Equity markets are turning sour in the second half of this year after a major

comeback. Rising Treasury yields and bloodshed in the Middle East caught

investors off guard.

Halloween is drawing near. A sweets buying spree will likely be more rampant

in the US considering strong retail sales data while European households may

prefer trick or turn away the naughty.

Whatever this is a festival for investors to celebrate because of “the

Halloween effect”. It is a market timing strategy based on the hypothesis that

stocks perform better from Halloween to 1 May than they do from the beginning of

May through the end of October.

Also termed as “sell in May and go away”, the strategy proves to be more

reliable than it sounds, at least throughout the last half-century.

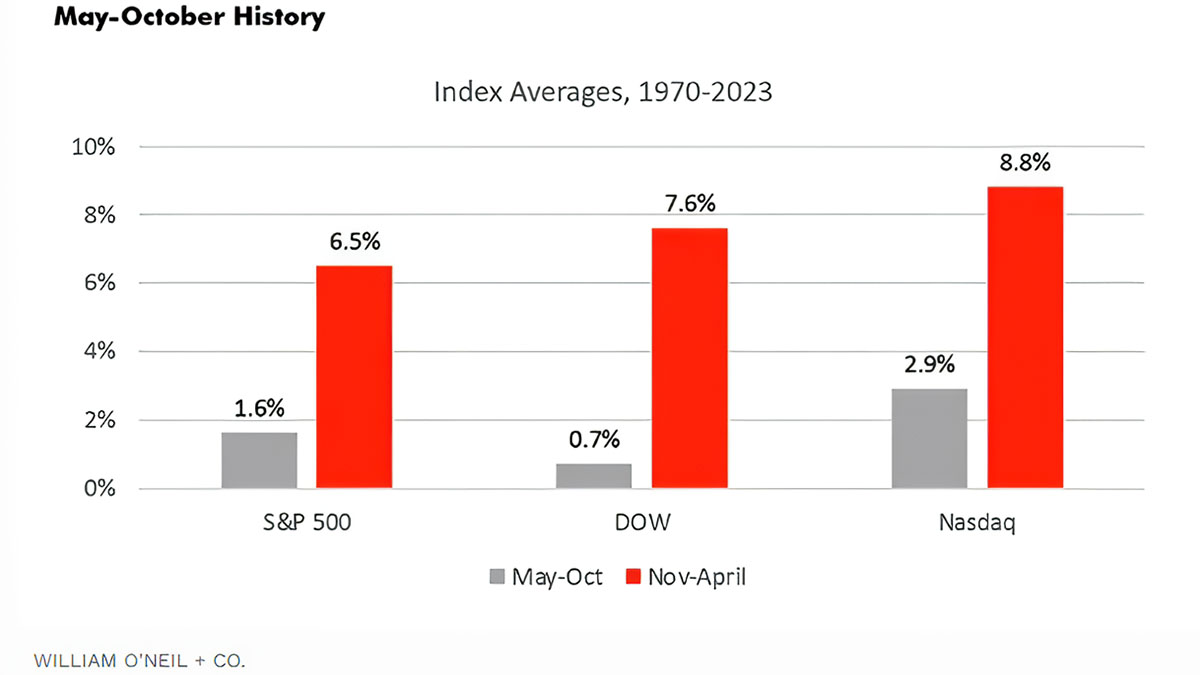

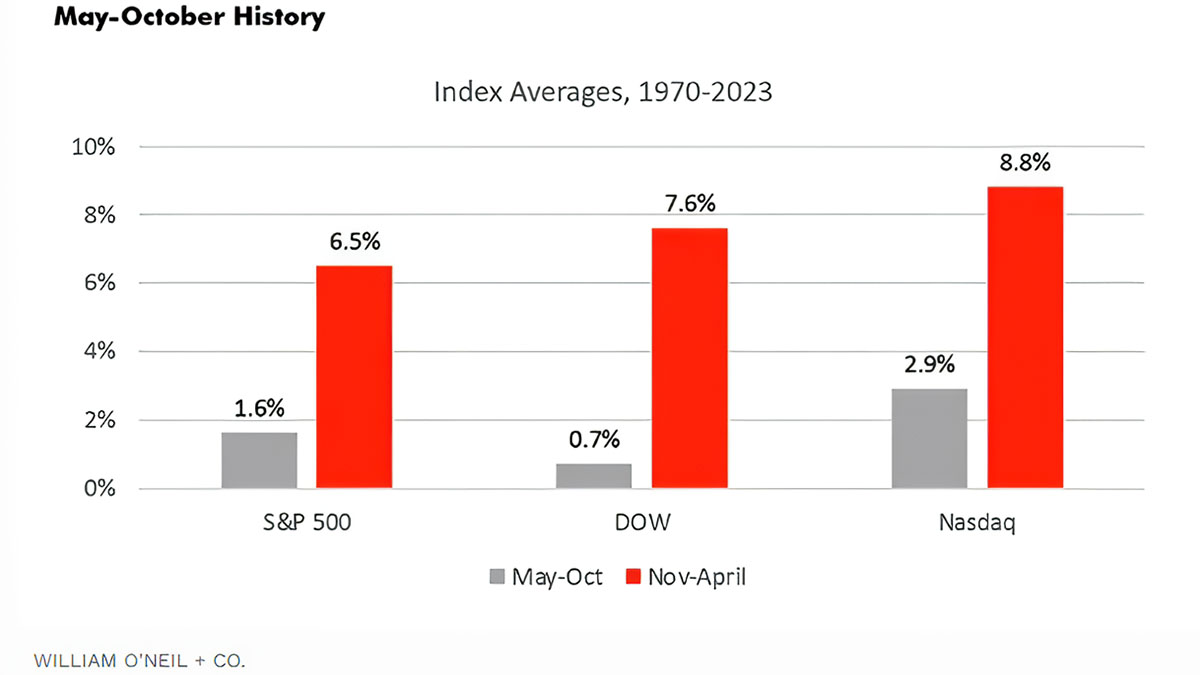

As shown in the chart below, the S&P 500 has averaged a 6.5% gain during

November-April versus only a 1.6% gain the rest of the year, a difference of

4.9%. The NASDAQ at 5.9% and the DJIA at 6.9% have even bigger performance

differentials.

According to the CFA Institute, recent research seems to confirm this stock

market anomaly dating back to at least the 1930s has not been arbitraged away,

and in fact, is stronger than ever.

A recent study titled “The Halloween Indicator: Everywhere and All the Time”

has lent more credence to the theory by suggesting that the November through

April “winter” period delivered returns that were, on average, 4.52% higher than

the “summer” returns.

That research covered 108 stock markets using all historical data available

based on a sample of over 55,000 monthly observations. It showed the effect was

evident in 81 out of the 108 markets.

Another key conclusion is that, over the past 50 years, the difference in

returns widened to an average of 6.25%. In other words, it is almost the time to

place a wager if you have a faith in the bonanza of wealth from “ghosts”.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.