Gas bulls are through a bitterly chilly winter, and perhaps the worse is yet

to come. On Monday US natural gases took a nosedive by 13% to their lowest in a

week and European wholesale gas prices fell by 3.5% as the mild weather is

expected to continue suppressing energy demand.

Natural gases have been tanking since the start of this year, down as much as

34%, a heavy blow to those speculating on a more sustainable upward spiral as

the severe sanctions imposed on Russia resulted in evident supply

disruption.

"With a little under a month left of winter, the upside demand risk from a

prolonged spell of cold weather is diminishing," Timera Energy said in a

research note.

Gas producers are caught in such a U-turn that some of them are sounding a

production alarm. That prices have been plunging should be interpreted as a 'very clear signal' of necessary production cuts for the US, said Chesapeake

Energy CEO Nick Dell'Osso.

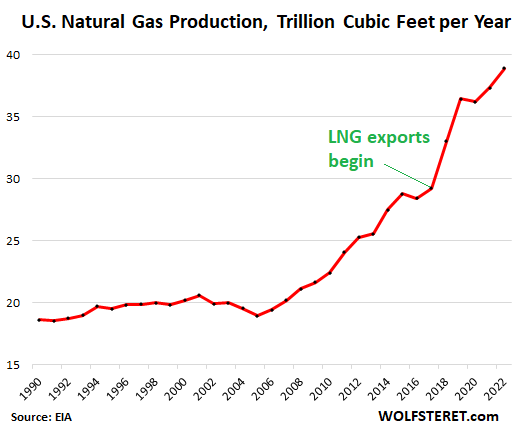

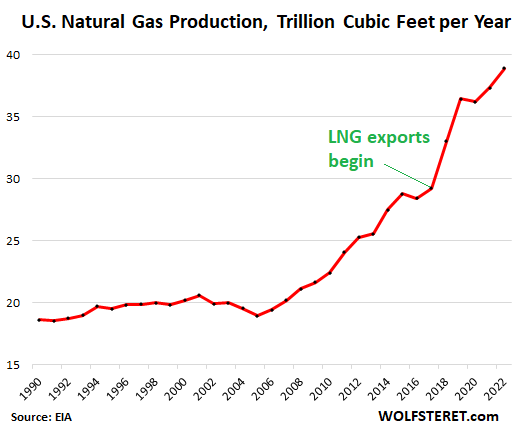

US natural gas production hit a record 39 trillion cubic feet in 2022,

according to EIA, having doubled since 2006. It came as gas prices in June rose

to a record high of over $5/gallon before a great pullback.

China, the largest gas importer, saw gas demand decline in 2022 for the first

time in around two decades mainly due to high prices and weak local consumption.

It is generally predicted that the demand is only going to slightly pick up in

2023 and the room of growth could be quite limited for the two years to come,

according to the Caijing’s interview with several experts. BSC Energy, a leading

energy consultant, even suggested China's natural gas market could be at stake

given renewable energy boom – a more self-dependent source of energy for the

nation.