Continuing from the previous article,EBC Finance revealed to everyone the story of the founding team behind the mysterious tycoon"Renaissance Technology Company"in the world's top hedge fund circle,and the incredible performance of its most famous"Medallion Fund"And Sharpe ratio,it is said that this low-key fund company mainly did futures and foreign exchange transactions before.

Maintain an annual revenue of 66% for 30 years, with trading profits exceeding $100 billion.

The investment trading partners around me can't bear it anymore and want to gain a deeper understanding of how this fund has achieved such amazing returns.

Today, EBC Financial Group will once again uncover the secret of making money from Simmons' Grand Medal Fund.

We have obtained the Chinese version of "People Who Understand the Market: The Story of Jim Simmons, the Father of Thought Trading, and Entrepreneurship Companies" introduced by Taiwan's Tianxia Culture Publishing House. PDF

Contact your exclusive EBC financial investment advisor for free if needed

Author Gregory Zuckerman is a highly acclaimed journalist for The Wall Street Journal, who has published The Greatest Trade Every and TheFrackers and other classic works.

In this book, he turns his attention to mathematician, billionaire hedge fund manager, and philanthropist Jim Simmons. Simmons is the founder of Renaissance Technology and the best performing fund in modern financial historyFounder of the Grand Medal Fund.

However, Simmons and Renaissance employees claimed to be confidential in the past 30During the year, almost no information about the organization was leaked, and Zuckerman's book made many contributions to accurately recording the history of the Renaissance.

He recorded Simmons graduating from Massachusetts Institute of Technology, holding a doctoral degree from Berkeley, teaching at Massachusetts Institute of Technology, Harvard University, and ultimately being promoted by Stony BrookThe experience of being awarded the position of Dean of the School of Mathematics by University. Managing Stony BrookWhen he was in the Mathematics Department of University, he received the highest honor in geometry, consolidating his reputation in the field of mathematics.

Simmons resigned from his job at Harvard University in 1964 and joined the Institute for Defense Analysis (IDA) at Princeton University in New Jersey, the largest and most classified intelligence unit in the United States under the National Security Agency, to work on deciphering Soviet codes during a cold war between the United States and the Soviet Union.

