EBC Finance takes you to explore the mysteries of the global hedge fund industry, and today's story begins with

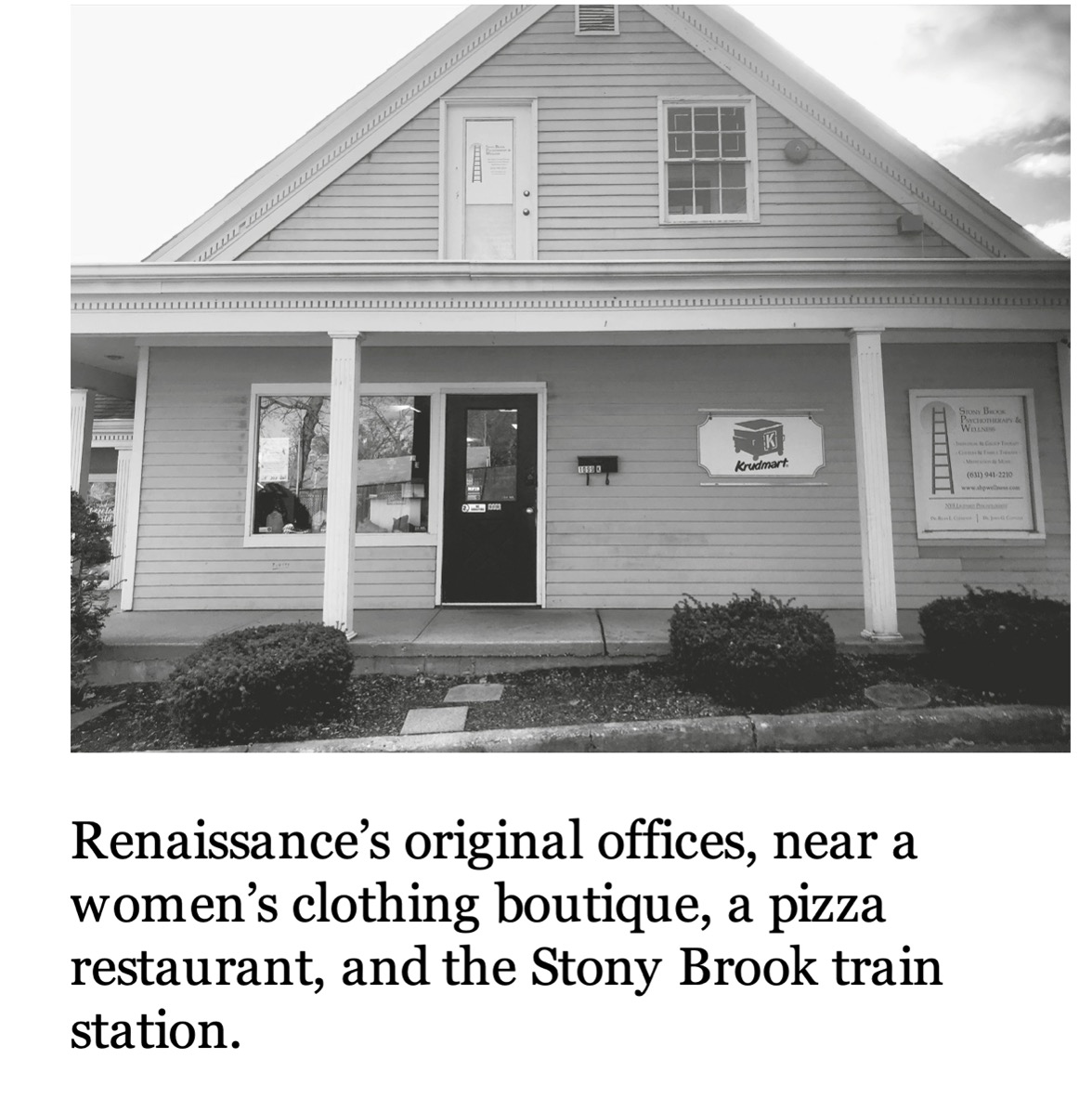

60 miles east of Wall Street, a land shaped like a whale's tail connects Long Island Sound and ConscienceBay) blocking each other.

The luxury houses here have a long gated driveway and a natural landscape worth millions of dollars, which is also called Old FieldA part of a small village. The locals have another name for this wealthy alley: Renaissance Riviera.

This is because the wealthiest residents and scientists in the region are providing quantitative hedge funds located near East Setakit——

Renaissance TechnologiesWork, this is the most well-known quantitative hedge fund company in the industry, specializing in the use of mathematical and statistical analysis to derive quantitative models.

