Gold has always been seen as a store of value, and for traders, gold futures offer an exciting way to capitalise on price movements without having to own physical gold. Whether you're looking for short-term gains or a way to hedge against economic uncertainty, understanding how gold futures work can open up new opportunities in the financial markets.

Understanding Gold Futures: Basics and Market Dynamics

Gold futures are contracts that allow traders to buy or sell gold at a predetermined price on a future date. These contracts are standardised and traded on exchanges such as the COMEX (a division of the CME Group). Instead of buying physical gold, traders speculate on its price movements using these contracts, making it a more accessible and liquid way to invest in gold.

The market for gold futures operates on leverage, meaning traders only need to put down a fraction of the contract's total value to open a position. This amplifies potential profits but also increases risk. Prices fluctuate based on supply and demand, and because gold is a globally traded asset, its market is active nearly 24 hours a day. This makes it appealing to traders looking for opportunities at different times.

Key Factors Influencing Gold Prices

To trade gold futures successfully, it's important to understand what drives gold prices. Unlike stocks, gold doesn't generate earnings or dividends, so its value is largely influenced by external factors such as:

Economic Conditions – During times of economic uncertainty or financial instability, investors tend to flock to gold as a safe-haven asset, pushing prices higher.

Inflation and Interest Rates – When inflation rises, gold often does well because it maintains purchasing power. On the other hand, higher interest rates can make gold less attractive compared to yield-bearing assets like bonds.

US Dollar Strength – Gold is typically priced in US dollars, so when the dollar strengthens, gold becomes more expensive for foreign investors, potentially lowering demand.

Supply and Demand – Mining production and jewellery demand also play a role, although their impact is generally less immediate compared to macroeconomic factors.

Being aware of these influences can help traders make more informed decisions when entering or exiting gold futures positions.

Choosing the Right Gold Futures Contract

Gold futures come in different contract sizes, with the most common being the standard 100-ounce contract traded on the COMEX. However, for those looking for smaller positions, mini (50-ounce) and micro (10-ounce) contracts are also available. These options allow traders with different levels of capital to participate in the gold market without overexposing themselves.

Another key consideration is the expiry date of the contract. Gold futures have specific expiration months, and traders need to decide whether they want to close their position before expiry or roll it over into a new contract. If left to expire, the contract is settled either financially or through physical delivery, though most traders opt for financial settlement to avoid dealing with actual gold.

Liquidity is another crucial factor. Larger contracts tend to have higher trading volumes, ensuring that orders can be executed more easily with minimal price slippage. If you're new to gold futures, it's generally advisable to stick to the most actively traded contracts to avoid unexpected execution issues.

Trading Strategies for Gold Futures Success

Having a strategy is essential for navigating the ups and downs of the gold market. Some of the most effective approaches include:

Trend Following – This involves identifying and riding price trends using technical indicators like moving averages. If gold is in an uptrend, traders might go long (buy), whereas in a downtrend, they might go short (sell).

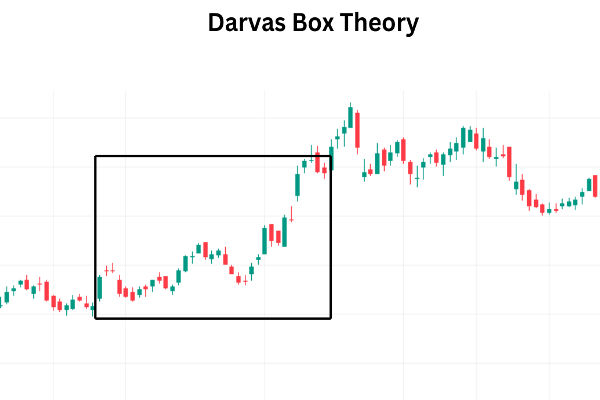

Breakout Trading – Gold prices often move within certain ranges. A breakout strategy involves entering a trade when gold moves beyond key support or resistance levels, expecting further momentum in that direction.

Mean Reversion – This strategy assumes that gold prices will revert to an average level over time. Traders using this method look for overbought or oversold conditions to enter positions.

News-Based Trading – Since gold reacts strongly to economic data, central bank policies, and geopolitical events, some traders make decisions based on breaking news or scheduled economic reports.

No single strategy works all the time, so it's important to adapt based on market conditions and test different approaches before committing large amounts of capital.

Managing Risks and Maximising Profits

Like any form of trading, gold futures carry risks, and it's crucial to have a risk management plan in place. Since leverage can magnify both gains and losses, using stop-loss orders is essential to limit potential downside. This means setting a predetermined level at which you'll exit a losing trade to prevent further losses.

Diversification can also help manage risk. Instead of putting all capital into gold futures, some traders balance their portfolio with other assets to reduce exposure to gold price volatility. Additionally, position sizing—only risking a small percentage of total capital on each trade—can prevent significant drawdowns.

Finally, staying informed about global events and regularly reviewing trading strategies can make a significant difference. The gold market is constantly evolving, and traders who keep learning and refining their approach tend to perform better over time.

Trading gold futures can be both rewarding and challenging, but with the right knowledge and risk management, it offers plenty of opportunities. Whether you're looking to profit from short-term price swings or hedge against economic uncertainty, understanding how the market works and developing a solid strategy will put you in a stronger position to succeed.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.