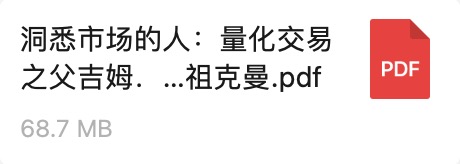

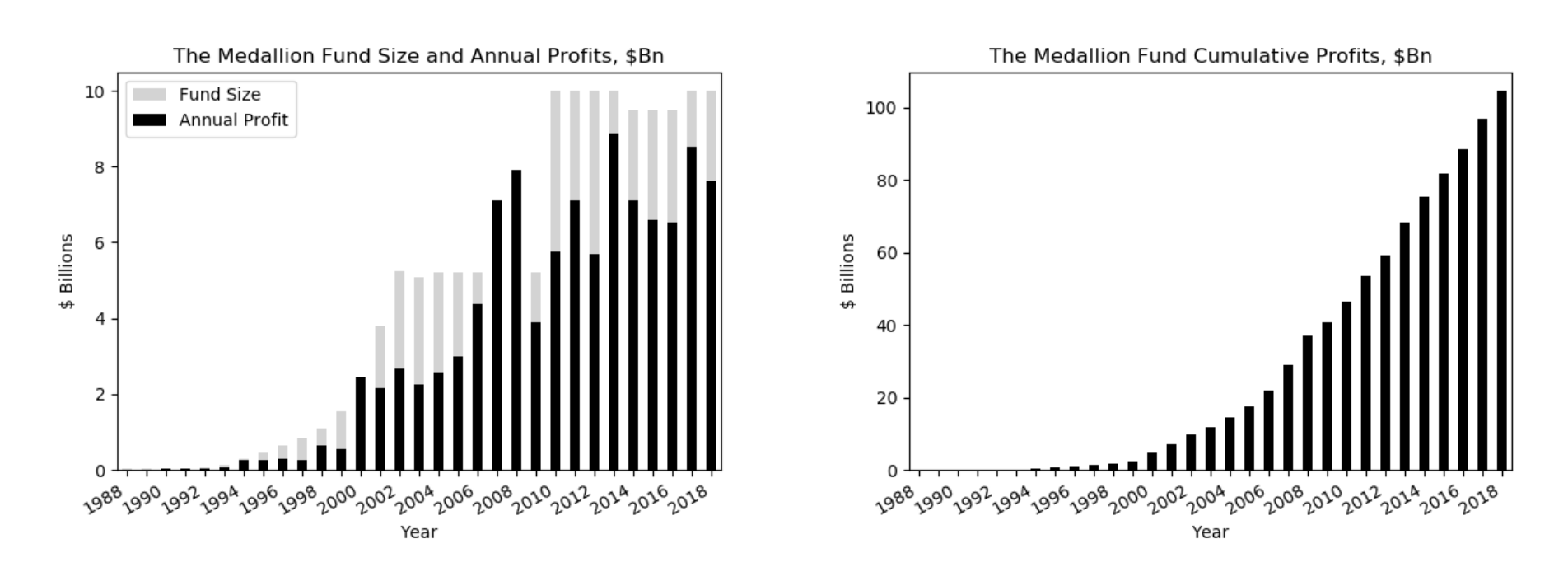

Performance of the Grand Medal Fund

Figure 1: (a) Comparison between annual profit and fund size. In most years, profits accounted for a significant portion of the fund, while in 2000, 2007, and 2008, returns exceeded100%. (b) Accumulated profits of the fund. The average fund size is $5.4 billion, with a cap of $10 billion in subsequent years.

The performance of the Renaissance Company Medal Fund is one of the wonders of modern finance. It is technically equivalent to printing money. In the 30 years since 1988, the average annual return on major medals has been 66%.

Although the fund size is only 45Billion dollars, but it has already generated profits of over 100 billion dollars. On its own, this performance is extraordinary. Even more surprising is that 30 years is a long time for competitors, but it has not been surpassed.

During the same period, the S&P 500 index rose by 5.1% annually. 90% of funds cannot reach this moderate figure - let alone reach the height of a major medal.

In the following years, the worst performing year was 1997, with a return of 32%. During the best year of the 2008 financial crisis, when the medal achieved a return rate of 152%. During the 10 years from 2008 to 2018, Medallion performed even better, with an average annual return of 80%.

However, in the worst year of the COVID-19 in 2020, all three Renaissance funds open to external investors suffered losses, ranging from 20% to 30%.

Even though three of its funds suffered significant losses, the Renaissance Fund's Medallion fund, which is not open to external investorsFund) has made a lot of money. Some investors claim that the fund's return last year was as high as 76%.

According to external analysis, "Medal funds have a very short investment holding time, sometimes only a few minutes, and often perform well when the market is volatile and trading volume surges. At the same time, the leverage ratio of the product is higher, which can significantly improve returns when the market rebounds."

data

The Renaissance had better data, older data, more complex data, and was better at processing them than anyone else. "- Zuckerman

There are many more factors that affect the market than ordinary people like us realize. Statistical techniques can identify subtle and high-dimensional causal relationships between influencing factors and inefficiencies in the market.

Since its early days, Renaissance companies have been collecting and organizing various data archives, from economic indicators to weather. The quantity and quality of these data are key to enabling algorithms to discover subtle and undiscovered predictive factors of market patterns. Compared to its competitors, the Renaissance had better, older, and more complex data to drive their systems.

machine learning

Not only are we 50.75% correct, but 50.75% are 100% correct. You can make billions of dollars in this way. "- Bob Mercer

When stocks are introduced into the portfolio, the fund begins to take off. Initially, the focus was on bonds, commodities, and currencies. However, in order for the fund to grow, more assets are needed. It has been proven that quantitative analysts during the Renaissance had difficulty deciphering stocks, asMercer and Brown joined the team and a brand new system was coded, which is essentially a complex statistical arbitrage version.

