Trading

Accounts & Conditions

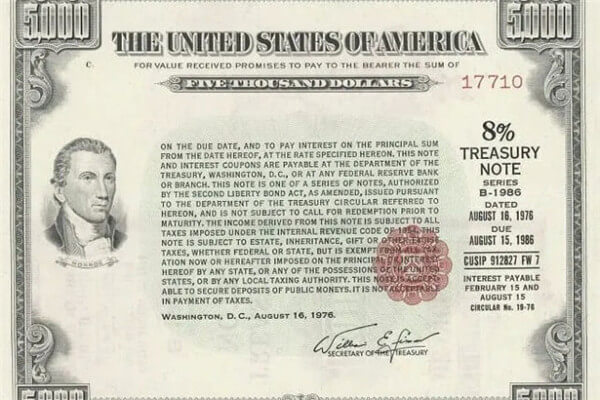

Trading Accounts

Trading Products

Leverage & Margin

Deposits & Withdrawals

Dividends

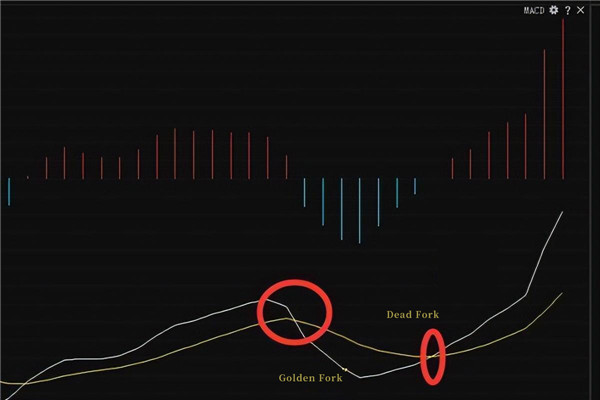

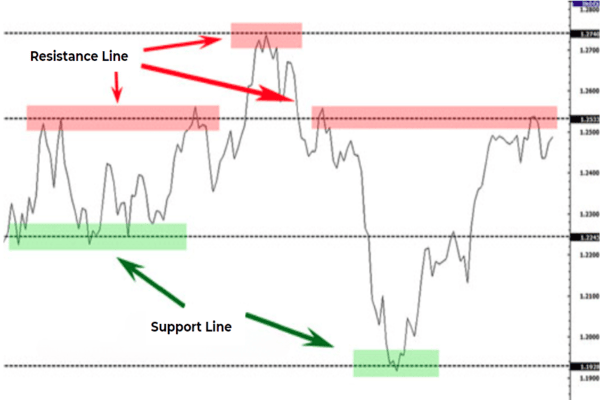

EBC Institute

Learning Centre

Online Webinars

About EBC