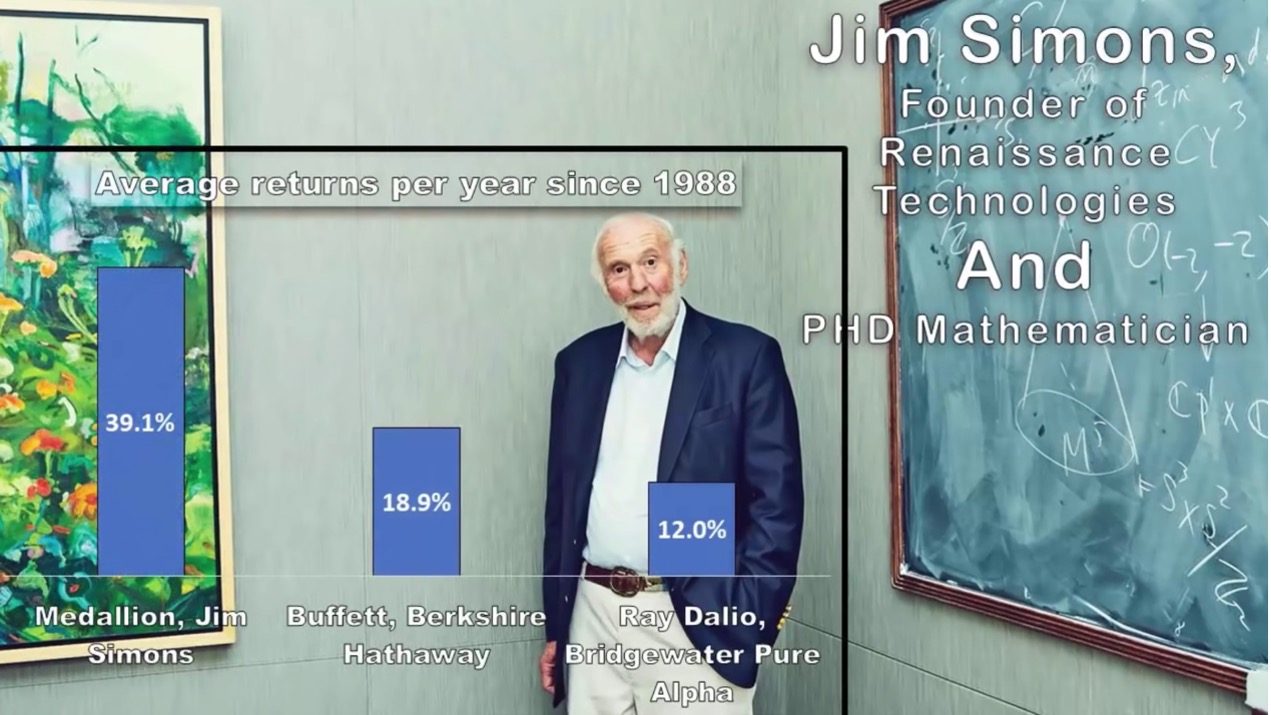

In 1988, James Simmons, the founder of quantitative tradingSimons founded the company's most profitable investment portfolio, also known as the 'greatest money making machine in the world', known as the 'Medallion Fund'.

The quantitative model of the Grand Medal Fund is based on Leonard E. Baum's Baum Welch algorithmImprovement and extension of algorithm model.

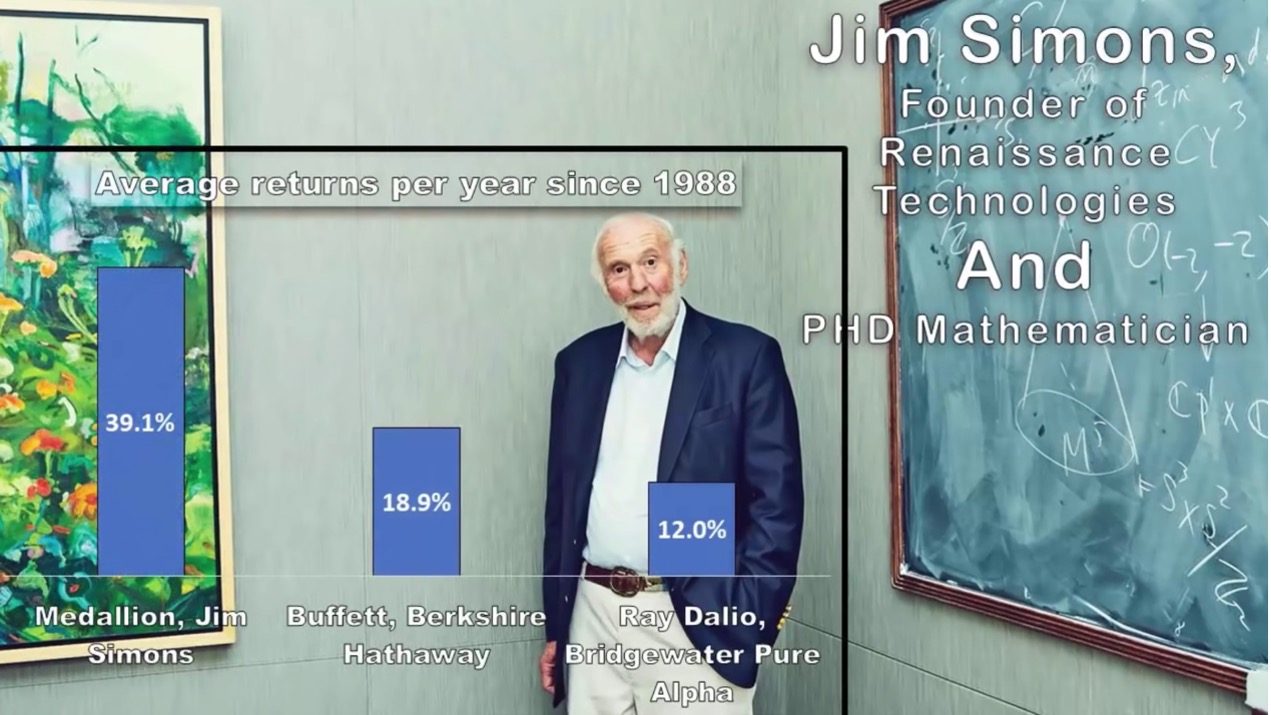

According to data compiled by Bloomberg, this legendary fund, known for its high confidentiality, has created approximately 550The profit of billion US dollars is more than 20 percentage points higher than the average annual return of the S&P 500 index during the same period, and even compared to the funds run by billionaires Ray Dario and George Soros, the profit is still about 10 billion US dollars higher.

For outsiders, the mystery lies in how the Grand Medal manages to achieve an annualized return of nearly 80% annually before deducting expenses.

Even after so many years, they still successfully resisted the imitators.

