Understanding and applying technical indicators is a very important aspect of

stock market investment. Among them, the bottom deviation of the RSI (relative

strength index) is a common but easily misunderstood phenomenon. This article

will explore in detail how to correctly understand the RSI bottom deviation and

how to apply this knowledge to make wise investment decisions.

Understanding the RSI Bottom Deviation

Firstly, clarify the basic concept of RSI. RSI is an indicator used to

measure the strength of Stock Prices. The larger the value, the stronger the

buyer's power, while the smaller the value, the stronger the seller's power.

Usually, when the RSI value is below 40, if there is a bottom deviation between

the RSI and the stock price, it is often a buying signal.

However, the question arises. When a stock is found to have a bottom

deviation in RSI, should it be the starting point for the institution to raise

the stock price, or is the institution ready to start shipping? This is a

crucial issue.

Determine the nature of the RSI bottom deviation

To correctly determine the nature of the RSI bottom deviation, it is

necessary to pay attention to two key factors: the high point of the bottom

deviation and the intention of the institution.

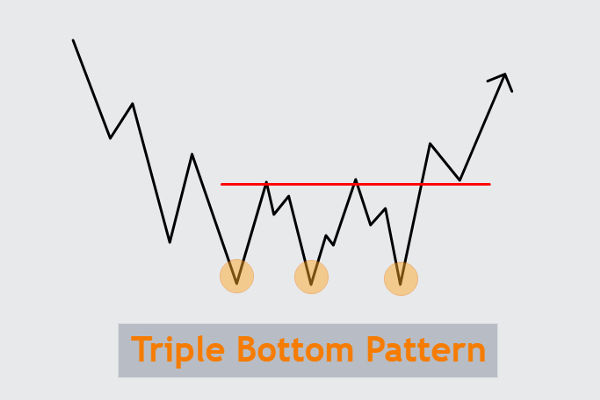

Bottom deviation usually manifests as a high point between two bottoms. This

high point is an important pressure level for stock prices. If the stock price

can break through this high point, then it may be a real increase. But if the

high point is not breached, it is likely to be just a rebound, not a real

rise.

The intention of the institution is also crucial. If institutions want to

drive up stock prices, they may appear at a time of bottom divergence, which

usually leads to subsequent increases. But once institutions want to ship, they

may also choose to ship after the bottom deviation, which will lead to

subsequent declines.

How to Use the RSI Bottom Deviation

Now, let's take a look at how to use the RSI bottom deviation to guide

investment decisions.

Nature of judgment: Firstly, when the RSI bottom deviates, analyze whether

the high point has been broken through. If the stock price can break through the

high point, then you can consider buying. But if the high point is not breached,

it is necessary to remain vigilant, as it may be a rebound rather than a real

rise.

Chasing up: If it is confirmed that the deviation from the RSI bottom is a

situation where the institution wants to drive up the stock price, it can

consider chasing up. Waiting for the stock price to break through the bottom and

deviate from the high point and adding positions at the appropriate time usually

results in a significant increase.

Escape from the top: If it is confirmed that the deviation from the RSI

bottom is a situation where the organization is preparing to ship, consideration

should be given to escaping from the top. Once the stock price cannot break

through the high point that deviates from the bottom, it is necessary to quickly

clear the position to avoid losses caused by subsequent declines.

Example analysis

To better understand how to use the RSI bottom deviation, let's take a look

at two examples.

Example 1: tesla rose after a divergence from the RSI bottom but did not

break through the high point and subsequently fell. It was wise to escape the

top.

Example 2: A stock rises after deviating from the RSI bottom and successfully

breaks through the high point, making it suitable for upward tracking

operations.

By correctly understanding and applying the RSI bottom deviation, one can

better guide their stock market investment decisions. But please remember that

any investment comes with risks, and no matter what indicators are used, always

be cautious and manage risks well.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.