The trend of US stocks and gold prices is not directly related, so why do

some people say that US stocks will affect gold prices? That's because they have

an indirect influence.

When it comes to the relationship between US stocks and spot gold, the

participation of the US dollar is essential.

The US stock market directly reflects the current economic situation in the

United States, thus reflecting the trend of the US dollar. The strength of the

US dollar, to some extent, affects the global economy, supply, geopolitics,

inflation, and other factors, which in turn affect gold to varying degrees.

To some extent, the US dollar and gold present the opposite situation. If the

US dollar rises, the price of gold will decrease. On the contrary, if the US

dollar falls, the price of gold will show an upward trend.

The indirect relationship between US stocks and gold only occurs at a

specific point in time. Because gold itself is a highly hedging product, when

the stock market falls, it indicates that the current economy is in a downward

phase and the price of gold will rise. But if there are more risk-averse capital

products, such as the appreciating US dollar, then gold will not maintain its

value as a currency in a state of appreciation, and gold prices will

plummet.

The rise of US stocks indicates an improvement in the US economy, but the

decline of US stocks indicates a recession in the US economy.

The US dollar is a highly safe haven among global currencies. When a country

experiences an economic recession, its stocks usually fall. To avoid this,

people choose to buy dollars as a safe haven. So the decline of stocks is

supported by the US dollar.

So when the US stock market rises, it indicates an improvement in the US

economy. The economic improvement of this powerful country, the United States,

can drive the improvement of the global economy. In order to earn profits,

investors would exchange the US dollar for other currencies with high interest

values for carry trading investments. At this time, the US dollar was heavily

sold, causing the decline of the US dollar to become an unavoidable asset.

The improvement of the US economy, the decline of the US dollar, and the rise

of US stocks will drive the rise of commodities such as spot gold. However, in

the context of a global debt crisis, liquidity is usually poor, which can prompt

countries and consortia with large amounts of gold to sell gold and exchange it

for cash currencies such as the US dollar to rescue the sluggish economic market

and restructure financial markets.

At this time, the spot gold price fell, and the stock market rebounded after

being oversold.

The Relationship between US Stocks and Gold Spot

Hedge demand: When investors feel that the economic or political environment

is unstable, they may seek Safe Haven Assets such as gold. This demand for

hedging may lead to an increase in gold prices, while the stock market may

decline as investors shift funds from the stock market to the gold market.

Inflation expectations: Gold is often seen as an asset to resist inflation,

as its value is not affected by inflation like currency. If investors anticipate

an increase in Inflation rates, they may purchase gold, which may lead to an

increase in gold prices and a decline in the stock market, as rising inflation

rates typically have a negative impact on corporate profits.

USD exchange rate: Gold is usually priced in USD, so changes in the USD

exchange rate may affect the price of gold. If the US dollar depreciates, the

price of gold may rise because investors need to pay more US dollars to purchase

gold. On the contrary, if the US dollar appreciates, gold prices may fall. In

this situation, the stock market may rise as the appreciation of the US dollar

is often seen as a positive signal for the US economy.

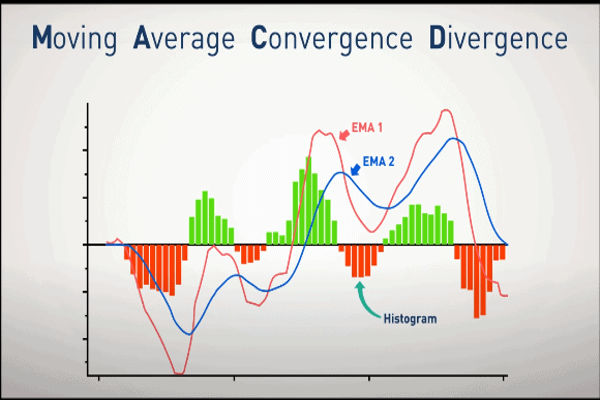

gold and stock market relationship

| Factor |

US Stock Market Trends |

Gold Price Trends |

| Economic Condition |

Directly reflects the US economic situation |

Indirectly affected by the US dollar trend and influenced by factors like the economy, supply, geopolitics, inflation, etc. |

| Strength of the US Dollar |

Dollar goes up → US stocks go down; Dollar goes down → Gold goes up |

Dollar goes up → Gold goes down; Dollar goes down → Gold goes up |

| Safe Haven Demand |

US stocks decline → Economic downturn → Gold goes up |

Economic or political instability → Gold goes up; Capital flows from the stock market to the gold market |

| Inflation Expectation |

Inflation rises → Gold goes up; Usually, stock market goes down |

Inflation rises → Gold goes up; Usually, stock market goes down |

| Global Economy and Currency |

US economic improvement → US stocks rise → Gold rises |

US economic recession → Stock market goes down → Investors buy the US dollar → Gold prices drop |

From the above, it can be

seen that there is a certain relationship between the US stock market and the

gold market, but this relationship is not absolute. In some cases, the stock

market and gold market may rise or fall simultaneously, as they are influenced

by different factors. Investors should decide whether to allocate funds to the

stock market and gold market based on their investment goals and risk

tolerance.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.