For many traders, the idea of making money in the stock market is built on the concept of following trends. Trend trading involves buying stocks that are moving upwards or shorting those that are moving downwards, with the goal of profiting from the continued momentum. But what exactly makes a stock trend? How do you spot these trends before they run their course? And how can you use the right tools and indicators to time your entry and exit perfectly? This guide will walk you through all these essential points and more, helping you understand how to identify and trade trending stocks from the ground up.

What Makes a Stock Trend?

Understanding what drives stock trends is crucial for any trend trader. At its core, a stock trend is simply the price movement of a stock in a particular direction—either upwards (an uptrend) or downwards (a downtrend). But these trends don't just happen by chance. They're often the result of several factors coming together.

Earnings Growth: One of the most significant factors that drive a stock's long-term trend is earnings growth. When a company consistently reports positive earnings, traders take notice. Positive earnings indicate that the company is performing well and that its stock has the potential for further growth. As earnings grow, so does trader confidence, and that confidence drives the stock price upwards.

Sector Performance: Stocks rarely trend in isolation. The overall performance of the sector a company belongs to plays a vital role. For example, a tech company's stock might perform well when the tech sector is booming, but struggle when the sector faces downturns. A rising tide lifts all boats, and a sector with strong growth can push individual stocks into trending up, just as a poor sector performance can drag stocks down.

Macroeconomic Trends: On a larger scale, broader economic factors such as interest rates, inflation, and consumer sentiment can also impact stock trends. When the economy is growing, stocks tend to trend upwards. Conversely, in times of economic downturn or recession, most stocks follow a downward trend as companies struggle to maintain profits.

But it's not just fundamentals that create stock trends. In today's digital age, the role of social media and retail trader interest cannot be ignored. Retail traders—those buying and selling stock in smaller quantities—have become incredibly influential, particularly in short-term trend creation. Platforms like Reddit's WallStreet Bets have seen stocks skyrocket simply because enough retail traders jumped in, pushing prices up in the short run. These types of trends are often more volatile, but they offer exciting opportunities for trend traders who know how to spot them early.

Tools and Platforms for Tracking Trending Stocks

Tools and Platforms for Tracking Trending Stocks

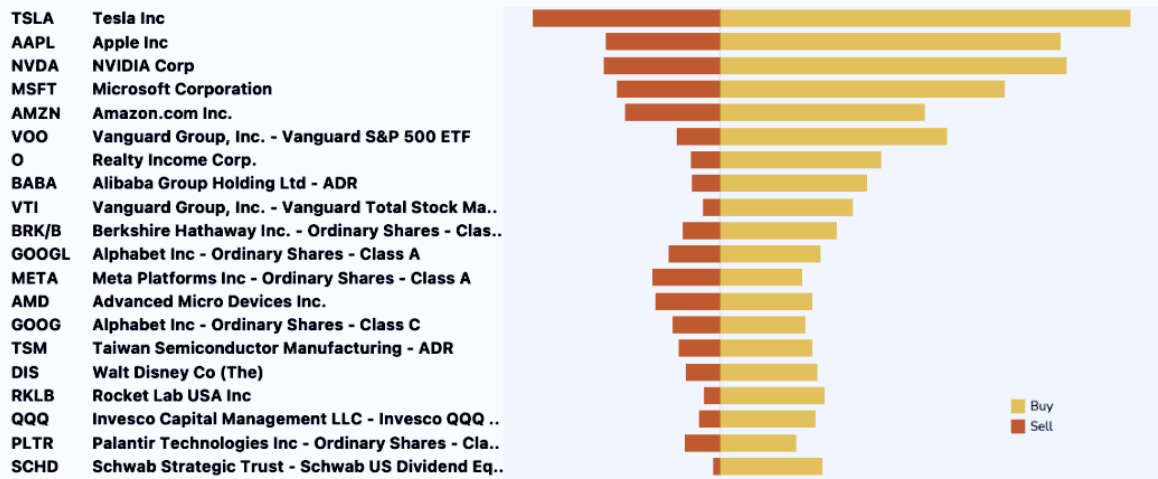

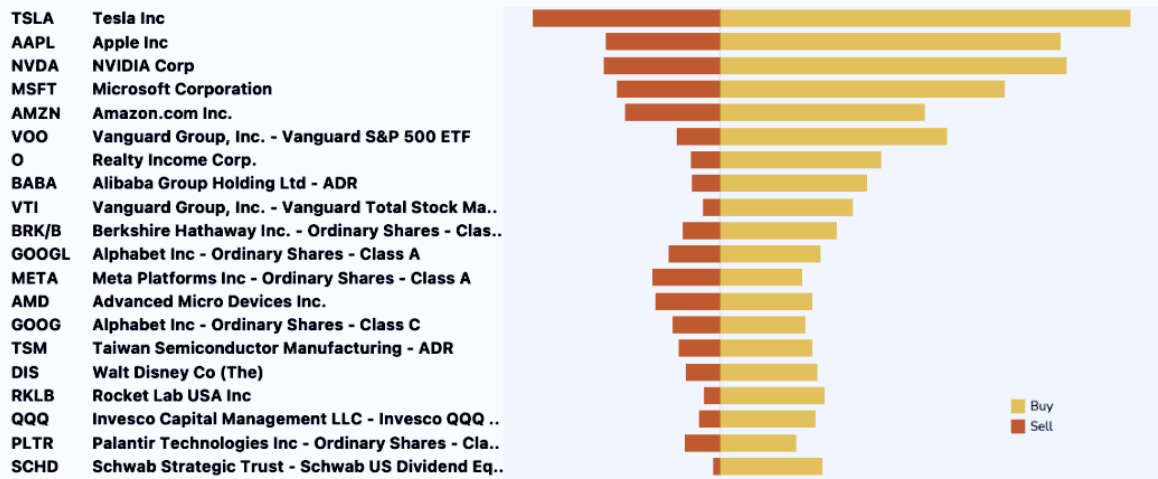

Now that we understand what drives trends, how can we track them? Thankfully, there are a variety of platforms and tools available that help traders identify trending stocks before they make a big move.

