For those new to investing, "equities" and "stocks" often appear interchangeable, leading to confusion. For example, you may have stumbled upon the phrase: "While all stocks are equities, not all equities are stocks."

While closely related, understanding equities vs stocks is essential for making informed investment decisions.

Understanding the Definition of Equities and Stock

Stock

Stocks are a type of equity representing shares in a publicly traded company. When a company issues stocks, it divides its ownership into units called shares, which investors can buy and sell on stock exchanges.

Owning stock in a company means you own a piece of that company with the potential to benefit from its growth and profitability. Stocks are the most common form of equity investment and are a primary way for individuals to participate in the financial markets.

Moreover, stocks are primarily categorised into common and preferred stocks. Common stockholders typically have voting rights in corporate decisions and may receive dividends, which are not guaranteed and can fluctuate based on the company's performance.

Preferred stockholders usually don't have voting rights but have a higher claim on assets and earnings, often receiving fixed dividends. Preferred stocks are generally less volatile than common stocks and are favoured by investors seeking steady income.

Equities

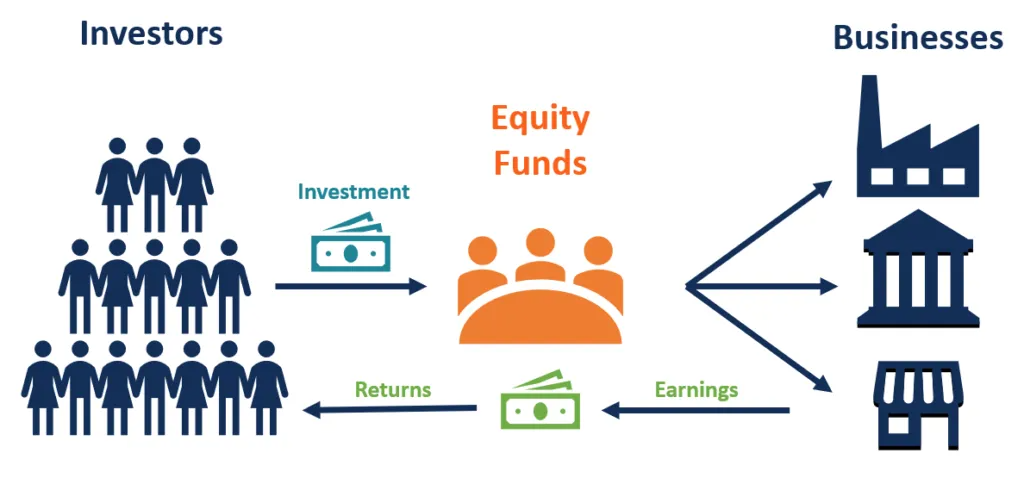

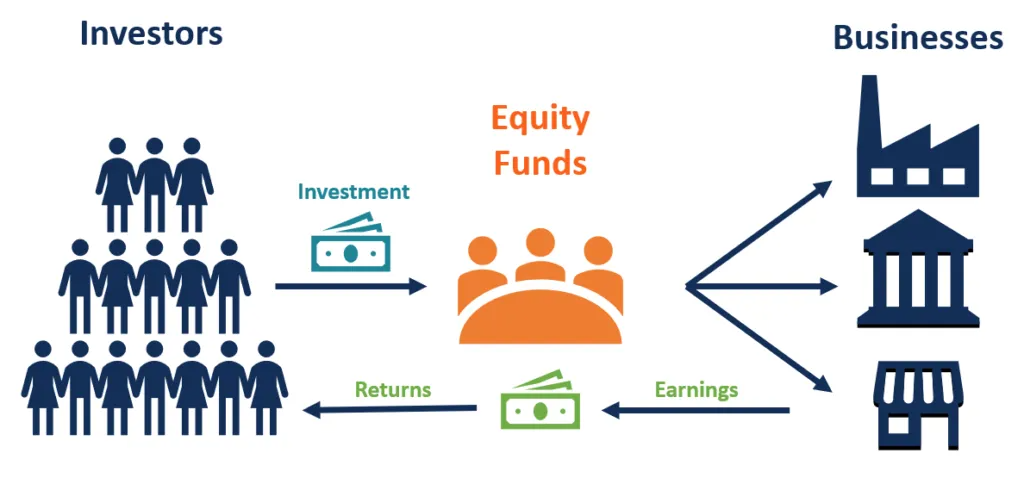

On the flip side, equity represents ownership in an asset or company. In the context of investing, equities refer to ownership interests in companies, encompassing various forms such as common stock, preferred stock, and other equity instruments.