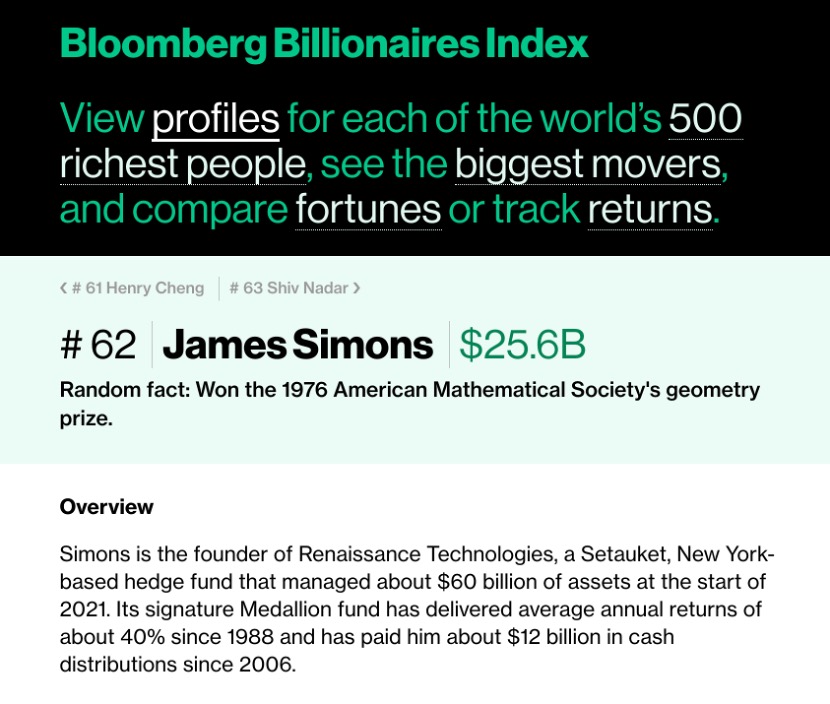

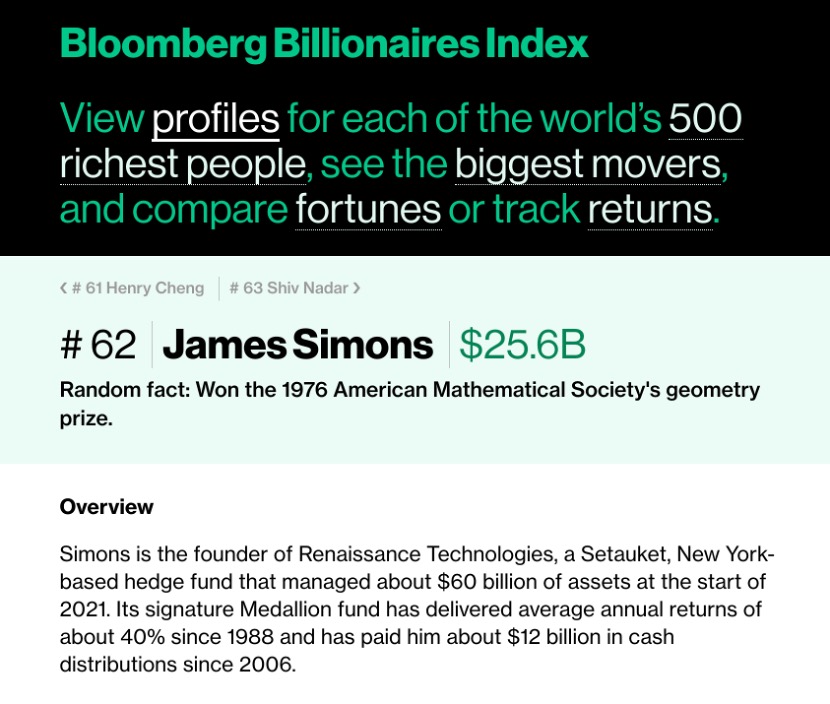

According to the latest Bloomberg Billionaires Index, James Simons, the world's most profitable hedge fund manager, ranks 62nd with a fortune of $25.6 billion.

So far, James Simons' algorithmic fund company has performed better than most funds, and his secret to success is his Renaissance strategy of always being closed to outsiders.

According to data from institutional investors, the legendary Medallion Medallion Medallion Fund rose by 76% during a turbulent year last year.