Identified the subtle relationships between stocks and used information to predict future deviations in price changes. According to Zuckerman, this enables them to accurately predict the direction of mid-term trading within 50.75% of the time.

implement

We have a strong understanding of risk, cost, impact, and market structure, and can fully utilize it

For edge systems based on very small amounts of reuse, transaction costs are crucial. The Renaissance was very skilled at estimating the costs of transactions before they were made. This enables them to make informed decisions on whether to take advantage of minor market anomalies.

Understanding the market liquidity limitations of assets can calculate the maximum size of transactions that can be made without adversely affecting the transaction. Confident predictions, predictable costs, and high liquidity will enable the Renaissance to maximize its scale and leverage to profit from opportunities.

Volatility and pullback

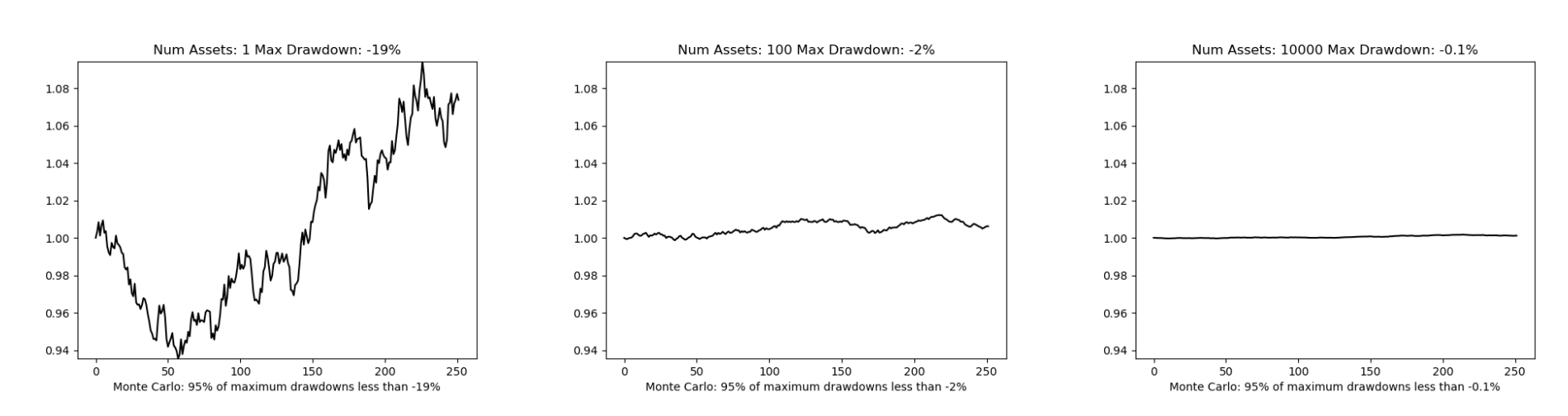

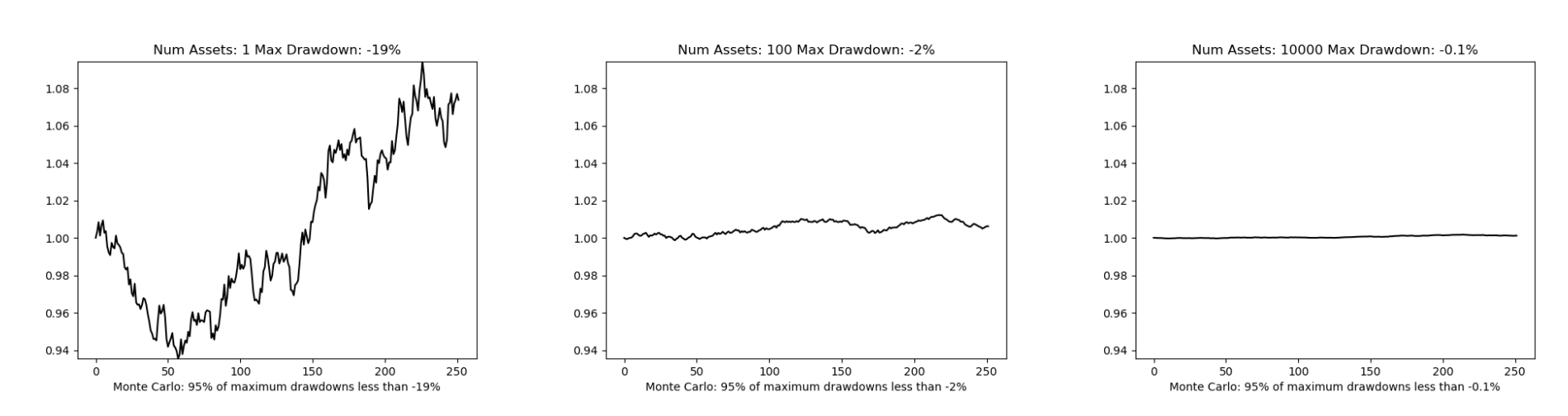

Figure 2: The impact of asset quantity on portfolio pullback. Asset Geometric Brownian motion GBM. Run 1000 in Monte Carlo simulationIn the second instance, 95% of cases retreat to -19% or less. For 100 types of assets, the withdrawal indicator has been reduced to -2%. For 10K assets, in 95% of cases, the pullback is -0.1% or less.

Diversified investment in stocks was a major breakthrough for the Renaissance and allowed the fund's asset size to expand to $10 billion. A key aspect of stocks is the number of available assets. ZuckermanIt is mentioned that the Renaissance may hold 4000 long and 4000 short positions in stocks at any time. The mid-term trading of such a large number of assets has a profound impact on portfolio risk and pullback.

Figure 2 uses composite data to illustrate the significant impact of trading a large number of unrelated assets on portfolio volatility. Extensive diversification and accurate execution brought partners such as Deutsche Bank and Barclays to the Renaissance.

On the other hand, the Renaissance exhibited a certain degree of skepticism and a deep understanding of risks in their models. They designed a solution that utilizes leverage while managing risks.

Figure 3 illustrates a synthetic example of a system with a daily return rate of 0.015% over 30 years. Without leverage, the compound annual return is only 4%.