Trading View is one of the most popular platforms for charting and technical analysis. It allows traders to visualise trends through advanced charting tools, as well as track various indicators like moving averages and RSI. Trading View also has a social component where traders can share ideas and analysis, making it a valuable resource for spotting trends early.

Yahoo Finance and Finviz are also excellent for screening stocks and identifying those that are showing signs of strong momentum. Both platforms offer free stock screeners that let traders filter stocks based on key metrics, including price movements, volume, and volatility. These tools are fantastic for spotting stocks with high momentum or unusual activity, which could indicate a trending stock.

In addition, heatmaps—available on platforms like Finviz—allow traders to see, at a glance, how different sectors and stocks are performing. Heatmaps visually represent the price movements of various stocks, with colours indicating whether a stock is trending up or down. It's a quick way to identify the strongest performers in the market and target them for trend trading.

Key Indicators for Identifying Trending Stocks

Once you've found a stock with potential, how do you know whether it's in a trend? Enter technical analysis, a vital tool for trend traders. Technical analysis involves using various indicators to study past price movements and predict future trends.

Moving Averages: One of the most common indicators used by trend traders is the moving average. A moving average smooths out price data over a certain period, giving traders a clearer picture of the stock's overall direction. The 50-day moving average (a shorter-term average) is often used to identify intermediate trends, while the 200-day moving average (a longer-term average) is better for spotting long-term trends. When a stock's price crosses above its 50-day moving average, it's often seen as a signal that the stock is trending up.

Relative Strength Index (RSI): The RSI is a momentum indicator that measures the speed and change of price movements. It ranges from 0 to 100. with values above 70 indicating that a stock is overbought (and potentially ready for a pullback) and values below 30 suggesting that it's oversold (and potentially due for a bounce). RSI is often used in conjunction with other indicators to confirm trends and identify potential reversal points.

Other indicators like MACD (Moving Average Convergence Divergence) and Bollinger Bands also play a role in identifying trends. MACD, for example, tracks the relationship between two moving averages and can help traders identify shifts in momentum, while Bollinger Bands help gauge whether a stock's price is trending strongly or is likely to reverse.

Timing Your Entry and Exit in Trend Trading

So, you've identified a stock that's trending, and you have the right indicators in hand. Now comes the tricky part—timing your entry and exit. In trend trading, getting in at the right time and exiting at the right moment can make all the difference.

Identifying the Start of a Trend: Trend traders often use technical indicators to pinpoint the beginning of a trend. For example, when the price crosses above a key moving average, it could signal the start of an uptrend. Conversely, when the price crosses below a major support level or moving average, it might signal the start of a downtrend.

The Importance of Technical Analysis: While fundamental factors can drive trends, it's often technical analysis that helps traders get in at the right time. By using tools like trendlines, moving averages, and momentum indicators, traders can time their entry points with greater accuracy.

Knowing When to Exit: Knowing when to get out is just as important as knowing when to enter. Many traders use trailing stops or set specific profit targets to lock in gains as the stock continues to trend. Additionally, it's crucial to monitor indicators like RSI to determine when the stock may be overbought and due for a pullback. Exiting at the right moment helps to maximise profits and minimise losses.

Case Studies: Successful Trending Stocks

Let's take a look at a few examples of stocks that experienced major trends and how traders capitalised on them.

Tesla (TSLA) in 2020: During 2020. Tesla's stock experienced a massive uptrend, driven by strong earnings, innovation in the electric vehicle market, and increasing trader sentiment. Traders who recognised the trend early, using indicators like the 50-day moving average crossing above the 200-day moving average, were able to ride the wave of growth. By entering the trend at the right time and holding on through the ups and downs, they saw significant returns.

GameStop (GME) in 2021: GameStop's short squeeze, driven by retail traders on Reddit, created a short-term but explosive trend. Trend traders who were quick to spot the stock's surge in volume and momentum could have profited handsomely by buying early and selling at the peak. However, this also highlights the risks of short-term trends driven by social media. Traders who failed to sell in time could have ended up with losses when the trend reversed.

The key takeaway from both examples is that successful trend trading is about recognising when a stock is in a clear trend, using the right indicators to time your entry, and exiting at the right moment. However, short-term trends—like GameStop's—can be unpredictable and more volatile, so it's crucial to manage risk appropriately.

To sum up, trend trading can be a rewarding strategy for those who are able to identify strong, sustained price movements in the market. By using the right tools, understanding key indicators, and timing your entries and exits with precision, you can capitalise on these trends and build a profitable trading strategy. Whether you're new to trend trading or looking to refine your approach, the concepts and techniques outlined in this guide can help you navigate the market with more confidence.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Tools and Platforms for Tracking Trending Stocks

Tools and Platforms for Tracking Trending Stocks