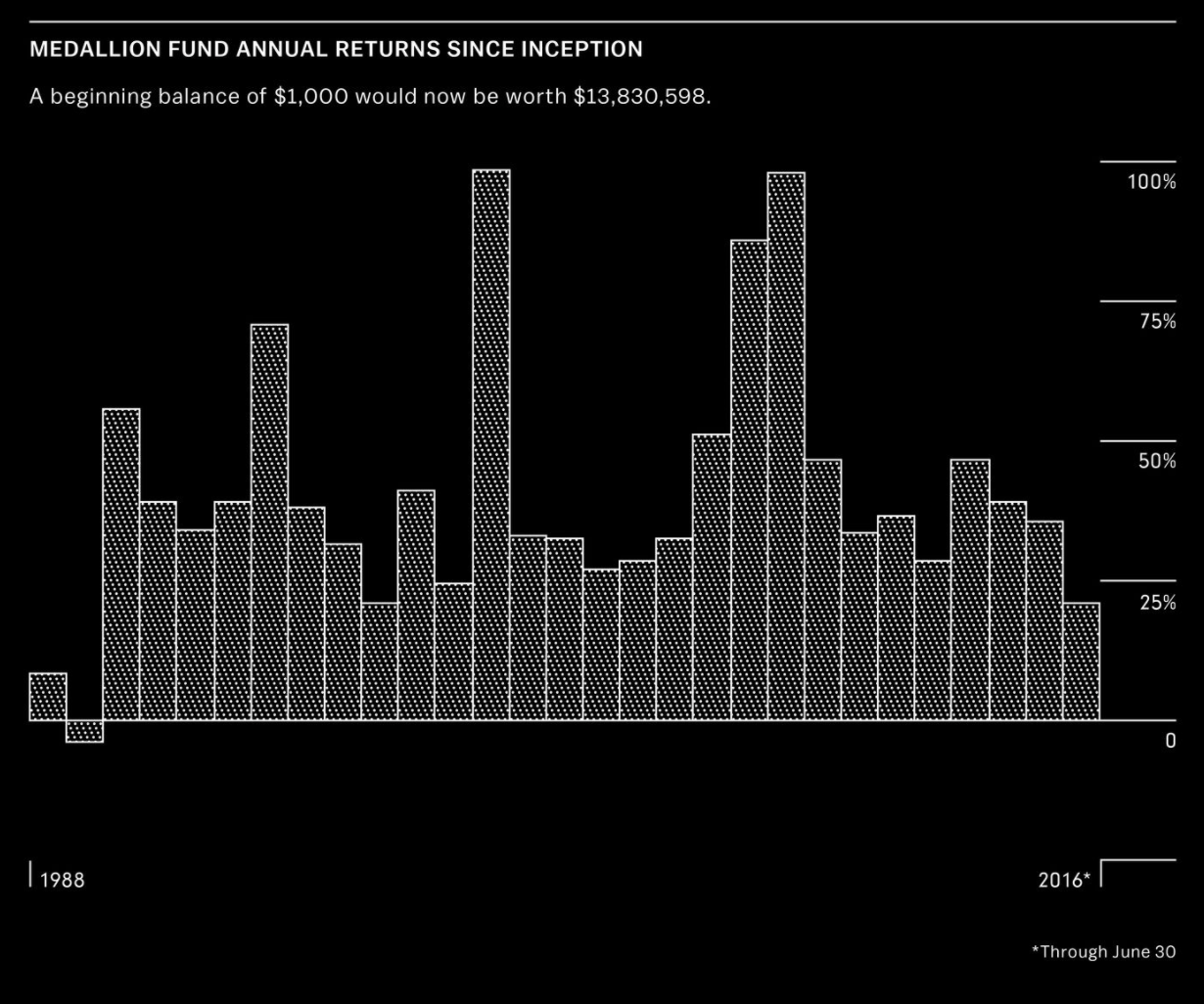

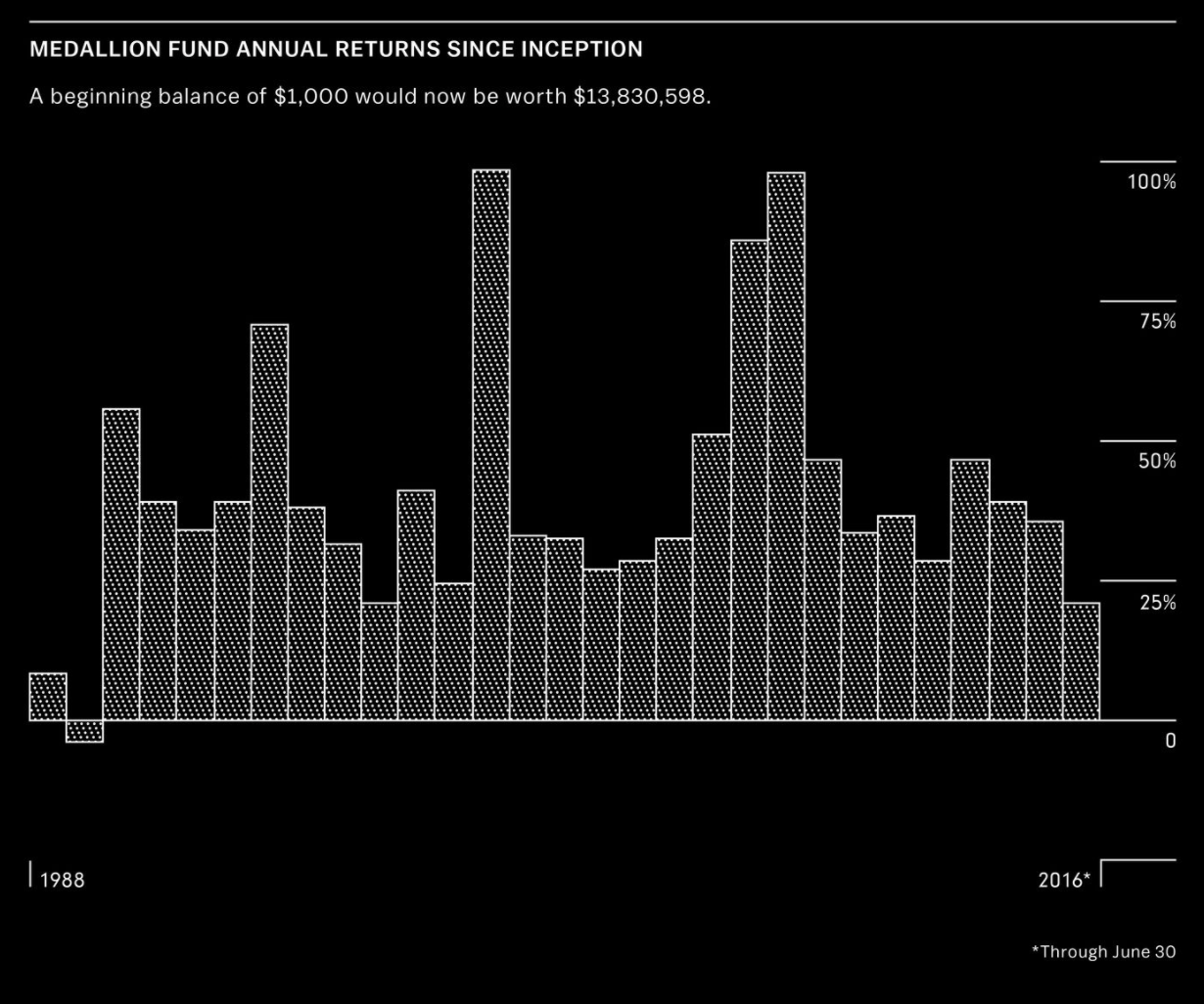

The annual return rate of the Grand Medal Fund managed by Simmons is shown in the figure above. Except for a decrease in net asset value in the second year of its establishment, all other years have achieved very high positive returns.

From its establishment in 1988 to Simmons' official retirement on January 1, 2010, the net annual return of the Grand Medal Fund exceeded 35%, far exceeding the annualized return of the S&P 500 Index. And when the market fluctuates significantly, the fund's performance actually improves.

In the 2000 technology stock market crash, the S&P 500 fell 10.1%, and the net return of the Grand Medal Fund was 98.5%, almost doubling; In the 2008 global financial crisis, various asset prices declined comprehensively, and most hedge funds suffered losses, while the net return of the Grand Medal Fund was 98.2%.

Note: The above data are the net investment income after deducting the fixed 5% management fee and performance commission ranging from 22% to 44% per year.