However, obtaining 12.5The same system with multiple leverage can generate a compound annual return of 60%. This is not about creating systems that maximize returns, but about creating systems that maximize leverage while controlling risks.

Success depends on doing everything right

The astonishing success of Medallion does not come down to a secret kept. Zuckerman believes that the operation of the Grand Medal has 20-25There are several aspects that they are good at. Overall, the sum of all these subtle differences in capabilities can provide truly outstanding operations.

In summary, some key aspects that drive the success of Medallion are:

Data: Renaissance has a large amount of data that may remotely affect price changes. They were one of the earliest people to start managing data archives and have the most experience in using them.

Machine Learning: RenaissanceThey have long applied their statistical learning algorithms to identify predictive data and statistically significant repetitive patterns in the market. Their early adoption of machine learning in the stock market was crucial.

Diversification: It is said that Medallion trades 8000 long/short positions in assets, with typical trades lasting for about 2Days. Applying a medium-term neutral strategy to such a large asset can greatly reduce volatility and retreat.

Liquidity limit: Each asset is traded within its available liquidity limit, allowing Medallion to enter and exit the market without unexpected impact or risk.

Concealment: Appropriate means of concealing entry and exit positions.

Accurate cost calculation: When the predictive advantage is small, accurate estimation of costs can improve the identification of profitable trading opportunities.

Dynamic scale adjustment: Utilize when opportunities abound. Reduce risk exposure when performance decreases.

Leverage: All of the best practices mentioned above are the foundation for obtaining important leverage. Zuckerman estimates that Medallion's average trading leverage is 12.5When the system is confident in opportunities, it can be leveraged up to 20 times. The historical unleveraged returns of Medallion are similar to those of the S&P 500 index.

References

The Man Who Solved the Market, Gregory Zuckerman, ISBN: 9780241422151

Chat with traders podcast, 183: Jim Simons - the pinnacle of tradingGreatness w/Gregory Zuckerman

Active fund managers track the S& P 500 for the nine years in a row inTrim for indexing

Cornell, Bradford, Medallion Fund: The Ultimate Counterexample? (December 16,2019)