The Ichimoku Cloud, also known as the Ichimoku Kinko Hyo, is one of the most comprehensive technical analysis indicators traders use to predict market trends, reversals, and momentum.

Developed by Goichi Hosoda, a Japanese journalist, in the 1930s, this indicator provides a detailed view of market trends, momentum, and potential reversals. Unlike other indicators focusing solely on price action, the Ichimoku Kinko Hyo combines multiple components to give traders a 360-degree view of the market.

It is widely used in forex and stocks, helping traders identify buy and sell signals, trend strength, and support and resistance levels.

Understanding the Cloud's 5 Components

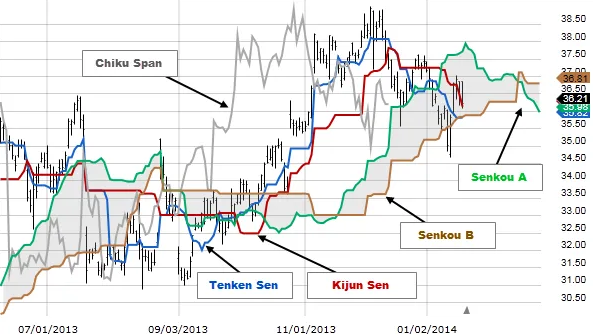

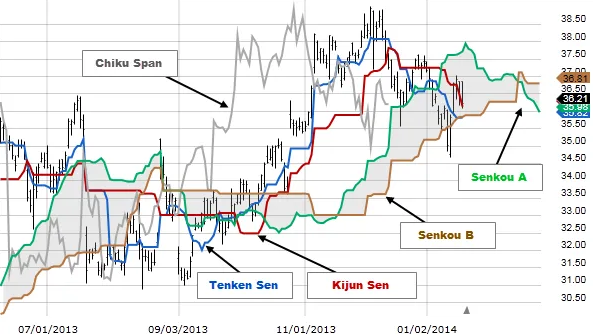

The indicator has five key components that cooperate to provide a detailed market outlook. The first is the Tenkan-Sen (Conversion Line), which is the short-term moving average calculated by taking the average of the highest high and lowest low over the past 9 periods. This line represents short-term momentum and signals early trend changes.

The second component, the Kijun-Sen (Base Line), is a longer-term moving average calculated using the average of the highest high and lowest low over 26 periods. It helps traders determine trend direction and serves as a support and resistance level.

The third and fourth components, Senkou Span A (Leading Span A) and Senkou Span B (Leading Span B), form the cloud, also called the Kumo. Senkou Span A is derived by averaging the Tenkan-Sen and Kijun-Sen and projecting the result 26 periods ahead. On the flip side, Senkou Span B is calculated by averaging the highest high and lowest low over the last 52 periods and projecting it 26 periods ahead.

The space between these two lines forms the cloud, acting as a dynamic support and resistance zone. If the price is above the cloud, it indicates a bullish trend, while a price below the cloud signals a bearish trend. A thicker cloud suggests strong support or resistance, while a thinner cloud indicates weaker levels.

The final component, the Chikou Span (Lagging Span), is the closing price plotted 26 periods behind. It helps traders confirm trends by comparing the current price action with historical price levels. If the Chikou Span is above past price levels, it confirms an uptrend, whereas if it is below, it supports a downtrend.

Using Ichimoku Cloud to Identify Trends

One of the main advantages of the Ichimoku Kinko Hyo is its ability to generate clear trading signals. A bullish signal occurs when the Tenkan-Sen crosses above the Kijun-Sen, indicating short-term momentum is stronger than long-term momentum. This suggests a buying opportunity, especially when the price is trading above the cloud.

Conversely, a bearish signal is generated when the Tenkan-Sen crosses below the Kijun-Sen, signalling a potential downtrend. The strongest buy signals occur when the crossover happens above the cloud, and the strongest sell signals occur when the crossover happens below the cloud.

In addition, traders use the cloud as a key indicator of trend direction. For example, when the price is above the cloud, the market is in a strong uptrend, and traders look for buying opportunities. If the price is below the cloud, the market is in a downtrend, and traders focus on selling opportunities. If the price is inside the cloud, it indicates market uncertainty and a potential trend reversal, making it a period where traders should exercise caution.

Using It as a Support and Resistance Indicator

Moreover, the indicator is an excellent tool for identifying key support and resistance levels. When the price approaches the cloud from above, it acts as a dynamic support zone, providing traders with potential entry points. If the price bounces off the cloud and moves higher, it confirms that buyers are still in control. Similarly, if the price approaches the cloud from below, it acts as a resistance zone, where sellers may step in to push prices lower.