The following figure shows the salary (in K) paid by the Renaissance to quantitative analysts and engineers hired by its East Setauket New York office on an H1B visa.

The Renaissance is known for hiring only a few elite researchers, but like previous H1B salary data, this is only a small sample that reflects the amount of compensation paid only to non US researchers (citizens working in the United States).

Data shows that the Renaissance was one of the highest paid institutions among many hedge funds. However, it is worth noting that salary is not the reason why most people work for Simmons.

The real attraction is their opportunity to invest in the Grand Medal Fund, which is only open to about 300 employees, of which about 90%I am a Ph.D. and a few people with deep connections to the company. Since its establishment in 1988, the annual return rate has been approximately 40%.

These almost excellent to magical returns have made many investors curious about the investment methods of the Renaissance.

We have combined the analysis of multiple overseas hedge fund research institutions to summarize the uniqueness of the trading strategy of the Renaissance Fund's money making tool - the Medallion Medallion:

-The trading strategy mainly focuses on short-term operations;

-Using a 'per transaction database' is likely to use data such as Limit Order tables that others rarely use for analysis. The practice of using information rarely used by others for analysis, judgment, and trading is an important reason for the longevity of Renaissance funds;

-The model does not use advanced mathematics, but rather complex statistical tools;

-Using speech recognition analysis methods to analyze data is likely to be statistical information theory (Bolekamp), maximum entropy (Della Pietra brothers), and hidden Markov models (Patterson);

-Using more than one trading model to obtain signals, the trading model is constantly changing;

-Different trading models may be used in trading different financial instruments and funds;

-Hire researchers with a focus on scientific and computer backgrounds, rather than Wall Street experts. The use of computers and other trading technologies is a crucial factor in a company's success, as speed also contributes to profits;

-The consideration of liquidity issues in trading instruments plays a crucial role;

At the end of 2019, Wall Street contributing writer GregoryZuckerman has published a book about how James Simmons built a talented and charismatic team, unveiling the mystery of the largest black box in the financial world. Interested everyone, EBC Financial Group has prepared an electronic PDF for you to contact your investment advisor for free.

The Investment Intuition of Mathematician James Simons

A good mathematician needs intuition and always has a strong curiosity about the development of many things, which is crucial for defeating the market. - James Simmons

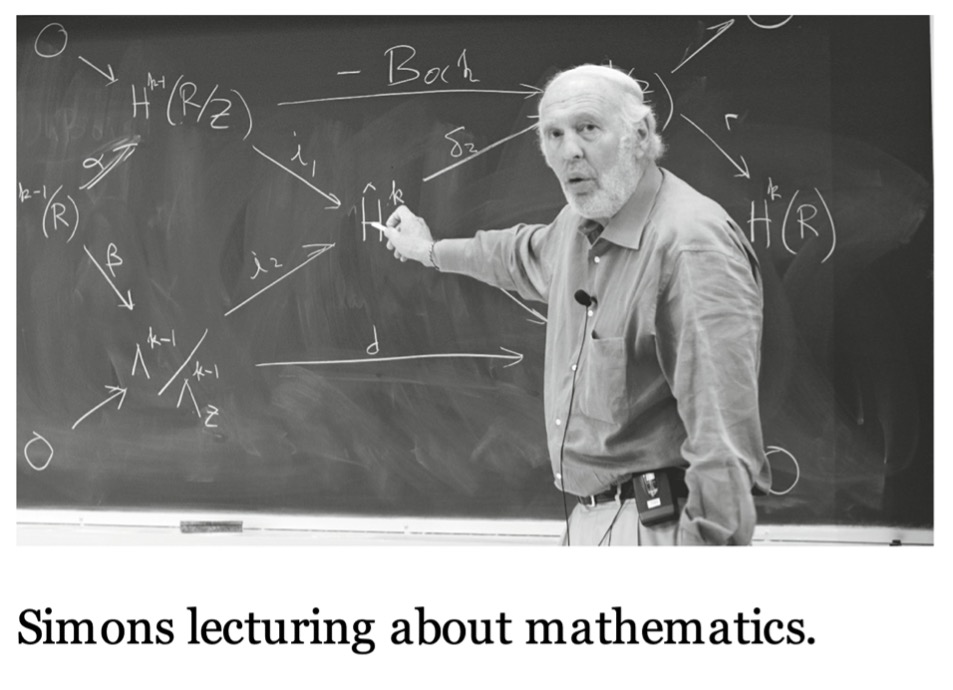

Immersed in the beauty of mathematics before the age of 40, winning the highest award in the field of geometry, OswaldVeblen, after the age of 40, rushed to Wall Street with his mathematical skills, defeating stock god Buffett and financial giant Soros with astonishing returns for 40 consecutive years.

Uncover the legendary life of James Simons, the world-renowned pioneer of quantitative trading and a recognized mathematician.

Simmons graduated from the Mathematics Department of Massachusetts Institute of Technology in 1958 and obtained a Ph.D. in Mathematics from the University of California, Berkeley in 1961, at the age of 23;

From 1964 to 1968, he was a researcher at the US Defense Research Institute and also a professor of mathematics at the Massachusetts Institute of Technology and Harvard University;

In 1968, he became the dean of the School of Mathematics at State University of New York at Stony Brook, at the age of 30;

In 1976, he won the Oswald Veblen Prize of the Mathematical Association of America for his research results on the minimization of multi bit plane area;

In 1978, Simmons left the academic community;

In 1982, founded the hedge fund Renaissance TechnologyTechnologies and established the Grand Medal Fund in 1988, marking the beginning of the "human-machine war" in the investment field;

From 1998 to 2007, the continuous financial market crises led to the decline of many popular hedge fund managers. However, Simmons' Grand Medal Fund performed well;

From 1988 to 1999, the Grand Medal Fund achieved a return of 2478.6%, ranking first among funds in the same period and twice as high as Soros' Quantum Fund. Even during the 2007 subprime crisis, the return rate of the Grand Medal Fund was still as high as 85%.

