In stock market trading, there are thousands of indicators and trading

strategies to choose from. But it should be remembered that any strategy is a

probability problem, and there is no 100% winning strategy. When traders use

these indicators and strategies in practical operations, they must understand

their winning rate and applicability in order to better manage funds and

positions and increase the probability of successful trading.

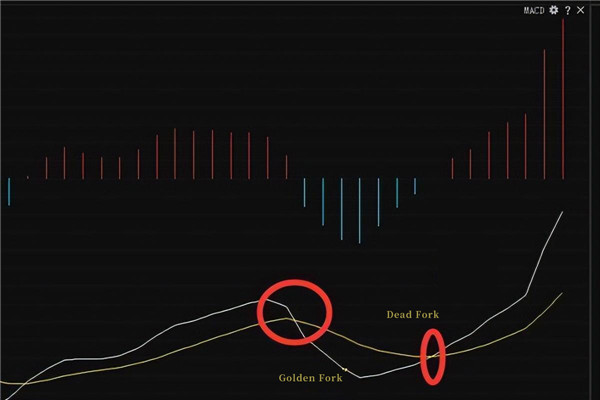

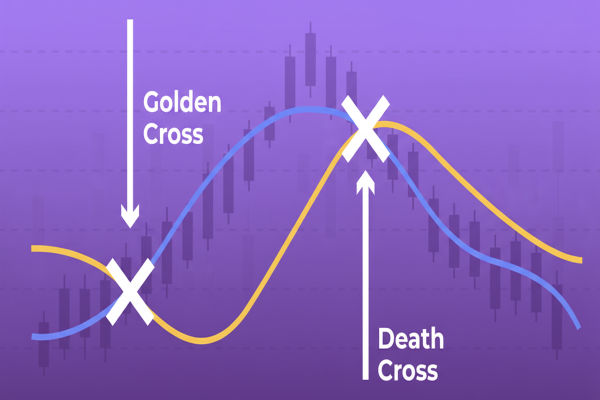

Firstly, let's discuss the MACD strategy. This strategy is actually very

simple. When a golden cross signal appears in the MACD, it indicates buying too

much, while a dead cross signal indicates buying short. To increase the winning

rate, combine the 200-day Moving Average of the index to determine the trend.

Because trends are traders' friends, trading along with them can improve the

winning rate.

When the K-line is above the EMA moving average, traders are in a long trend

and buy long when encountering a golden cross. On the contrary, when under the

EMA, they buy short when encountering a dead cross. But only when MACD shows a

golden cross below the zero axis and a dead cross above the zero axis is it

considered a true golden dead cross signal.

For example, randomly selecting a currency pair from the foreign exchange

market and operating on different time periods Before viewing the test results,

besides strategy, fund and position management are equally crucial. Set a

relatively conservative profit-loss ratio of 1 to 1.5. This means that if you

stop losing, you only lose $100, but if you make a profit, you can earn $150. At

the same time, by adopting relatively conservative risk control, each

transaction can only lose up to 1% of the funds. So if the stop-loss amount is

one hundred dollars, at least ten thousand dollars of funds are needed to carry

out the operation.

After a hundred backtests, it can be seen that the winning rate of this MACD

strategy in the foreign exchange market is 51%. If $100,000 is used for 100

trades, traders can expect to achieve a return of approximately 27.5%.

Of course, MACD has many other uses and strategies that traders can explore

on their own.

Different profit-loss ratios, fund management strategies, and risk control

strategies may produce different results, so traders should not blindly open

their positions for trading. Before using any strategy, it is best to conduct

self-testing, as each person's trading style is different and may lead to

completely different results.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.