In the world of technical analysis, traders are spoilt for choice when it comes to indicators. Among the most widely used are the envelope indicator and Bollinger Bands. Both are volatility-based tools that use moving averages to help traders identify overbought and oversold market conditions. But which one is better for your trading strategy?

This article compares the envelope indicator and Bollinger Bands in depth, helping you decide which one to use based on your trading style, goals, and market conditions.

What Is the Envelope Indicator?

The envelope indicator consists of two lines plotted above and below a moving average, typically a simple moving average (SMA). These lines are set at a fixed percentage distance from the central average and create an upper and lower boundary, or envelope, around the price.

The main purpose of the envelope indicator is to highlight extreme price movements. When prices move too far from the mean, the indicator may suggest a reversal or mean reversion could occur. It is particularly useful in range-bound markets or for traders who follow mean-reverting strategies.

What Are Bollinger Bands?

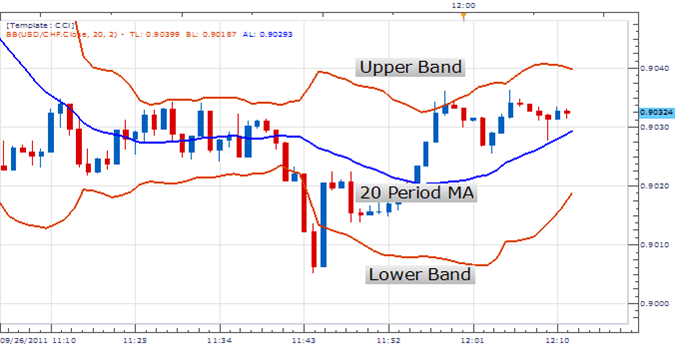

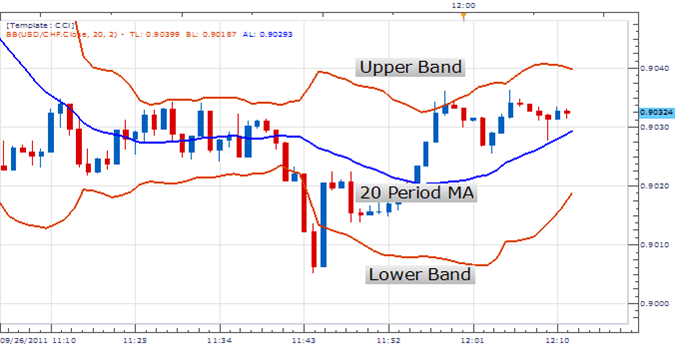

Bollinger Bands, developed by John Bollinger in the 1980s, also consist of a central moving average with two outer bands. However, unlike the envelope indicator, Bollinger Bands use standard deviation to calculate the distance of the upper and lower bands from the average.

This means that the bands expand and contract based on market volatility. During high volatility, the bands widen. When volatility drops, the bands contract. Bollinger Bands are widely used by traders to spot price breakouts, identify trends, and confirm overbought or oversold conditions.

Envelope Indicator: Pros and Cons

Pros:

Simplicity: The fixed percentage setting makes the envelope indicator easy to understand and customise.

Adaptability: Works well across different timeframes and markets.

Helps spot reversals: Good for mean reversion strategies in non-trending markets.

Cons:

Static nature: The bands do not adjust dynamically to volatility.

Less responsive: May lag in fast-moving or highly volatile conditions.

Requires tuning: Incorrect percentage settings can reduce effectiveness.

Bollinger Bands: Pros and Cons

Pros:

Dynamic bands: Adjust in real-time based on volatility, offering more responsive signals.

Trend detection: Help traders identify breakouts and momentum shifts.

Widespread use: Supported by most trading platforms and widely studied.

Cons:

Complexity: Requires understanding of standard deviation and volatility.

More false signals: Sensitive to price changes, which can lead to whipsaws.

Crowded trade setups: As it is widely used, some signals may be priced in.

Envelope Indicator vs Bollinger Bands: Key Differences

Both indicators are centred around a moving average, but the key difference lies in how the bands are calculated.

The envelope indicator uses a fixed percentage, while Bollinger Bands use a standard deviation based on recent price data.

Bollinger Bands are more sensitive to volatility, expanding and contracting with market conditions.

The envelope indicator is often preferred in stable, sideways markets, while Bollinger Bands tend to perform better in trending or volatile environments.

When to Use the Envelope Indicator

The envelope indicator is ideal for traders who follow mean-reverting strategies. If you're trading in a market that is moving sideways or within a defined range, this indicator can help identify potential turning points.

It's also useful for short-term traders who want a clean, no-fuss approach to price boundaries. Because the bands remain constant unless manually adjusted, traders can plan more predictable entry and exit levels.

To maximise its effectiveness, pair the envelope indicator with other tools like RSI or MACD to confirm signals and reduce false positives.

When to Use Bollinger Bands

Bollinger Bands shine in markets with frequent price surges or pullbacks. If your strategy involves riding trends or capitalising on volatility, Bollinger Bands offer a more dynamic view of price movement.

They are particularly helpful in spotting breakouts. When price moves sharply beyond the upper or lower band following a squeeze (when the bands are very narrow), it can be a sign of an impending trend.

Combining Bollinger Bands with volume indicators or candlestick patterns can enhance your analysis and improve entry accuracy.

Can You Use Both Together?

Absolutely. Many traders use both the envelope indicator and Bollinger Bands together to gain a broader perspective. For instance, the envelope can provide a baseline structure, while Bollinger Bands add dynamic insights based on current volatility.

However, be cautious of information overload. When using multiple indicators, make sure they complement rather than contradict each other.

Which Is Better?

There's no one-size-fits-all answer. The better indicator depends on your trading goals, style, and the market conditions.

Choose the envelope indicator if you prefer clean, fixed boundaries and trade range-based strategies.

Opt for Bollinger Bands if you rely on volatility-based signals or trend breakouts.

Test both indicators using historical data and demo trading platforms to see which works best for your chosen asset and strategy.

Final Thoughts

Both the envelope indicator and Bollinger Bands have stood the test of time and remain favourites among technical traders. Each has its own strengths and limitations, and understanding how they work will help you make smarter, more informed trading decisions.

Instead of asking which is universally better, consider which is better for you and the market you're trading. With practice, you may find that using them together gives you the edge you've been looking for.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.