When you own equity in a company, you hold a portion of its assets and earnings. This ownership stake entitles you to potential dividends and, in some cases, voting rights in corporate decisions.

While stocks are the most common form of equity, "equities" encompasses a broader range of ownership interests. It includes private equity, which involves ownership in private companies not listed on public exchanges, and venture capital, which refers to investments in early-stage startups. These forms of equity are typically less liquid and involve higher risk but can offer substantial returns.

The equity market, commonly known as the stock market, is where equities are bought and sold. Major stock exchanges like the New York Stock Exchange (NYSE) and Nasdaq facilitate stock trading, providing a platform for companies to raise capital and for investors to buy and sell ownership stakes. The equity market plays a crucial role in the economy by enabling capital formation and offering investment opportunities.

Equities vs Stocks: Key Distinction

While often used interchangeably, "equities" and "stocks" carry subtle differences that are crucial for investors to understand. Equities refer broadly to ownership in a company, whereas stocks specifically denote the publicly traded shares representing that ownership.

To clarify the distinction, the table below highlights equities vs stocks key differences:

Feature

|

Equities |

Stock |

Definition

|

Represents ownership interest in a company |

A type of equity that represents ownership via publicy traded shares |

| Scope |

Broad term, includes stock, private equity and prefered shares |

Narrower term, specifically refers to shares of publicy traded companies |

| Types Included |

Common stock, preferred stock, private equity, venture capital |

Common stock and preferred stock |

| Market Access |

Public and Private Market |

Public stock exchanges |

| Ownership Representation |

Can include partial ownership not always tied to voting rights |

Usually tied to ownership with voting rights in common stocks |

| Liquidity |

May be illquid (especially private equity)

|

Highly liquid when traded on major exchanges |

| Investment Access |

Often requires significant capital or qualification for private equity

|

Easily accessible to retail investors through brokerage accounts |

Types of Equity Investments

Equity investments come in various forms, each with its own characteristics and implications for investors. Common stock is the most prevalent type, granting shareholders voting rights and the potential for dividends. Preferred stock, while less common, offers fixed dividends and priority over common stockholders in the event of liquidation but typically lacks voting rights.

Private equity involves investing in companies that are not publicly traded, often requiring significant capital and offering less liquidity. Understanding these different types of equity investments allows investors to tailor their portfolios to their risk tolerance and investment goals.

Benefits and Risks of Investing in Equities

Investing in equities offers several advantages. Equities have the potential for capital appreciation, meaning the value of your investment can increase over time as the company grows and becomes more profitable.

Additionally, many companies distribute a portion of their profits to shareholders in dividends, providing a source of income. Equities also offer liquidity, as stocks can be bought and sold relatively easily on stock exchanges. Furthermore, owning equities allows investors to participate in the success of companies and the broader economy.

However, while equities offer potential rewards, they also come with risks. The value of stocks can fluctuate due to various factors, including company performance, economic conditions, and market sentiment. Investors may experience losses if the value of their investments declines.

Additionally, dividends are not guaranteed and can be reduced or eliminated if a company faces financial difficulties. It's crucial for investors to assess their risk tolerance and diversify their portfolios to mitigate potential losses.

How to Start Investing in Equities

For new investors, getting started with equity investing involves several steps. First, educate yourself about the basics of investing and understand your financial goals and risk tolerance. Next, you'll need to open a brokerage account, which serves as a platform to buy and sell stocks. Once you set up your account, you can research and select stocks that align with your investment objectives.

It's advisable to start with a diversified portfolio, possibly including exchange-traded funds (ETFs) or mutual funds, which offer exposure to a broad range of equities. Regularly reviewing and adjusting your portfolio helps ensure it remains aligned with your goals.

Conclusion

In conclusion, understanding equities vs stock can help new investors grasp where their money is going and what kind of exposure or rights they're getting. While all stocks are equities, not all equities are publicly traded stocks.

The terminology matters more as you diversify into complex instruments or private investment opportunities.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.