The Invincible Heaven Group of the Renaissance Fund: 100 doctors, astrophysicists, statisticians and computer scientists

For so many years, Simmons has been secretive about the investment model of the Grand Medal Fund. Except for the core team members, no one knows how they earn so much return in the market, and no other organization or individual can replicate their brilliance.

People began to try to infer the "mysterious model" behind the brilliant performance of the Grand Medal Fund from the background of the core team of Renaissance Company.

The Renaissance has a very good working environment and first-class employees, and it is reported that the company employed approximately 100 peopleDoctors, astrophysicists, statisticians and computer scientists created models for trading stocks, bonds, commodities and currencies - predicting price movements by looking for weak signals in market noise.

After years of trial and error, Simmons and his team found that short-term trading from a few seconds to a few months worked best. It's like weather: predicting the likelihood of rain in the next hour is much easier than predicting a storm in two weeks.

I don't know how to hire traders who do fundamental trading because they sometimes make money and sometimes lose money. But I do know how to hire scientists because I have some personal feelings about this field.

I am not the most astute person in the world, and if I participated in the Mathematical Olympiad, my performance would not be particularly good. But I like to ponder, to ponder things in my heart, which is to repeatedly think about certain things. As it turns out, that's a great method.

——James Simmons

The Renaissance Fund has always been low-key to the outside world, so little is known about it. The most common guess about them is the use of Hidden Markov Models (HMMs).

In the early days of Renaissance technology, the famous statistician Leonard Baum undoubtedly played a crucial role and contributed immensely.

The core founder, Baum, was one of the inventors of the famous Baum Welch algorithm, which is the core algorithm used for parameter estimation in the Hidden Markov Model (HMM) model;

Another startup figure of Renaissance Technology, Elwyn Berlekamp, is a mathematics professor and an expert in statistical information;

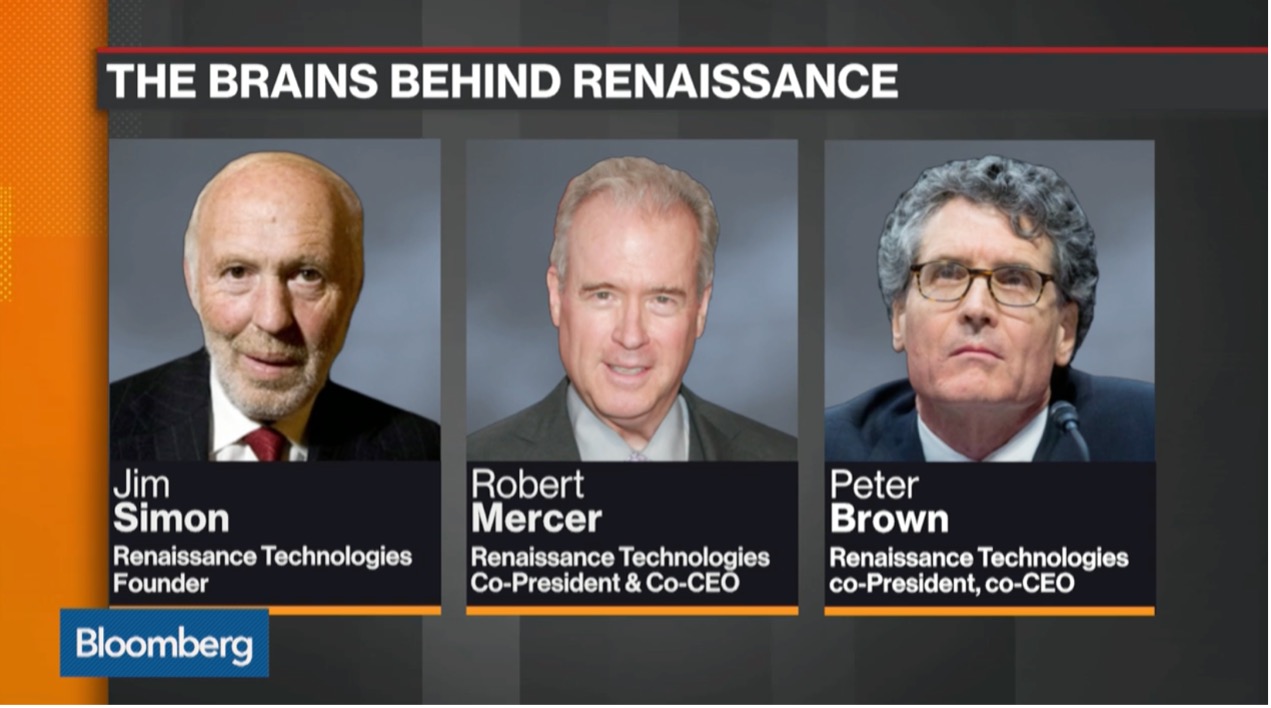

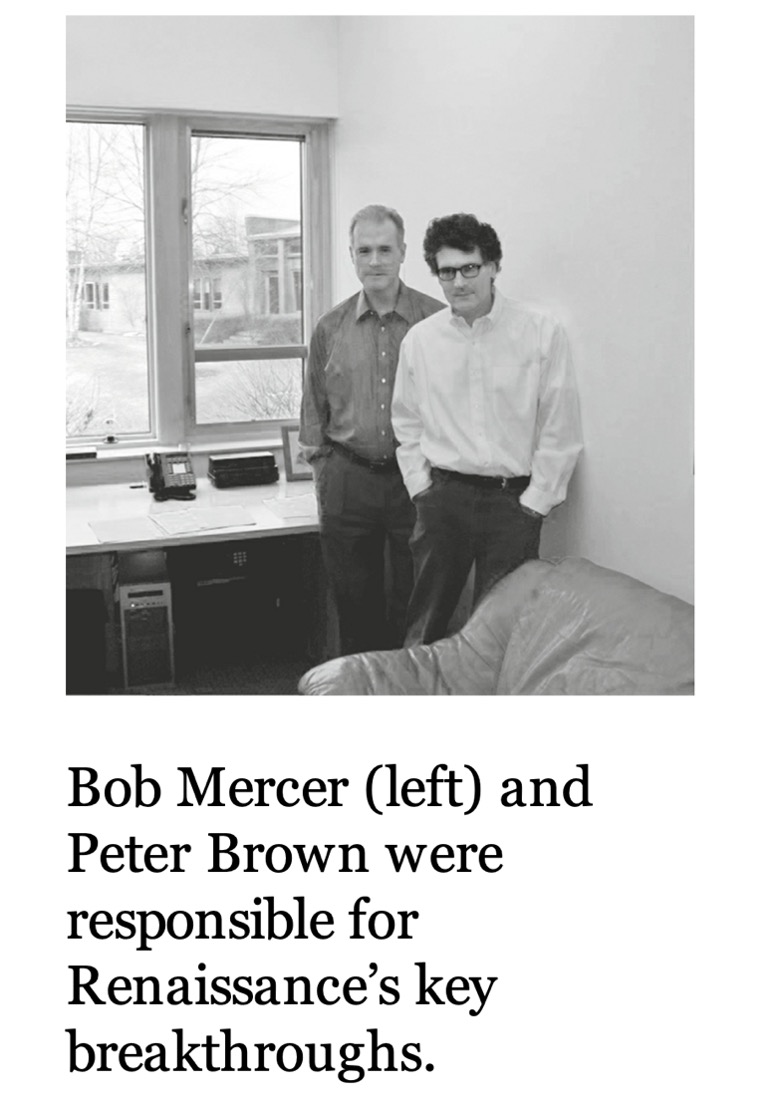

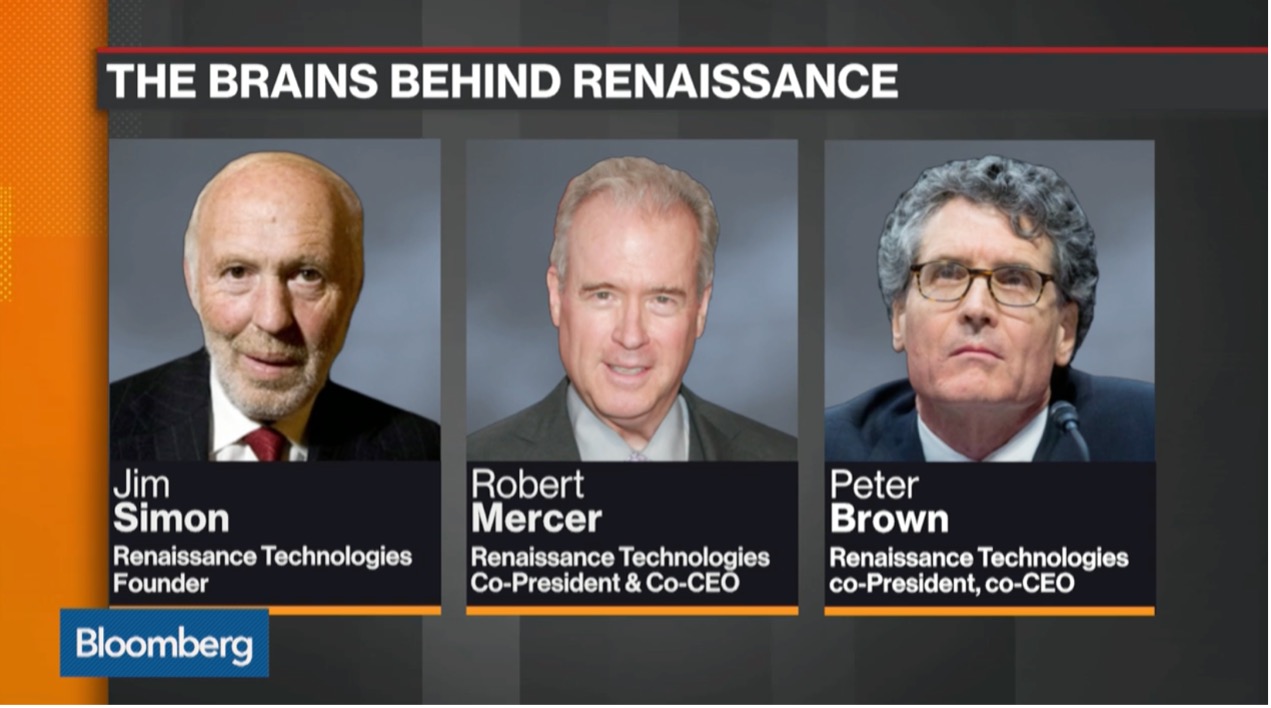

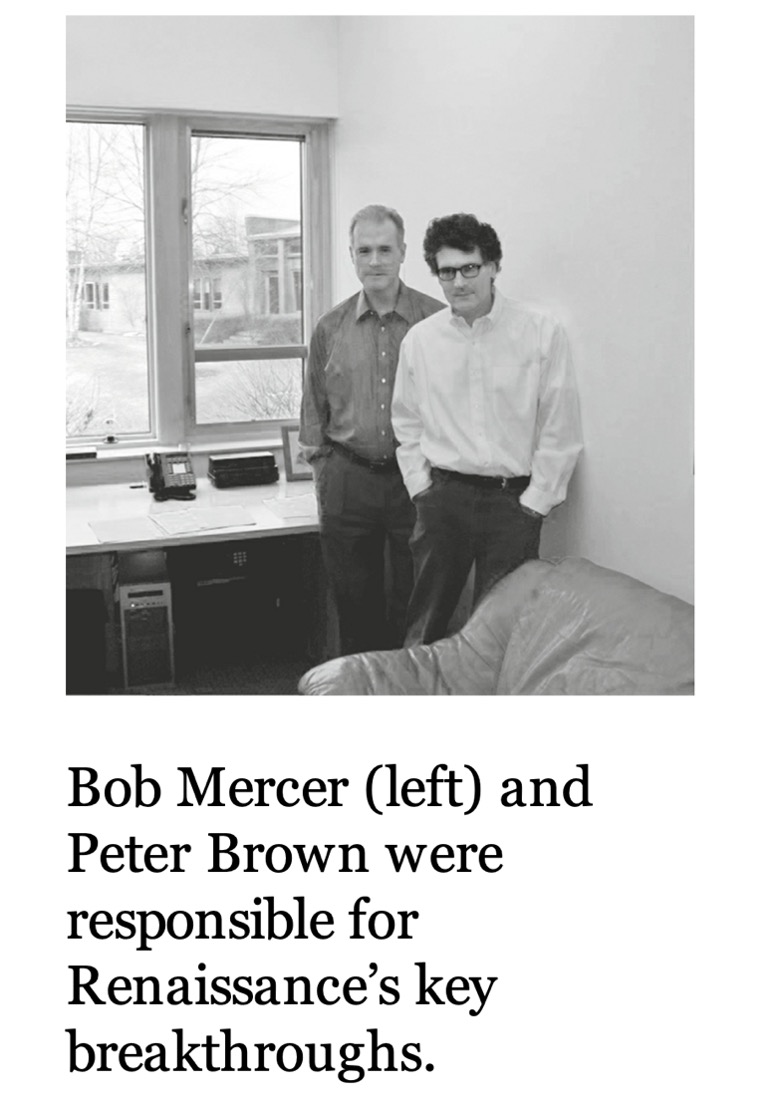

Renaissance Technology has successively introduced the world's top HMM (Hidden Markov Model) expert - Nick, a PhD in mathematics from the University of CambridgePatterson, Peter Brown (natural language processing and machine translation), Robert Mercer (speech recognition), SDella Pietra& V. Della Pietra, inventor of the maximum entropy iteration algorithm.

Simmons once recruited the entire elite of IBM's speech laboratory to Renaissance Company. Among the core members of the company, there were multiple experts in the fields of HMM (Hidden Markov Models) and speech recognition. Based on these backgrounds, people have reason to believe that Hidden Markov Models are the mysterious magic weapon for the Grand Medal Fund to achieve brilliant performance.

In fact, there are many similarities between the process of stock price prediction and speech recognition. For example, in the process of word recognition, the pronunciation of a word is divided into a series of continuous "phonemes", and the final recognition of the entire pronunciation as a word is determined by this continuous phoneme sequence.

This scenario is similar to predicting the rise and fall of stock prices, where the rise or fall of stock prices is also driven by a series of time series of price and quantity factors. For example, in a unilaterally rising market, the probability of stock prices rising in the future is relatively high.

Hidden Markov models can describe this dynamic process and mine more information from time series, which is an advantage over statistical learning models such as linear regression, SVM or random forest.

The flagship tool of the Renaissance Technology Fund is the timing strategy based on hidden Markov models (TimingStrategy. Through HMM model and Baum Welch algorithm, traders can find the most likely hidden state transition and the probability of a certain observation variable, and then give the optimal timing strategy.

In addition to the implicit Markov model, the Renaissance Fund also explores and applies the following cutting-edge scientific knowledge to hedge funds:

Fuzzy logic: A method of making logical judgments and operations, assuming that various concepts cannot be completely represented by "yes" or "no",And it can be 70% 'yes' and 30%' no ', which is what we call paradoxical. Both yes and no cannot be completely determined. The operation method of fuzzy logic is designed for many situations in real life that cannot be expressed with clear logical relationships, and it is often difficult to accurately judge in quantitative investment. Therefore, in the same situation, using fuzzy logic may be more appropriate.

Neural network: A computational method that combines many small models to simulate the way the human brain makes judgments. Each small model is equivalent to a neuron, which can be thought about simply and then made by a "brain". It can be used in conjunction with fuzzy logic.

Genetic coding: Simulating the process of gene mutation and recombination in biological evolution, allowing many models to freely mutate and combine, and searching for the most suitable model combination to adapt to the environment through real data.

The investment strategies of the Renaissance were based on mathematical and statistical models to achieve very attractive risk adjusted returns.

Wavelet transform: A technique of signal processing. It is to create specific small fluctuations and interact with the object to be studied. When the wavelet is to be separated, the wavelet contains some information about the research object. When processing financial data, wavelet can be a small transaction. Through the reaction of market price to this, we can infer whether there is any big transaction at what price.

Bayesian network: Bayesian computing method means that various probabilities are only an incomplete belief at present, and people should update various probabilities according to the latest information. Bayesian network is a network built according to this idea, describing the possible causal relationship between a series of uncertain data and processes, and updating it constantly.

Typhoon geometry: Fractal dimensional space and chaotic coefficients, butterfly effect flapping out tornadoes. De Manberrot once proposed that the distribution of financial prices is not normal and has a clear fat tail. The price change cannot be described by normal distribution, but can be described by fractal geometry. The changes in financial prices can also be seen as fractional dimensions. An important viewpoint of continuous time financial theory is that the total sum of changes in financial prices is infinite.

Cluster analysis: A statistical tool that divides various objects into different groups based on data and predetermined standards. In fact, it is commonly referred to as the complex version where the larger ones stand behind and the smaller ones stand forward. Of course, clustering analysis completed by machines can quickly classify a large amount of data and find categories that we do not know.

It is such a talented team composed of the world's top scientists in astronomy, quantum mechanics, biology, mathematics, physics, statistics and other fields that has created an unparalleled peak of quantitative investment. The trading volume of this fund can sometimes even account for 10% of the entire Nasdaq market trading volume.

Simmons once revealed that there are three criteria for selecting the trading variety of the fund: publicly traded varieties, high liquidity, and meeting certain requirements set by mathematical models.

There are many risks in the capital market, with liquidity risk being the first to bear the brunt.

Hedge funds, unlike traditional financial instruments, face significant liquidity risks unless appropriately quantified and managed to identify liquidity bottlenecks in asset allocation in real time,Real time monitoring of portfolio liquidity is a major challenge otherwise.

The same applies to leveraged margin trading. With its headquarters in London, EBC Finance can provide you with customized deep liquidity fund pools for top global hedge funds and other large institutions, truly achieving a superior trading environment such as institutional level tight spreads, clearing level market depth, and rapid transactions within milliseconds.

If you have any consulting needs, you can contact EBC Investment Advisor or the official website for inquiries.