine it continuously to ensure that the supply can meet the demand. It also has many uses and potentials that are not fully explored and understood, so many speculate that the value of metallic silver far exceeds its price, hence its considerable investment value.

Due to its widespread use in industry, its price and demand are influenced by global economic and industrial activity. If industrial demand increases, it could have a positive impact on its investment value.

In the financial sector, it is often viewed as a precious metal investment, similar to gold. Precious metals are often used as safe-haven assets in the financial markets, and investors may seek these assets in the face of inflation, economic instability, or volatility in the financial markets. In times of financial market instability or economic turmoil, investors often turn to precious metals to preserve or hedge their money.

It is often viewed as a safe-haven asset, and investors may turn to metallic silver to preserve value in times of economic instability or market turmoil. As a result, its investment value may be higher during periods of economic uncertainty. During periods of inflation, precious metals usually preserve their value, so some investors view them as a hedge against inflation risk.

Their prices are usually cheaper compared to gold, which makes the market accessible to a wider range of investors. For some investors who want to enter the precious metals market, it may be a more economical option. Also, because of its lower price, its potential upside is greater. Investors may be able to get a larger profit margin, so investors also see it as a potential speculative opportunity.

The investment market for metallic silver is relatively small, and the price is more volatile, thus providing some speculative opportunities. Investors can use the market fluctuations to find a time to buy or sell and make short-term speculative gains. However, this also increases investment risk, particularly for inexperienced investors.

Still, there are investors who prefer metallic silver to gold. The famous investor Warren Buffett, for example, has emphasized that the principle of investing is to choose assets that are useful, serve a purpose, and meet a practical need. Since silver has countless uses in industry and medicine, he prefers to invest in it as compared to gold. The fact that he invested close to a billion dollars in silver shows his approval of silver in industry and commerce.

He believes that in medicine, silver is used in bandages, catheters, and as a healing agent for burns and other health conditions. In electronics, silver is the best conductor, does not corrode easily, and is widely used for wiring and connecting components. In addition, demand for silver is increasing in emerging industries such as electric vehicle batteries and the photovoltaic industry.

About ten percent of silver production comes from silver mines, while 80 percent of silver comes from recycling and associated products from copper mining. The price of physical silver may be higher than the futures price because the market may perceive physical silver differently than the futures price, creating a relative disconnect. As more people recognize the difference between the price and the actual value of silver, it is expected to be a positive driver for its price to rise.

Is it necessary to hoard silver?

Whether it is necessary to hoard a precious metal like silver usually depends on one's investment objectives, risk tolerance, and market analysis. It is often viewed as a hedge against inflation. In times of rising inflationary expectations, some investors may choose to hoard silver to preserve their wealth.

This is because precious metals are often seen as an asset against inflation. In times of inflation, prices rise, but the value of precious metals remains relatively stable, so some investors choose to hold precious metals to preserve their value. Some investors prefer to hold precious metals, such as gold and silver, as a relatively stable way to store value. In this case, hoarding silver may be consistent with their long-term investment strategy.

Adding different types of assets to a portfolio can help diversify risk. It can be used as part of a diversified portfolio to provide investors with another asset class. Precious metals typically have a low correlation with traditional assets such as stocks and bonds and therefore may offer some protection in times of market volatility.

Precious metals are often favored in times of economic instability or elevated geopolitical risk and are seen as a safe-haven asset in times of market turmoil and economic uncertainty. If individuals are concerned about instability in the financial system or expect the market to experience shocks, they may consider holding silver, a precious metal. It is a hedge against risk while also hedging against the risk that other assets may face.

If one intends to invest for the long term, they may consider purchasing physical silver (e.g., silver coins or bars). Short-term traders may prefer to use financial derivatives such as futures or exchange-traded funds (ETFs). It is also important to understand that there are some potential risks and drawbacks to hoarding silver, including volatility in the market price and management and storage costs.

Is it necessary to hoard silver?

| Investment Considerations |

Yes |

Negate |

| Industrial Application Demand |

√ |

|

| Medical Application Demand |

√ |

|

| Electronics Demand |

√ |

|

| Emerging Industry Demand |

√ |

|

| Investment Diversification Tools |

√ |

|

| Inflation Hedging |

√ |

|

| Rare Precious Metals |

√ |

|

| Long-term value investments |

√ |

|

| Short-term market volatility |

|

√ |

| Cautious physical holdings |

|

√ |

Disclaimer:This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security, transaction, or investment strategy is suitable for any specific person.