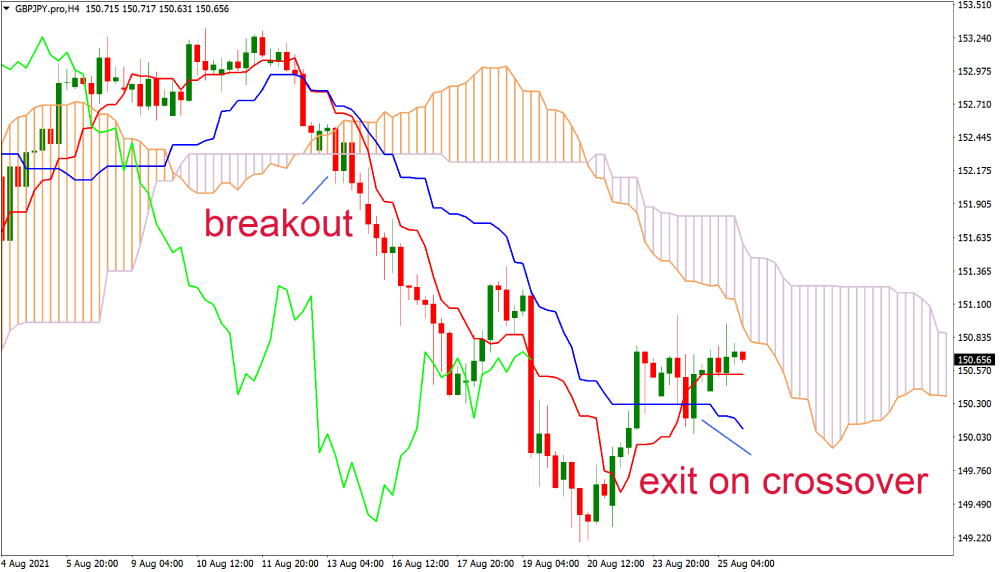

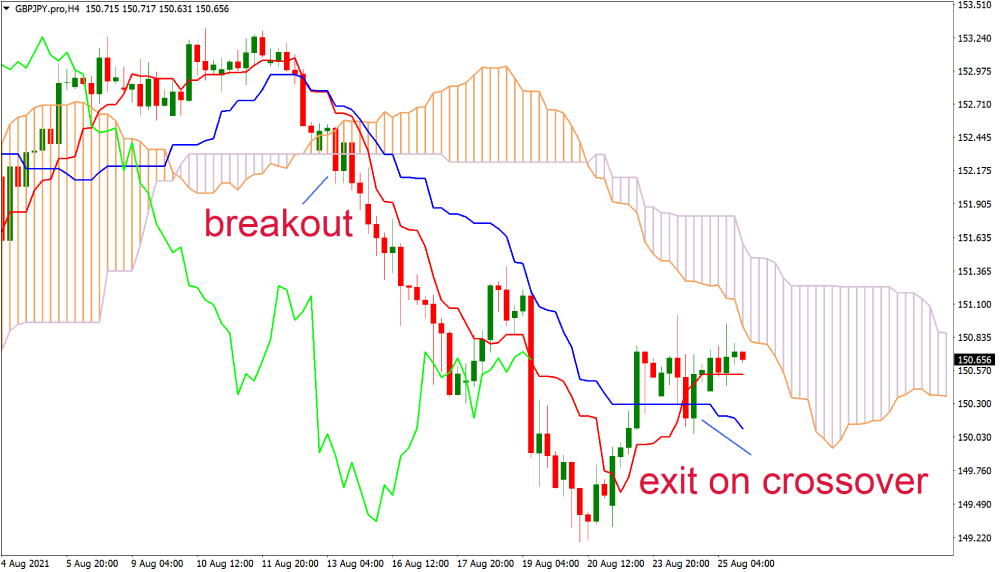

Furthermore, we recommend using the indicator as support and resistance by monitoring breakouts. If the price breaks above a bearish cloud, it suggests a potential trend reversal to the upside.

Alternatively, if the price breaks below a bullish cloud, it indicates a shift toward a bearish trend. To increase accuracy, traders often wait for a confirmed breakout with increased volume before entering a position.

Generating Trade Signals with Ichimoku Cloud

The Ichimoku Cloud also generates multiple trading signals, helping traders identify the best entry and exit points. The first signal is the Tenkan-Sen and Kijun-Sen crossover, which works similarly to a moving average crossover strategy. When the Tenkan-Sen crosses above the Kijun-Sen, it generates a bullish signal, suggesting that the short-term trend is gaining momentum. Conversely, when the Tenkan-Sen crosses below the Kijun-Sen, it indicates a bearish signal, meaning downward momentum is increasing.

Another important trading signal is the Chikou Span confirmation. When the Chikou Span is positioned above historical price movements, it confirms the bullish trend, reinforcing buy signals. If it moves below past prices, it confirms a bearish trend, supporting sell signals. Using the Chikou Span in combination with other Ichimoku elements improves trade accuracy by filtering out false breakouts and weak trends.

Traders also identify price crossing above or below the cloud as a strong confirmation signal. A bullish trade setup occurs when the price moves above the cloud, especially when supported by a bullish Tenkan-Sen and Kijun-Sen crossover. A bearish trade setup happens when the price breaks below the cloud, signalling a strong downtrend continuation.

Real-World Example in Forex and Stock Trading

A real-world example of the indicator in action can be seen in forex trading. Suppose a trader analyses the EUR/USD currency pair on a daily chart. The price is currently above the cloud, and the Tenkan-Sen has crossed above the Kijun-Sen, indicating a bullish trend. The Chikou Span is also above past price levels, confirming the strength of the uptrend.

The trader enters a long position, setting a stop-loss below the cloud as a risk management measure. Over the next few days, the price continues rising, and the trader exits the trade at a major resistance level, securing profits.

Similarly, in stock trading, an investor analysing Apple's (AAPL) stock might notice that the price has fallen below the cloud, signalling a bearish trend. The Chikou Span is also below past price levels, confirming the downtrend. The investor decides to short-sell the stock or wait for a more favourable buying opportunity when the price re-enters the cloud.

Conclusion

In conclusion, the Ichimoku Cloud is one of the most powerful and versatile technical indicators, offering traders accurate market predictions through a combination of trend analysis, support and resistance identification, and momentum confirmation.

By understanding its five key components, traders can gain a clearer picture of market conditions and make well-informed trading decisions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.