Understanding the Profitability Index

The profitability index (PI) is an essential tool for evaluating investment opportunities, particularly in capital budgeting. It helps businesses determine whether a project is worth pursuing by assessing how much value it creates for every unit of investment. This is especially useful when funds are limited and must be allocated efficiently.

At its core, PI is a ratio that compares the present value of expected future cash flows to the initial investment. If the PI is greater than 1. the project is expected to generate more value than its cost, making it a strong candidate for investment. A PI below 1 indicates that the project is likely to result in a loss, as the future cash inflows will not be sufficient to recover the initial expenditure.

Businesses and investors use this financial indicator to prioritise projects, ensuring they choose those that provide the highest return per pound invested. This makes PI an essential metric when multiple investment opportunities are available but capital is restricted.

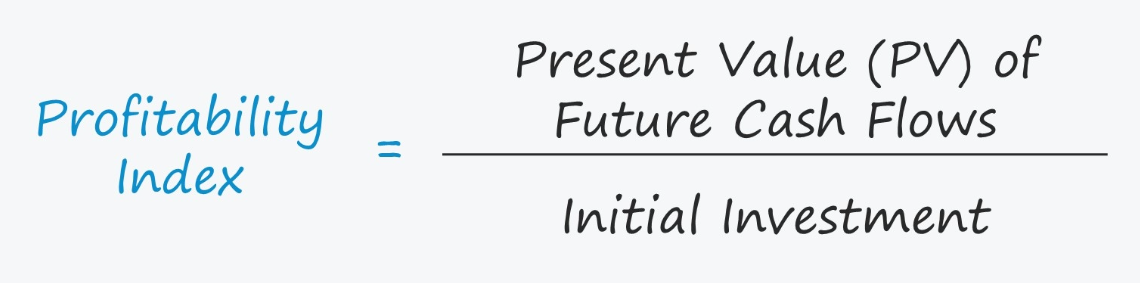

How to Calculate the Profitability Index

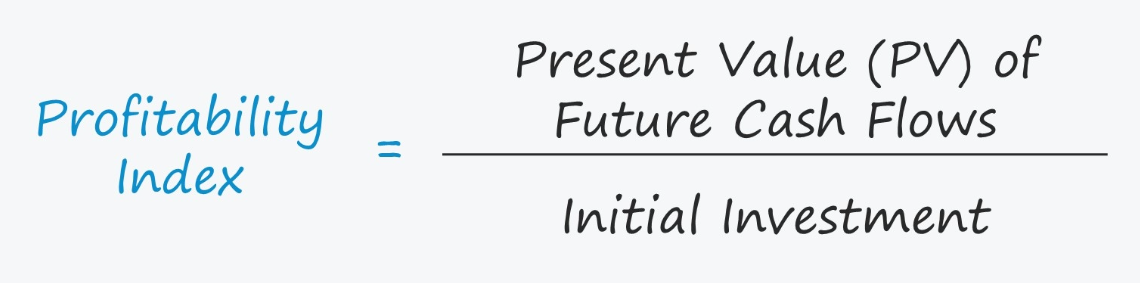

The formula for calculating the profitability index is:

Profitability Index=Present Value of Future Cash Flows/Initial Investment

This calculation involves two key components:

This calculation involves two key components:

Present Value of Future Cash Flows – This represents the expected earnings from the project, adjusted for the time value of money. Since money today is worth more than the same amount in the future, cash flows must be discounted to reflect their present worth.

Initial Investment – This is the upfront cost required to start the project, including capital expenditures, operational costs, and other expenses.

For example, if a company is considering an investment requiring £500.000 and expects to generate discounted cash flows of £700.000. the profitability index would be:

PI=700.000/500.000=1.4

Since the PI is greater than 1. the project is expected to create more value than its cost, making it a potentially profitable investment.

The discount rate used in the calculation is crucial, as it reflects the cost of capital or the minimum return required to justify the investment. A higher discount rate reduces the present value of future cash flows, which can lower the PI and impact investment decisions.

What Profitability Index Values Tell You

Interpreting the profitability index correctly helps investors and business leaders make well-informed financial decisions.

PI > 1: The project is expected to generate more value than its cost and should be considered for investment.

PI = 1: The project is expected to break even, meaning it neither creates nor destroys value. In such cases, additional factors like strategic benefits may influence the decision.

PI < 1: The project is expected to generate less value than its cost, suggesting that it may not be a wise investment.

While a PI greater than 1 is generally a positive sign, it is essential to compare it with other financial metrics, such as Net Present Value (NPV) and Internal Rate of Return (IRR).

For instance, NPV provides the absolute monetary value an investment is expected to generate, whereas PI indicates the return per unit of investment. If a company has multiple projects to choose from but limited capital, PI can help prioritise those that offer the best value for money.

Advantages and Limitations of the Profitability Index

Advantages

Helps prioritise investments when capital is limited – Since PI measures return per unit of investment, it allows businesses to allocate funds efficiently.

Considers the time value of money – Unlike simple return calculations, PI discounts future cash flows, ensuring a more realistic valuation of long-term projects.

Useful for comparing projects of different sizes – Two projects with the same NPV may have different PIs, helping businesses identify which one provides a better return on investment per pound spent.

Limitations

Does not account for project size – A small project with a high PI may seem attractive but could generate lower overall returns than a larger project with a slightly lower PI.

Ignores project duration – Two projects with similar PIs may have vastly different timeframes, affecting cash flow availability and financial planning.

Dependent on accurate cash flow estimates – If future cash flows are overestimated or underestimated, the PI may provide misleading results.

To overcome these limitations, PI should be used alongside other financial metrics. While it is effective for ranking projects, NPV and IRR provide additional context regarding overall profitability and expected returns.

Practical Applications of the Profitability Index

The profitability index is widely used in corporate finance, particularly in capital budgeting decisions. Companies across industries rely on PI to assess investment opportunities and allocate resources efficiently.

Corporate Investments

Large corporations use PI when evaluating expansion projects, infrastructure improvements, and research & development investments. For example, a technology company might use PI to determine whether developing a new product line will generate sufficient value relative to its cost.

Manufacturing and Industrial Projects

Manufacturers use PI to decide between upgrading existing machinery or investing in new production lines. Suppose a car manufacturer is considering two projects—one to modernise its current factory and another to build a new plant. Even if both have similar NPVs, the project with a higher PI may be preferable if capital is limited.

Energy and Renewable Projects

In the energy sector, companies use PI to evaluate renewable energy projects like wind farms and solar plants. Since these projects require significant upfront investments, PI helps determine whether they will generate enough return per unit of investment to justify the expenditure.

Individual Investment Decisions

Even individual investors can apply PI when assessing business ventures or property investments. For example, a property investor might compare different real estate projects to see which provides the highest return per pound invested, helping them make more strategic financial decisions.

Government and Public Sector Projects

Governments and municipalities use PI when allocating funds for infrastructure projects such as roads, public transportation, and utilities. When budget constraints exist, PI helps prioritise projects that provide the most economic and social benefits per unit of investment.

By applying the profitability index in various investment scenarios, businesses and investors can make more strategic and financially sound decisions.

Conclusion

The profitability index serves as a practical and effective tool for investment analysis. While it has limitations, its ability to rank projects based on return efficiency makes it invaluable in capital budgeting. By understanding how to calculate and interpret PI, businesses and investors can maximise returns while minimising financial risks.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

This calculation involves two key components:

This calculation involves two key components: