A buy stop order is a powerful trading tool used by short-term and long-term traders alike. If you're wondering how to manage risks and capitalise on potential price movements, understanding buy stop orders is essential. This guide will explain what a buy stop order is, how it works, when to use it, and the potential risks and benefits.

Whether you're new to trading or looking to refine your skills, mastering buy stop orders can help you make more informed decisions and maximise your profits.

What is a Buy Stop Order and Stop Price?

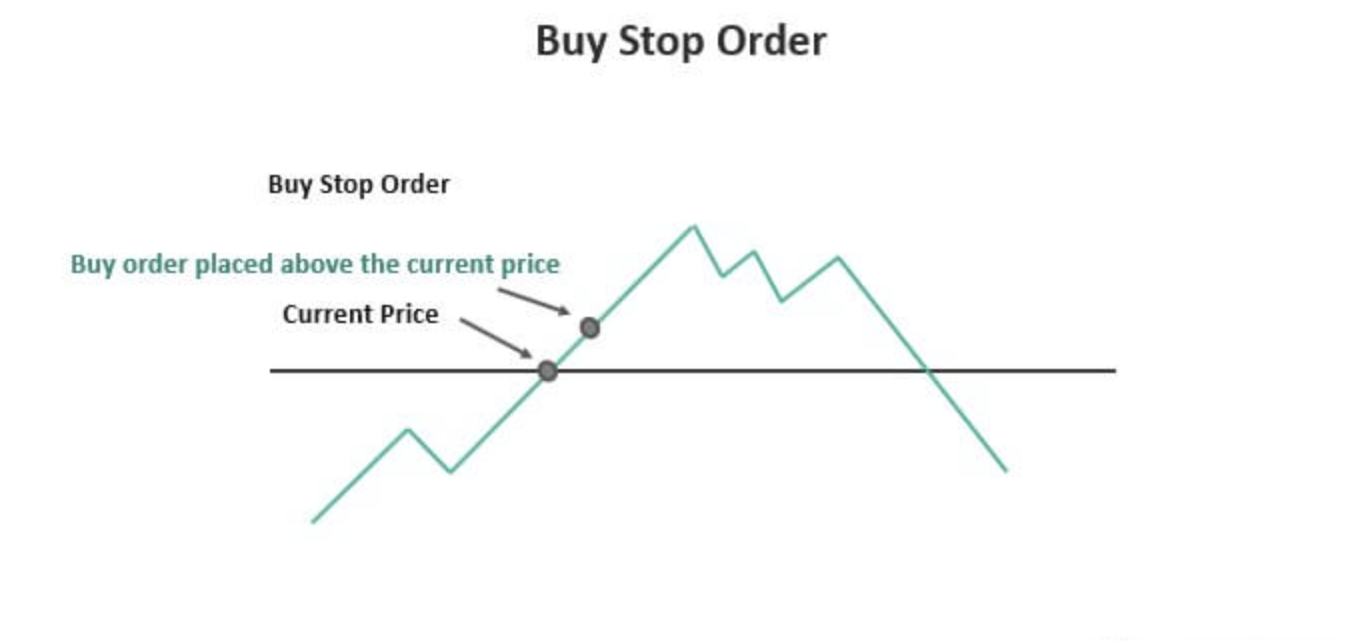

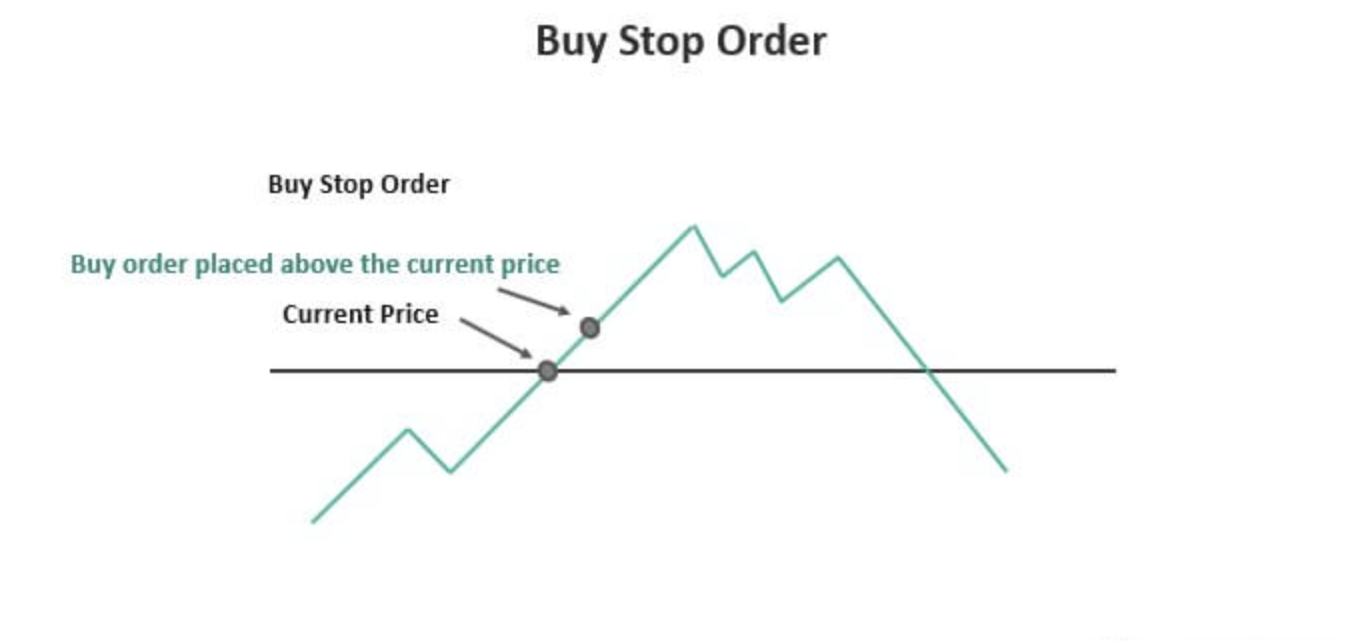

A buy stop order is an instruction placed with a broker to buy or sell a security once its price reaches or exceeds a specified level, known as the stop price.

Key characteristics of a buy stop order:

It is placed above the current market price.

It becomes a market order once the stop price is triggered.

It is commonly used to enter trades during upward price momentum.

Unlike limit orders, which allow you to buy or sell at a specified price or better, buy stop orders ensure the trade is executed as soon as the price surpasses the stop level, regardless of price fluctuations.

How does a buy stop order work at market price?

To understand how a buy stop order works, consider this example:

A stock is currently trading at a current price of £50.

You believe the stock will continue to rise if it breaks above £55.

You place a buy stop order at £55.

By setting the buy stop order at a higher price of £55, you aim to capitalise on the anticipated upward trend.

If the stock price reaches £55, your buy stop order is triggered, and the trade is executed at the next available market price.

Buy stop orders are particularly useful for traders looking to capture gains during upward trends, as they allow you to enter trades only when certain price conditions are met.

When Should You Use a Buy Stop Order at a Specified Price?

Buy stop orders are ideal for specific trading scenarios. Here are some common situations where they are most effective:

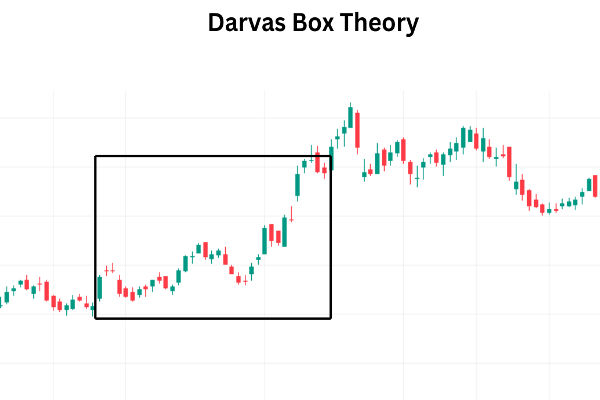

1. Confirming breakouts

Use a buy stop order to enter a trade when a security's price breaks above a key resistance level, confirming a potential upward trend.

2. Avoiding premature entries

A buy stop order helps you avoid entering a trade too early by waiting for the stock's price to reach a specific price level.

3. Following momentum

Traders often use buy stop orders to capitalise on strong upward momentum, ensuring they don't miss out on price surges. This ensures that you only enter trades when the stock's price shows strong upward momentum.

4. Setting automated entries

If you're unable to monitor the market constantly, buy stop orders can automate your trades, triggering only when certain conditions are met.

Advantages of Using Buy Stop Orders

Buy stop orders offer several benefits for traders, particularly in fast-moving markets.

Avoid emotional trading: By pre-setting your trade conditions, you can stick to your strategy and avoid impulsive decisions.

Capture price momentum: Automated execution ensures you don't miss entry points during market breakouts. During normal trading hours, market orders triggered by buy stop orders can be executed quickly, ensuring you capture price momentum.

Improve trading discipline: Using buy stop orders encourages a systematic approach to trading, helping you follow your plan.

Risks Associated with Buy Stop Orders and Execution Price

While buy stop orders offer many advantages, they are not without risks.

Slippage: In volatile markets, the execution price may differ from your stop price, potentially leading to higher-than-expected costs.

Market reversals: If the price briefly spikes above the stop level and then drops, you may enter a trade that quickly turns unprofitable.

Over-reliance on automation: Automated trades may not account for sudden market changes or news events.

Similarly, a sell stop order can help you manage risks by triggering a sale when the stock reaches an exact price, protecting you from further losses.

To mitigate these risks, it's important to combine buy stop orders with other risk management tools, such as stop-loss orders.

Quick Facts About Buy Stop Orders

Feature |

Description |

| Placement |

Above the current market price |

| Trigger |

Become a market order once the stop price is reached |

| Best for |

Capturing upwards price momentum |

| Common risk |

Slippage during volatile price movements |

Tips for Managing Buy Stop Orders

To use buy stop orders effectively, follow these actionable tips:

Set realistic stop prices: Avoid placing stop prices too close to the current market price or limit price to reduce the risk of premature triggers.

Combine with stop-loss orders: Protect your capital by setting stop-loss orders to limit potential losses if the trade moves against you.

Monitor market conditions: Stay informed about market trends and news that could impact price movements.

Consider using a stop limit order to gain more control over the execution price, ensuring your trade is executed at a favourable limit price.

Backtest your strategy: Test your use of buy stop orders in a demo account to refine your approach and improve your results.

Avoid overtrading: Use buy stop orders selectively to ensure you're only entering high-probability trades.

Common Mistakes to Avoid when Using Buy Stop Orders

Even experienced traders can make mistakes when using buy stop orders. Here are some common pitfalls to avoid:

Placing stop prices too close: Tight stop prices can lead to frequent triggers, even during minor price fluctuations. Market order generally provides the highest certainty of execution but may not guarantee the price you initially saw, especially during volatile periods.

Ignoring market volatility: High volatility can cause slippage, leading to less favourable execution prices.

Overlooking risk management: Failing to set stop-loss orders can expose you to significant losses if the market reverses. Additionally, consider using a sell limit order to ensure you sell at or above a specified price, protecting your investment from significant drops.

By recognising these mistakes and planning accordingly, you can improve your trading performance.

Why Buy Stop Orders Matter in Trading

Buy stop orders play an important role in both short-term and long-term trading strategies. They allow traders to:

Enter trades based on confirmed price momentum. Similarly, sell stop orders can help you exit trades based on confirmed downward price momentum, protecting your profits.

Automate entry points, reducing the need for constant monitoring.

Improve discipline and reduce emotional decision-making.

Understanding the differences between buy stop orders, sell stop orders, and limit orders is crucial for effective trading strategies.

For traders who want to capture upward price movements while managing risks, buy stop orders are an essential tool.

Conclusion

Understanding buy stop orders is crucial for traders looking to profit from upward price momentum. By knowing how they work, when to use them, and how to manage associated risks, you can make more informed trading decisions.

To use buy stop orders effectively, set realistic stop prices, combine them with stop-loss orders, and monitor market conditions. With practice and discipline, buy stop orders can become a valuable part of your trading toolkit.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.